Seagate 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

informational purposes only and is not indicative of the results of operations that would have been achieved if the acquisition had taken place at

the beginning of the earliest period presented, nor does it intend to be a projection of future results.

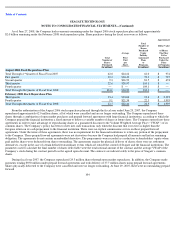

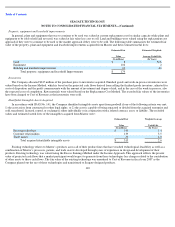

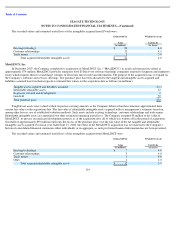

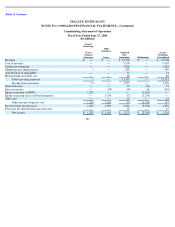

The unaudited pro forma financial information for the fiscal year ended June 30, 2006 combines the Company’s historical results for the

fiscal year ended June 30, 2006 and, due to differences in our reporting periods, the historical results of Maxtor for the period from July 3, 2005

to May 19, 2006.

EVault, Inc.

Fiscal Year Ended

June 30, 2006

(In millions, except per share data)

(Unaudited)

Revenue

$

12,199

Net income

$

489

Basic net income per share

$

0.84

Diluted net income per share

$

0.80

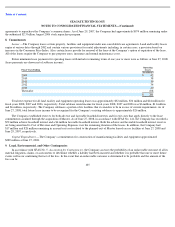

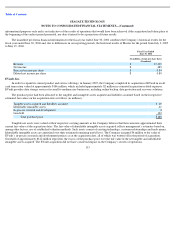

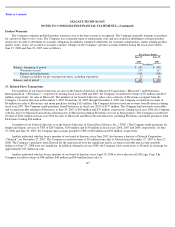

In order to expand its current product and service offerings, in January 2007, the Company completed its acquisition of EVault in an all

cash transaction valued at approximately $186 million, which included approximately $2 million in estimated acquisition-related expenses.

EVault provides data storage services for small to medium size businesses, including online backup, data protection and recovery solutions.

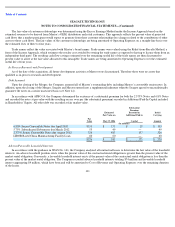

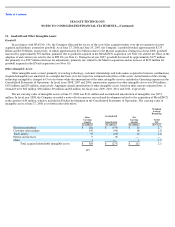

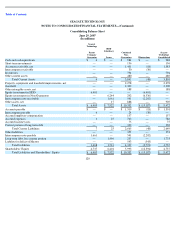

The purchase price had been allocated to the tangible and intangible assets acquired and liabilities assumed based on their respective

estimated fair values on the acquisition date as follows (in millions):

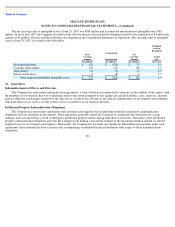

Tangible net assets were valued at their respective carrying amounts as the Company believes that these amounts approximated their

current fair values at the acquisition dates. The fair value of identifiable intangible assets acquired reflects management’s estimates based on,

among other factors, use of established valuation methods. Such assets consist of existing technology, customer relationships and trade names.

Identifiable intangible assets are amortized over their estimated remaining useful lives. The Company assigned $4 million to the value of

EVault’s in-process research and development projects as at the acquisition date, all of which was written off in the period of acquisition.

Goodwill of approximately $122 million represents the excess of the purchase price over the fair value of the net tangible and identifiable

intangible assets acquired. The EVault acquisition did not have a material impact on the Company’s results of operations.

113

Tangible assets acquired and liabilities assumed

$

19

Identifiable intangible assets

41

In

-

process research and development

4

Goodwill

122

Total purchase price

$

186