Seagate 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

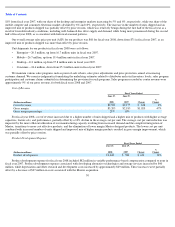

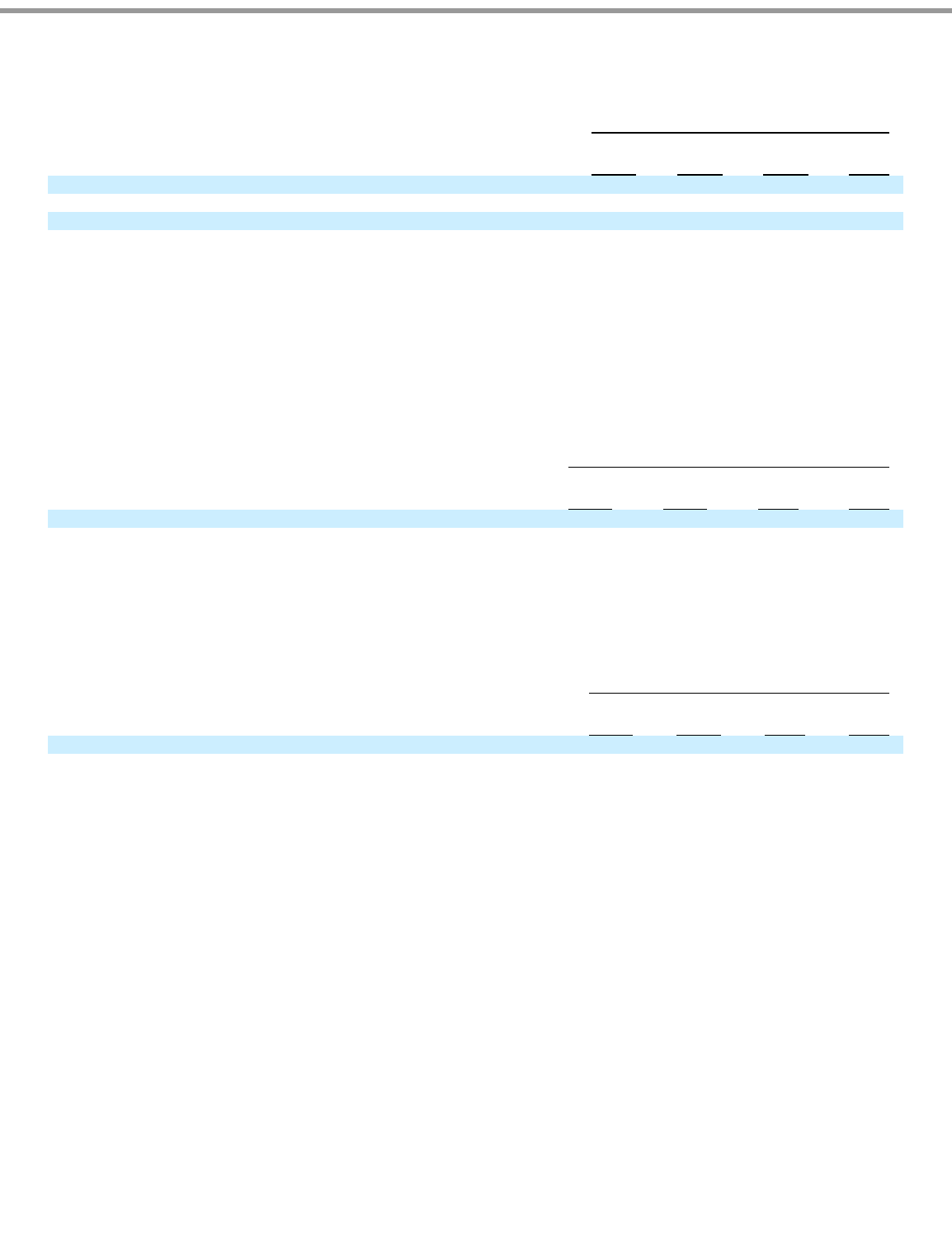

Cost of Revenue

The increase in cost of revenue for fiscal year 2007 was principally as a result of the acquisition of Maxtor. The gross margin percentage

decrease from fiscal year 2006 was due to the sale of lower margin Maxtor designed products during the first six months of fiscal year 2007;

costs and charges related to our acquisition of Maxtor during fiscal year 2007 (including integration and retention costs of $54 million, stock-

based compensation of $27 million, amortization of existing technology of $150 million, and an $18 million accrual for the settlement of

customer compensatory claims associated with quality issues related to legacy Maxtor products shipped prior to the closing of the Maxtor

acquisition); and an aggressive pricing environment in fiscal year 2007, particularly in the high capacity 3.5-inch and mobile markets in the first

half of the year, and the low end OEM desktop and mobile markets in the second half. These effects were partially offset by the elimination of

variable performance-based compensation for fiscal year 2007, compared to an expense of $76 million recorded in Cost of revenue in fiscal year

2006.

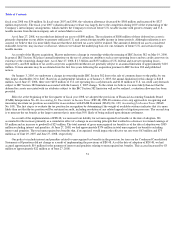

Product Development Expense

The increase in product development expense from fiscal year 2006 was primarily due to increases of $115 million in salaries and benefits

resulting from increased staffing levels due in part to the retention of certain Maxtor employees, and $10 million in stock-based compensation

related to the Maxtor acquisition, $7 million in non-Maxtor stock-based compensation and $4 million in the write-off of in-process research and

development related to our acquisition of EVault, partially offset by the elimination of variable performance-based compensation for fiscal year

2007, compared to an expense of $46 million in fiscal year 2006.

Marketing and Administrative Expense

The increase in marketing and administrative expense from fiscal year 2006 was primarily due to the recording in our first quarter of a

$40 million increase in the provision for doubtful accounts receivable related to eSys, previously a distributor of Seagate products, an increase of

$86 million in salaries and benefits resulting from increased staffing levels due in part to the retention of certain Maxtor employees, an increase

of $5 million in integration and retention costs related to the Maxtor acquisition, an increase of $11 million in advertising expense and an

increase of $11 million in non-Maxtor stock-based compensation. These increases were partially offset by the elimination of variable

performance-based compensation for fiscal year 2007, compared to an expense of $41 million in fiscal year 2006.

55

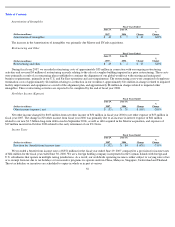

Fiscal Years Ended

(Dollars in millions)

June 29,

2007

June 30,

2006

Change

%

Change

Cost of revenue

$

9,175

$

7,069

$

2,106

30

%

Gross margin

$

2,185

$

2,137

$

48

2

%

Gross margin percentage

19%

23%

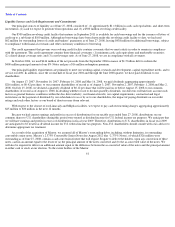

Fiscal Years Ended

(Dollars in millions)

June 29,

2007

June 30,

2006

Change

%

Change

Product development

$

904

$

805

$

99

12

%

Fiscal Years Ended

(Dollars in millions)

June 29,

2007

June 30,

2006

Change

%

Change

Marketing and administrative

$

589

$

447

$

142

32

%