Seagate 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Cash provided by operating activities for fiscal year 2007 was approximately $943 million and included the effects of:

•

net income adjusted for non

-

cash items including depreciation, amortization, stock

-

based compensation and tax benefits related to a

change in our valuation allowance for deferred tax assets;

•

a decrease of $391 million in accounts payable;

•

a decrease of $465 million in accrued expenses, employee compensation and warranty. A large part of this increase was due to variable

performance

-

based compensation earned during fiscal year 2006 and paid in fiscal year 2007;

•

the payment of accrued exit costs and retention bonuses related to the Maxtor acquisition; and

Cash provided by operating activities for fiscal year 2006 was approximately $1.5 billion and included the effects of:

•

a reduction of $106 million in inventories.

•

net income adjusted for non-cash items including depreciation, amortization and stock-based compensation;

•

increases of $190 million in accounts receivable and $113 million in inventories; and

Cash Used in Investing Activities

•

increases of $91 million in accounts payable and $120 million in accrued expenses, employee compensation and warranty.

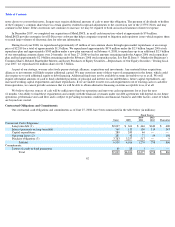

During fiscal year 2008, we used $991 million for net cash investing activities, which was primarily attributable to expenditures for

property, equipment and leasehold improvements of approximately $930 million and $74 million for the acquisition of MetaLINCS. The

approximately $930 million we invested in property, equipment and leasehold improvements was primarily comprised of:

•

$88 million for manufacturing facilities and equipment related to our subassembly and disc drive final assembly and test facilities in

the Far East;

•

$

490 million to upgrade and expansion of our recording media operations in the United States, Malaysia and Singapore;

•

$184 million for manufacturing facilities and equipment for our recording head operations in the United States, the Far East and

Northern Ireland;

•

$

65 million for manufacturing facilities and equipment for alternative technologies in the United States; and

During fiscal year 2007, we used $402 million for net cash investing activities, which was primarily attributable to expenditures for

property, equipment and leasehold improvements of approximately $906 million and $178 million (net of cash acquired) for the acquisition of

EVault, partially offset by $675 million of maturities and sales of short-term investments in excess of purchases of short-term investments. The

approximately $906 million we invested in property, equipment and leasehold improvements was primarily comprised of:

•

$103 million for research and development, information technology infrastructure and other facilities and equipment costs.

•

$192 million for manufacturing facilities and equipment related to our subassembly and disc drive final assembly and test facilities in

the Far East;

59

•

$

414 million to upgrade and expansion of our recording media operations in the United States, Singapore and Northern Ireland;