Seagate 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

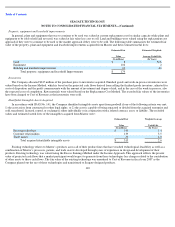

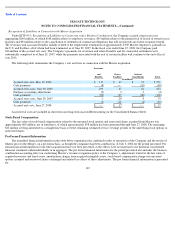

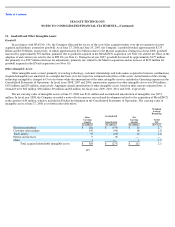

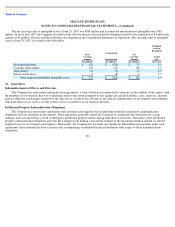

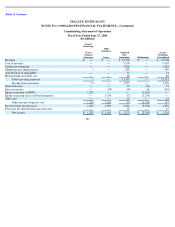

The net carrying value of intangible assets at June 29, 2007 was $188 million and accumulated amortization of intangibles was $185

million. In fiscal year 2007, the Company recorded a write-off of in-process research and development related to the acquisition of EVault in the

amount of $4 million, which is included in Product development in the Consolidated Statements of Operations. The carrying value of intangible

assets at June 29, 2007 is set forth in the table below.

12. Guarantees

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Weighted

Average

Remaining

Useful

Life

(In millions)

(In millions)

(In millions)

(In Years)

Existing technology

$

176

$

(121

)

$

55

2.1

Customer relationships

152

(47

)

105

2.6

Trade names

36

(9

)

27

2.9

Patents and licenses

9

(8

)

1

5.7

Total acquired identifiable intangible assets

$

373

$

(185

)

$

188

2.5

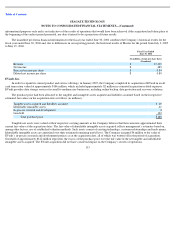

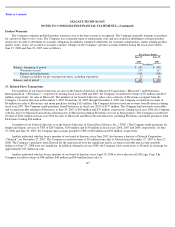

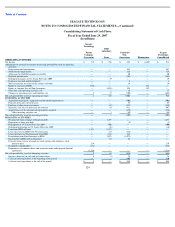

Indemnifications to Officers and Directors

The Company has entered into indemnification agreements, a form of which is incorporated by reference in the exhibits of this report, with

the members of our board of directors to indemnify them to the extent permitted by law against any and all liabilities, costs, expenses, amounts

paid in settlement and damages incurred by the directors as a result of any lawsuit, or any judicial, administrative or investigative proceeding in

which the directors are sued as a result of their service as members of our board of directors.

Intellectual Property Indemnification Obligations

The Company has entered into agreements with customers and suppliers that include limited intellectual property indemnification

obligations that are customary in the industry. These guarantees generally require the Company to compensate the other party for certain

damages and costs incurred as a result of third party intellectual property claims arising from these transactions. The nature of the intellectual

property indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be

required to pay to its customers and suppliers. Historically, the Company has not made any significant indemnification payments under such

agreements and no amount has been accrued in the accompanying consolidated financial statements with respect to these indemnification

obligations.

116