Seagate 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

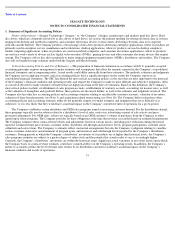

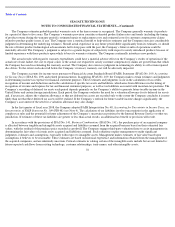

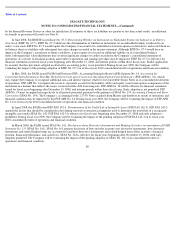

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations (SFAS No. 141(R)). The standard changes the

accounting for business combinations including the measurement of acquirer shares issued in consideration for a business combination, the

recognition of contingent consideration, the accounting for pre-acquisition gain and loss contingencies, the recognition of capitalized in-process

research and development, the accounting for acquisition related restructuring liabilities, the treatment of acquisition related transaction costs and

the recognition of changes in the acquirer’s income tax valuation allowance. SFAS No. 141(R) is effective for fiscal years beginning after

December 15, 2008, with early adoption prohibited. The Company currently believes that the adoption of SFAS No. 141(R) will result in the

recognition of certain types of expenses in its results of operations that are currently capitalized pursuant to existing accounting standards,

amongst other potential impacts. SFAS No. 141(R) will impact the accounting for business combinations completed by the Company on or after

adoption in its fiscal year 2010.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities—Including an

Amendment of FASB Statement No. 115

(SFAS No. 159). SFAS No. 159 permits entities to choose to measure many financial instruments and

certain other items at fair value. Unrealized gains and losses on items for which the fair value option has been elected will be recognized in

earnings at each subsequent reporting date. SFAS No. 159 is effective for financial statements issued for fiscal years beginning after

November 15, 2007. The Company does not expect to adopt SFAS No. 159 with respect to its current assets and liabilities but will continue to

evaluate the potential application of SFAS No. 159 on an on-going basis.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (SFAS No. 157) which defines fair value, establishes a

framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. This

Statement applies under other accounting pronouncements that require or permit fair value measurements, the FASB having previously

concluded in those accounting pronouncements that fair value is the relevant measurement attribute. Accordingly, SFAS No. 157 does not

require any new fair value measurements. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after

November 15, 2007, and interim periods within those fiscal years. The Company will adopt SFAS No. 157 for financial assets in its fiscal year

2009 and for non-financial assets in its fiscal year 2010. The Company is currently evaluating the impact of the pending adoption of SFAS

No. 157 on its consolidated results of operations and financial condition.

81