Seagate 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

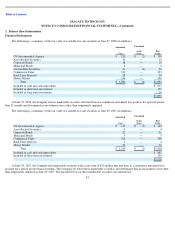

The Company transacts business in various foreign countries and its primary foreign currency cash flows are in countries where it has a

manufacturing presence. The Company has established a foreign currency hedging program to protect against the change in value of foreign

currency cash flows resulting from operating and capital expenditures over the next year. The Company hedges portions of its forecasted

expenditures denominated in foreign currencies with foreign currency forward contracts designated as cash flow hedges. When the U.S. dollar

weakens significantly against the foreign currencies, the increase in value of the future foreign currency expenditure is offset by gains in the

value of the foreign currency forward contracts designated as hedges. Conversely, as the U.S. dollar strengthens, the decrease in value of the

future foreign currency cash flows is offset by losses in the value of the foreign currency forward contracts. These foreign currency forward

contracts, carried at fair value, may have maturities of up to twelve months.

For derivative instruments designated as cash flow hedges, the company initially records the effective portion of the gain or loss on the

derivative in Other comprehensive income, and the ineffective portion is reported in Other income (expense). Amounts in Other comprehensive

income are reclassified into Cost of revenue in the same period during which the hedged forecasted transaction affects earnings.

The Company also hedges a portion of its foreign currency denominated balance sheet positions with foreign currency forward contracts to

reduce the risk that its earnings will be adversely affected by changes in currency exchange rates. The changes in fair value of these hedges are

recognized in Other income (expense) in the same period as the gains and losses from the remeasurement of the assets and liabilities. These

foreign currency forward contracts are not designated as hedging instruments under SFAS No. 133.

The Company evaluates hedging effectiveness prospectively and retrospectively and records any ineffective portion of the hedging

instruments in Other income (expense) on the Statement of Operations. The Company did not have any net gains (losses) recognized in Other

income (expense) for cash flow hedges due to hedge ineffectiveness in fiscal years 2008, 2007 and 2006. In addition, the Company did not

discontinue any cash flow hedges for a probable forecasted transaction that would not occur in fiscal years 2008, 2007, and 2006.

As of June 27, 2008, the notional value of the Company’s outstanding foreign currency forward contracts was approximately $25 million

in British pounds, $27 million in Euros, $115 million in Singapore dollars, $510 million in Thai baht, $20 million in Chinese yuan, $2 million in

Malaysian ringgit, $15 million in Japanese yen, and $15 million in Czech koruna. The fair value of the Company’s outstanding foreign currency

forward contracts at June 27, 2008 was a liability of $24 million. The Company does not believe that these derivatives present significant credit

risks, because the counterparties to the derivatives consist of major financial institutions with high credit quality ratings, it limits the notional

amount on contracts entered into with any one counterparty and maintains limits on maximum terms of contracts based on the credit rating of the

financial institutions. In addition, the exposure related to forward contracts is generally limited to the amount that a counterparty’s obligation

exceeds the amount owed by the Company. Net foreign currency transaction losses included in the determination of consolidated net income

were $1 million, $3 million and $6 million for fiscal years 2008, 2007 and 2006, respectively.

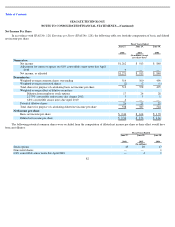

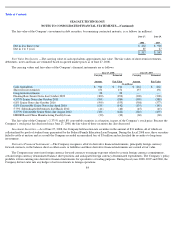

Accounts Receivable

85

June 27,

2008

June 29,

2007

(In millions)

Accounts receivable

$

1,416

$

1,433

Allowance for doubtful accounts

(6

)

(50

)

$

1,410

$

1,383