Seagate 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

notes choose to convert their notes, Seagate may require additional amounts of cash to meet this obligation. The payment of dividends to holders

of the Company’s common shares have in certain quarters resulted in upward adjustments to the conversion rate of the 2.375% Notes and may

continue in the future. If the conversion rate continues to increase, we may be required to book an increased amount of interest expense.

In December 2007, we completed our acquisition of MetaLINCS, in an all cash transaction valued at approximately $74 million.

MetaLINCS provides enterprise level E-

Discovery software that helps companies respond to litigation and regulatory issues which requires them

to search large volumes of electronic data for relevant information.

During fiscal year 2008, we repurchased approximately 65 million of our common shares through open market repurchases at an average

price of $22.89 for a total of approximately $1.5 billion. We repurchased approximately $974 million under the $2.5 billion August 2006 stock

repurchase plan and approximately $500 million under a new plan announced on February 4, 2008, to repurchase up to an additional $2.5 billion

of our outstanding common shares over 24 months. As of June 27, 2008 we had no amounts remaining under the August 2006 stock repurchase

plan and had approximately $2.0 billion remaining under the February 2008 stock repurchase plan. See Part II, Item 5: “Market for Registrant’s

Common Shares, Related Shareholder Matters and Issuer Purchases of Equity Securities—Repurchases of Our Equity Securities.” During fiscal

year 2007, we repurchased 62 million shares for $1.5 billion.

As part of our strategy, we may selectively pursue strategic alliances, acquisitions and investments. Any material future acquisitions,

alliances or investments will likely require additional capital. We may enter into more of these types of arrangements in the future, which could

also require us to seek additional equity or debt financing. Additional funds may not be available on terms favorable to us or at all. We will

require substantial amounts of cash to fund scheduled payments of principal and interest on our indebtedness, future capital expenditures, any

increased working capital requirements and share repurchases. If we are unable to meet our cash requirements out of existing cash or cash flow

from operations, we cannot provide assurance that we will be able to obtain alternative financing on terms acceptable to us, if at all.

We believe that our sources of cash will be sufficient to fund our operations and meet our cash requirements for at least the next

12 months. Our ability to fund these requirements and comply with the financial covenants under our debt agreements will depend on our future

operations, performance and cash flow and is subject to prevailing economic conditions and financial, business and other factors, some of which

are beyond our control.

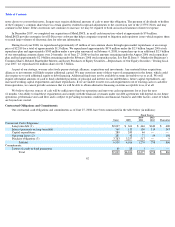

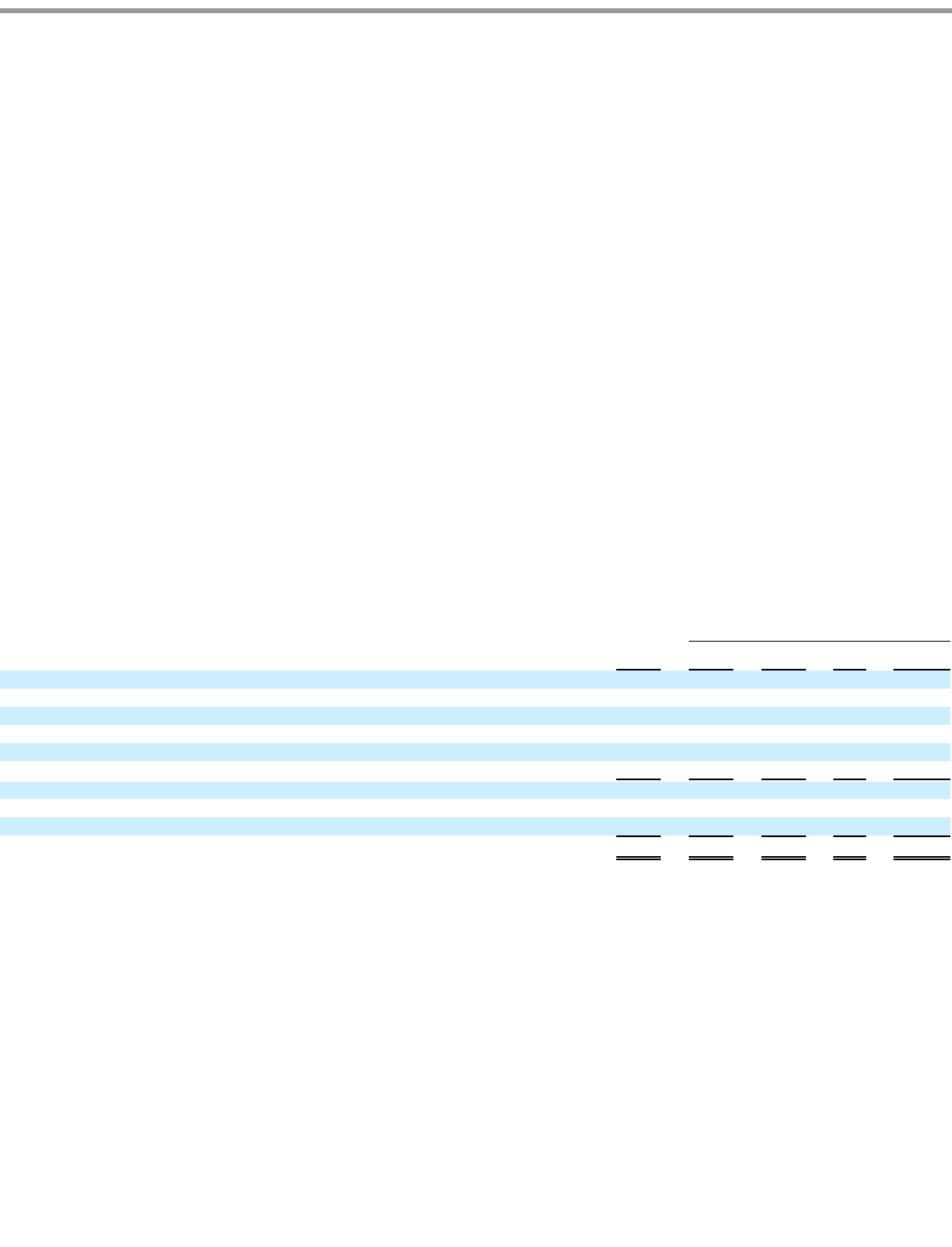

Contractual Obligations and Commitments

Our contractual cash obligations and commitments as of June 27, 2008, have been summarized in the table below (in millions):

62

Fiscal Year(s)

Total

2009

2010-

2011

2012-

2013

Thereafter

Contractual Cash Obligations:

Long term debt (1)

$

2,037

$

361

$

446

$

630

$

600

Interest payments on long

-

term debt

560

113

190

114

143

Capital expenditures

289

243

46

—

—

Operating leases (2)

281

42

77

54

108

Purchase obligations (3)

3,783

3,257

517

—

9

Subtotal

6,950

4,016

1,276

798

860

Commitments:

Letters of credit or bank guarantees

89

88

1

—

—

Total

$

7,039

$

4,104

$

1,277

$

798

$

860