Seagate 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

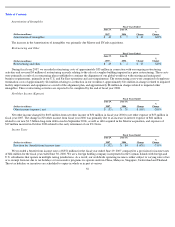

Amortization of Intangibles

The increase in the Amortization of intangibles was primarily due Maxtor and EVault acquisitions.

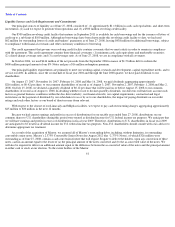

Restructuring and Other

During fiscal year 2007, we recorded restructuring costs of approximately $33 million in connection with our ongoing restructuring

activities and reversed $4 million of restructuring accruals relating to the sale of a surplus building impaired in a prior restructuring. These costs

were primarily a result of a restructuring plan established to continue the alignment of our global workforce with existing and anticipated

business requirements, primarily in our U.S. and Far East operations and asset impairments. The restructuring costs were comprised of employee

termination costs of approximately $14 million relating to a reduction in our workforce, approximately $11 million in charges related to impaired

facility improvements and equipment as a result of the alignment plan, and approximately $8 million in charges related to impaired other

intangibles. These restructuring activities are expected to be completed by the end of fiscal year 2008.

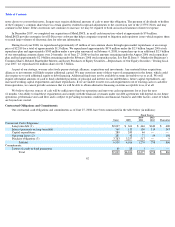

Net Other Income (Expense)

Net other income changed by $103 million from net other income of $50 million in fiscal year 2006 to net other expense of $53 million in

fiscal year 2007. The change in Net other income from fiscal year 2006 was primarily due to an increase in interest expense of $81 million

related to our new $1.5 billion long-term debt issued in September 2006, as well as debt acquired in the Maxtor acquisition, and expenses of

$19 million incurred in October 2006 related to the early retirement of our 8% Notes.

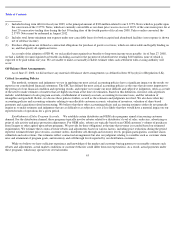

Income Taxes

We recorded a benefit from income taxes of $352 million for the fiscal year ended June 29, 2007 compared to a provision for income taxes

of $84 million for the fiscal year ended June 30, 2006. We are a foreign holding company incorporated in the Cayman Islands with foreign and

U.S. subsidiaries that operate in multiple taxing jurisdictions. As a result, our worldwide operating income is either subject to varying rates of tax

or is exempt from tax due to tax holidays or tax incentive programs we operate under in China, Malaysia, Singapore, Switzerland and Thailand.

These tax holidays or incentives are scheduled to expire in whole or in part at various

56

Fiscal Years Ended

(Dollars in millions)

June 29,

2007

June 30,

2006

Change

%

Change

Amortization of intangibles

$

49

$

7

$

42

600

%

Fiscal Years Ended

(Dollars in millions)

June 29,

2007

June 30,

2006

Change

%

Change

Restructuring and other

$

29

$

4

$

25

625

%

Fiscal Years Ended

(Dollars in millions)

June 29,

2007

June 30,

2006

Change

%

Change

Other income (expense), net

$

(53

)

$

50

$

(103

)

-

206

%

Fiscal Years Ended

(Dollars in millions)

June 29,

2007

June 30,

2006

Change

%

Change

Provision for (benefit from) income taxes

$

(352

)

$

84

$

(436

)

-

519

%