Seagate 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

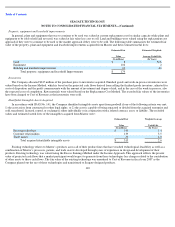

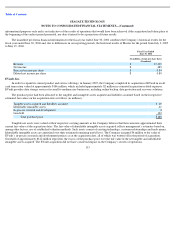

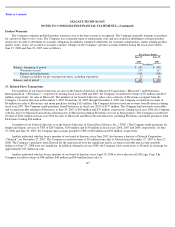

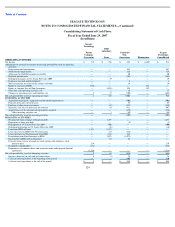

Product Warranty

The Company estimates probable product warranty costs at the time revenue is recognized. The Company generally warrants its products

for a period of three to five years. The Company uses estimated repair or replacement costs and uses statistical modeling to estimate product

return rates in order to determine its warranty obligation. In addition, estimated settlements for customer compensatory claims relating product

quality issues, if any, are accrued as warranty expense. Changes in the Company’s product warranty liability during the fiscal years ended

June 27, 2008 and June 29, 2007 were as follows:

13. Related Party Transactions

Fiscal Years Ended

June 27,

2008

June 29,

2007

(In millions)

Balance, beginning of period

$

430

$

445

Warranties issued

255

217

Repairs and replacements

(263

)

(298

)

Changes in liability for pre

-

existing warranties, including expirations

23

66

Balance, end of period

$

445

$

430

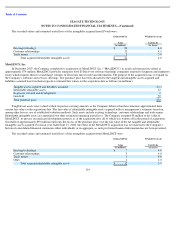

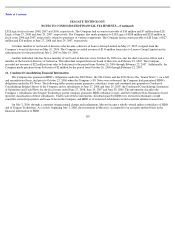

Two members of our board of directors are also on the boards of directors of Microsoft Corporation (“Microsoft”) and Flextronics

International Ltd. (“Flextronics”), respectively. During fiscal years 2008 and 2007, the Company recorded net revenue of $5 million and $113

million, respectively, for sales to Microsoft. The member of our board of directors who is also a director of Flextronics resigned from the

Company’s board of directors on December 3, 2007. From June 30, 2007 through December 3, 2007, the Company recorded net revenue of

$6 million for sales to Flextronics and made purchases totaling $115 million. The Company did not record any revenue from Flextronics during

fiscal year 2007. The Company made purchases from Flextronics in fiscal year 2007 of $177 million. The Company had non-trade receivables

and accounts payable relating to Flextronics at June 29, 2007 of $66 million and $37 million, respectively. During fiscal year 2006, the Company

sold disc drives to Microsoft and certain subcontractors to Microsoft including Flextronics for use in their products. The Company recorded net

revenue of $214 million in fiscal year 2006 for sales to Microsoft and Microsoft subcontractors, including Flextronics and made purchases from

Flextronics totaling $64 million.

A member of our board of directors is on the board of directors of United Parcel Service, Inc. (“UPS”) The Company made payments for

freight and logistic services to UPS of $207 million, $160 million and $130 million in fiscal years 2008, 2007 and 2006, respectively. At June

27, 2008 and June 29, 2007, the Company had accounts payable to UPS of $30 million and $33 million, respectively.

Another individual who has been a member of our board of directors since June 2002 also became a director of Xiotech Corporation

(“Xiotech”) on November 27, 2007. The Company recorded revenue of $2 million from sales to Xiotech from November 27, 2007 to June 27,

2008. The Company’s purchases from Xiotech for the same period were not significant and its accounts receivable and accounts payable

balances at June 27, 2008 were not significant. In addition, during fiscal year 2008, the Company sold certain assets to Xiotech in exchange for

approximately $13 million in cash.

Another individual who has been a member of our board of directors since April 29, 2004 is also a director of LSI Logic Corp. The

Company recorded revenue of $48 million, $46 million and $44 million from sales to

117