Seagate 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

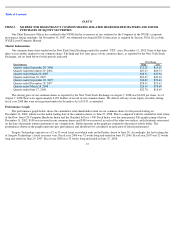

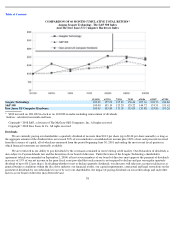

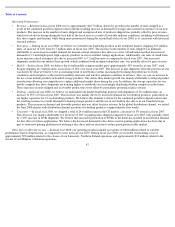

COMPARISON OF 66 MONTH CUMULATIVE TOTAL RETURN*

Among Seagate Technology, The S&P 500 Index

And The Dow Jones US Computer Hardware Index

Copyright

©

2008 S&P, a division of The McGraw-Hill Companies, Inc. All rights reserved.

Copyright

©

2008 Dow Jones & Co. All rights reserved.

Dividends

12/11/02

6/27/03

7/2/04

7/1/05

6/30/06

6/29/07

6/27/08

Seagate Technology

100.00

159.03

125.81

156.44

207.36

202.70

184.86

S&P 500

100.00

105.19

125.29

133.22

144.72

174.51

151.62

Dow Jones US Computer Hardware

100.00

105.80

115.05

133.03

135.88

193.80

193.20

*

$100 invested on 12/11/02 in stock or on 11/30/02 in index

-

including reinvestment of dividends.

Indexes

calculated on month

-

end basis.

We are currently paying our shareholders a quarterly dividend of no more than $0.12 per share (up to $0.48 per share annually) so long as

the aggregate amount of the dividend does not exceed 50% of our cumulative consolidated net income plus 100% of net cash proceeds received

from the issuance of capital, all of which are measured from the period beginning June 30, 2001 and ending the most recent fiscal quarter in

which financial statements are internally available.

We are restricted in our ability to pay dividends by the covenants contained in our revolving credit facility. Our declaration of dividends is

also subject to Cayman Islands law and the discretion of our board of directors. Under the terms of the Seagate Technology shareholders

agreement (which was amended on September 2, 2004) at least seven members of our board of directors must approve the payment of dividends

in excess of 15% of our net income in the prior fiscal year (provided that such consent is not required to declare and pay our regular quarterly

dividend of up to $0.12 per share). In deciding whether or not to declare quarterly dividends, our directors will take into account such factors as

general business conditions within the disc drive industry, our financial results, our capital requirements, contractual and legal restrictions on the

payment of dividends by our subsidiaries to us or by us to our shareholders, the impact of paying dividends on our credit ratings and such other

factors as our board of directors may deem relevant.

38