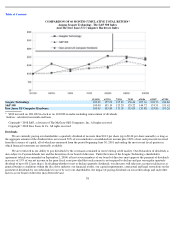

Seagate 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 6.

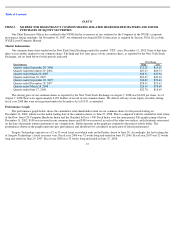

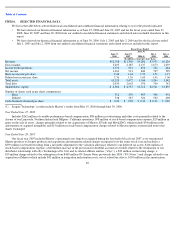

SELECTED FINANCIAL DATA

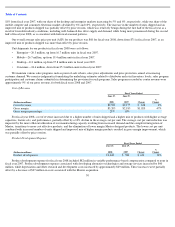

We list in the table below selected historical consolidated and combined financial information relating to us for the periods indicated.

•

We have derived our historical financial information as of June 27, 2008 and June 29, 2007 and for the fiscal years ended June 27,

2008, June 29, 2007 and June 30, 2006 from our audited consolidated financial statements and related notes included elsewhere in this

report.

Year Ended June 27, 2008

•

We have derived our historical financial information as of June 30, 2006, July 1, 2005 and July 2, 2004 and for the fiscal years ended

July 1, 2005 and July 2, 2004 from our audited consolidated financial statements and related notes not included in this report.

Fiscal Years Ended

June 27,

2008

June 29,

2007

June 30,

2006(1)

July 1,

2005

July 2,

2004

(In millions, except per share data)

Revenue

$

12,708

$

11,360

$

9,206

$

7,553

$

6,224

Gross margin

3,205

2,185

2,137

1,673

1,459

Income from operations

1,376

614

874

722

444

Net income

1,262

913

840

707

529

Basic net income per share

2.46

1.64

1.70

1.51

1.17

Diluted net income per share

2.36

1.56

1.60

1.41

1.06

Total assets

10,120

9,472

9,544

5,244

3,942

Total debt

2,030

2,063

970

740

743

Shareholders

’

equity

$

4,586

$

4,737

$

5,212

$

2,541

$

1,855

Number of shares used in per share computations:

Basic

512

558

495

468

452

Diluted

538

587

524

502

498

Cash dividends declared per share

$

0.42

$

0.38

$

0.32

$

0.26

$

0.20

(1)

Seagate Technology

’

s results include Maxtor

’

s results from May 19, 2006 through June 30, 2006.

Includes $262 million of variable performance-based compensation, $88 million in restructuring and other costs primarily related to the

closure of our Limavady, Northern Ireland and Milpitas, California operations, $98 million of stock-based compensation expense, $20 million in

gains on the sale of assets, charges primarily related to our acquisitions of Maxtor, EVault and MetaLINCs which include $94 million in the

amortization of acquired intangibles and $15 million in stock-based compensation charges related to Maxtor options assumed and nonvested

shares exchanged.

Year Ended June 29, 2007

Our fiscal year 2007 included Maxtor’s operating losses largely recognized during the first half of fiscal year 2007 as we transitioned

Maxtor products to Seagate products and acquisition and integration related charges recognized over the entire fiscal year and includes a

$359 million tax benefit resulting from a favorable adjustment to the valuation allowance related to our deferred tax assets, $101 million of

stock-based compensation expense, a $40 million increase in the provision for doubtful accounts receivable related to the termination of our

distributor relationship with eSys Technologies Pte. Ltd. and its related affiliate entities (“eSys”), a $29 million restructuring charge, a

$19 million charge related to the redemption of our $400 million 8% Senior Notes previously due 2009 (“8% Notes”) and charges related to our

acquisition of Maxtor which include $42 million in integration and retention costs, net of related tax effects, $150 million in the amortization

40