Seagate 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

many of our OEM customers including Hewlett-Packard, Dell, EMC, IBM and Lenovo. We also have key relationships with major distributors,

who sell our disc drive products to small OEMs, dealers, system integrators and retailers throughout most of the world. Substantially all of our

revenue is denominated in U.S. dollars.

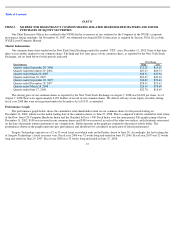

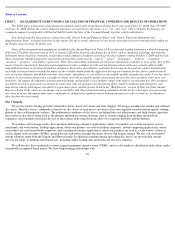

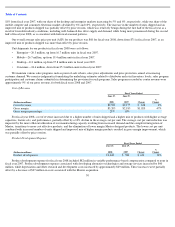

The following table summarizes our disc drive revenue from sales to OEMs, distributors and retailers:

The only customer exceeding 10% of our disc drive revenue for fiscal years 2006 through 2008 was Hewlett-Packard. Dell exceeded 10%

of our disc drive revenue in fiscal years 2008 and 2006.

Industry Overview

Fiscal Years Ended

June 27,

2008

June 29,

2007

June 30,

2006

Revenues by Channel (%)

OEM

67

%

64

%

72

%

Distributors

26

%

30

%

25

%

Retailers

7

%

6

%

3

%

Revenues by Geography (%)

North America

30

%

30

%

30

%

Europe

27

%

27

%

27

%

Far East

43

%

43

%

43

%

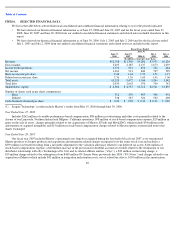

Our industry is characterized by several trends that have a material impact on our strategic planning, financial condition and results of

operations.

Disc Drive Industry Consolidation

Due to the significant challenges posed by the need to continually innovate and improve manufacturing efficiency and because of the

increasing amounts of capital and research and development investments required, the disc drive industry has undergone significant

consolidation as disc drive manufacturers and component manufacturers merged with other companies or exited the industry. Through such

combinations, disc drive manufacturers have also become increasingly vertically integrated. While recent combinations have limited the

opportunity for additional industry consolidation, the increasing technological challenges, associated levels of investment and competitive

necessity of large-scale operations, may still drive future industry consolidation. Additionally, we may in the future face indirect competition

from present and potential customers who from time to time evaluate whether to offer electronic data storage products that may compete with

our products.

Price Erosion

Our industry has been characterized by continuous price erosion for disc drive products with comparable capacity, performance and feature

sets (i.e., “like-for-like products”). Price erosion for like-for-like products (“price erosion”) is more pronounced during periods of:

•

industry consolidation in which competitors aggressively use discounted price to gain market share;

•

few new product introductions when multiple competitors have comparable or alternative product offerings;

•

temporary imbalances between industry supply and demand; and

Disc drive manufacturers typically attempt to offset price erosion with an improved mix of disc drive products characterized by higher

capacity, better performance and additional feature sets and/or product cost reductions.

43

•

seasonally weaker demand, which may cause excess supply.