Seagate 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

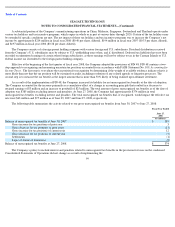

provisions of FIN 48. As of the date of adoption of FIN 48, the Company had accrued approximately $19 million for the payment of interest and

penalties relating to unrecognized tax benefits. This accrual increased by $3 million to approximately $22 million as of June 27, 2008.

During the 12 months ending June 27, 2008, the Company recognized a previously unrecognized tax benefit of approximately $13 million

related to the recognition of foreign uncertain tax benefits as a result of new information obtained during the year. The Company also recognized

a previously unrecognized tax benefit of approximately $9 million for foreign uncertain tax benefits resulting in a reduction of the Maxtor

goodwill as a result of the expiration of certain foreign statutes of limitation for pre-acquisition periods.

During the 12 months beginning June 28, 2008, the Company expects to reduce its unrecognized tax benefits by approximately $21 million

as a result of the expiration of certain statutes of limitation. The Company does not believe it is reasonably possible that other unrecognized tax

benefits will materially change in the next 12 months. However, the resolution and/or timing of closure on open audits are highly uncertain as to

when these events occur.

The Company files U.S. federal, U.S. state, and foreign tax returns. The statutes of limitation for U.S. Federal returns are open for fiscal

year 2003 and forward. The Internal Revenue Service has completed its examination of fiscal years ending in 2003 and 2004. For state and

foreign tax returns, the Company is generally no longer subject to tax examinations for years prior to fiscal year 2001.

5. Restructuring Costs and Other

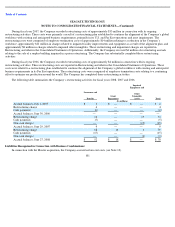

Ongoing Restructuring Activities

During fiscal year 2008, the Company recorded restructuring and other charges of $88 million, comprised mainly of charges related to the

planned closures of its Limavady, Northern Ireland and Milpitas, California operations. These restructuring and other charges are reported in

Restructuring and other in the Consolidated Statement of Operations.

The restructuring charges associated with the Limavady facility were primarily related to employee termination costs of $29 million and

approximately $18 million related to expected grant repayments. The Company plans to cease production of its Limavady facility during the first

quarter of fiscal year 2009 and expects all activities related to this closure to be complete by the second half of fiscal year 2009. The Company

expects additional restructuring charges of approximately $10 million to be recorded primarily over the next two quarters, resulting in aggregate

restructuring charges of approximately $60 million to $65 million.

The Company recorded approximately $19 million of restructuring charges associated with employee termination costs related to the

planned closure of its media manufacturing facility in Milpitas, California. The Company plans to cease production of its Milpitas facility during

the first quarter of fiscal year 2009 and expects all activities related to this closure to be complete by the second half of fiscal year 2009. The

Company expects additional restructuring charges of approximately $17 million to be recorded primarily over the next two quarters, resulting in

an aggregate restructuring charge of approximately $36 million. In addition, as a result of the planned closure of the Milpitas facility, the

Company expects approximately $38 million relating to accelerated asset depreciation to be recorded to cost of revenue in the first quarter of

fiscal year 2009.

The remaining restructuring and other charges were primarily comprised of employee termination costs as a result of plans to continue the

alignment of the Company’s global workforce with existing and anticipated business requirements around the world. The Company expects

these restructuring activities to be completed by the end of its fourth quarter of fiscal year 2009.

100