Seagate 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

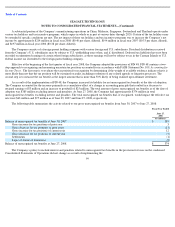

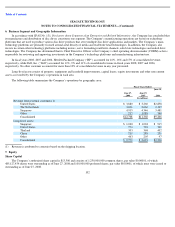

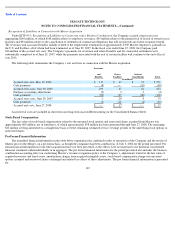

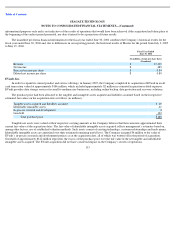

As of June 27, 2008, the Company had no amounts remaining under the August 2006 stock repurchase plan and had approximately

$2.0 billion remaining under the February 2008 stock repurchase plan. Share purchases during the fiscal year were as follows:

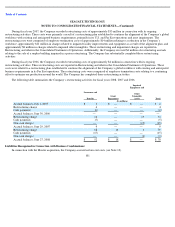

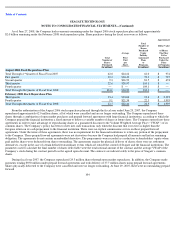

From the authorization of the August 2006 stock repurchase plan and through the fiscal year ended June 29, 2007, the Company

repurchased approximately 62.0 million shares, all of which were cancelled and are no longer outstanding. The Company repurchased these

shares through a combination of open market purchases and prepaid forward agreements with large financial institutions, according to which the

Company prepaid the financial institutions a fixed amount to deliver a variable number of shares at future dates. The Company entered into these

agreements in order to take advantage of repurchasing shares at a guaranteed discount to the Volume Weighted Average Price (“VWAP”) of its

common shares. The Company’s policy has been to enter into such transactions only when the discount that it receives is higher than the

foregone return on its cash prepayment to the financial institution. There were no explicit commissions or fees on these prepaid forward

agreements. Under the terms of these agreements, there was no requirement for the financial institutions to return any portion of the prepayment

to the Company. These prepaid forward agreements were not derivatives because the Company had prepaid all amounts and had no remaining

obligation. The agreements do not contain an embedded derivative. The prepayments were recorded as a reduction to shareholders’ equity when

paid and the shares were deducted from shares outstanding. The agreements require the physical delivery of shares; there were no settlement

alternatives, except in the case of certain defined extraordinary events which are outside the control of Seagate and the financial institutions. The

parameters used to calculate the final number of shares deliverable were the total notional amount of the contract and the average VWAP of the

Company’s stock during the contract period less the agreed upon discount. The contracts are indexed solely to the price of Seagate’s common

shares.

During fiscal year 2007, the Company repurchased 24.3 million shares through open market repurchases. In addition, the Company made

payments totaling $950 million under prepaid forward agreements and took delivery of 37.7 million shares using prepaid forward agreements.

Shares physically delivered to the Company were cancelled and were no longer outstanding. At June 29, 2007, there were no outstanding prepaid

forward

104

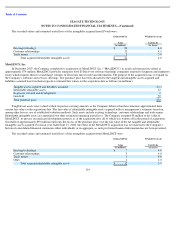

Total

Number of

Shares

Purchased

Average

Price

Paid

per

Share

Total

Number of

Shares

Purchased

Under

Publicly

Announced

Plans

or

Programs

Approximate

Dollar Value

of Shares

That May

Yet be

Purchased

Under the

Plans

or Programs

(In millions)

(In millions)

(In millions)

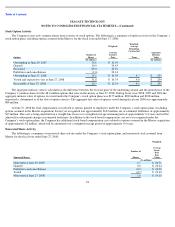

August 2006 Stock Repurchase Plan

Total Through 4

th

Quarter of Fiscal Year 2007

62.0

$

24.62

62.0

$

974

First quarter

10.2

$

24.41

72.2

$

725

Second quarter

9.3

$

26.99

81.5

$

474

Third quarter

22.6

$

20.97

104.1

$

—

Fourth quarter

—

$

—

104.1

$

—

Total Through 4th Quarter of Fiscal Year 2008

104.1

$

24.02

104.1

$

—

February 2008 Stock Repurchase Plan

Third quarter

13.4

$

23.06

13.4

$

2,191

Fourth quarter

9.1

$

21.54

22.5

$

1,995

Total Through 4th Quarter of Fiscal Year 2008

22.5

$

22.44

22.5

$

1,995