Seagate 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

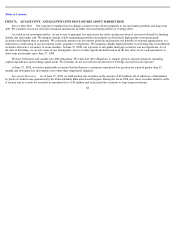

Table of Contents

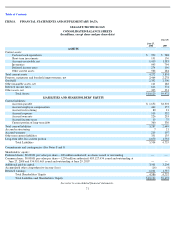

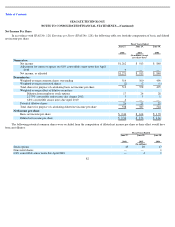

SEAGATE TECHNOLOGY

CONSOLIDATED STATEMENTS OF SHAREHOLDERS

’

EQUITY

For Fiscal Years Ended June 27, 2008, June 29, 2007 and June 30, 2006

(In millions)

See notes to consolidated financial statements.

74

Number

of

Common

Shares

Par

Value

of

Shares

Additional

Paid-in

Capital

Deferred

Stock

Compensation

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Total

Balance at July 1, 2005

477

$

—

$

632

$

(3

)

$

(9

)

$

1,921

$

2,541

Comprehensive income, net of tax:

Change in unrealized gain (loss) on marketable securities, net

(2

)

(2

)

Change in unrealized gain (loss) on cash flow hedges, net

4

4

Net income

840

840

Comprehensive income

842

Issuance of common shares related to employee stock options and

employee stock purchase plan

18

118

118

Issuance of common shares, assumption of options and nonvested

shares in connection with the acquisition of Maxtor

98

1,956

1,956

Substantial premium on convertible debt assumed

175

175

Dividends to shareholders

(155

)

(155

)

Tax benefit from stock options

44

44

Repurchases of common shares

(17

)

(399

)

(399

)

Stock

-

based compensation

88

2

90

Balance at June 30, 2006

576

—

2,858

(1

)

(7

)

2,362

5,212

Comprehensive income, net of tax:

Change in unrealized gain (loss) on marketable securities, net

7

7

Change in unrealized gain (loss) on cash flow hedges, net

(4

)

(4

)

Net income

913

913

Comprehensive income

916

Issuance of common shares related to employee stock options and

employee stock purchase plan

21

219

219

Dividends to shareholders

(212

)

(212

)

Repurchases of common shares

(24

)

(576

)

(576

)

Payments made under prepaid forward agreements

(950

)

(950

)

Shares received under prepaid forward agreements

(38

)

Stock

-

based compensation

127

1

128

Balance at June 29, 2007

535

—

3,204

—

(

4

)

1,537

4,737

Cumulative effect adjustment to adopt recognition and

measurement provisions of FASB Interpretation No. 48 (See

Note 4)

(3

)

(3

)

Comprehensive income, net of tax:

Change in unrealized gain (loss) on cash flow hedges, net

(9

)

(9

)

Change in unrealized gain (loss) on auction rate securities, net

(3

)

(3

)

Net income

1,262

1,262

Comprehensive income

1,250

Issuance of common shares related to employee stock options and

employee stock purchase plan

15

178

178

Dividends to shareholders

(216

)

(216

)

Tax benefit from stock options

6

6

Repurchases of common shares

(65

)

(1,479

)

(1,479

)

Stock

-

based compensation

113

113

Balance at June 27, 2008

485

$

—

$

3,501

$

—

$

(

16

)

$

1,101

$

4,586