Seagate 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

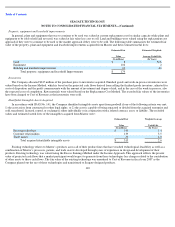

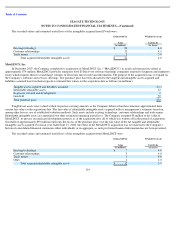

LSI Logic for fiscal years 2008, 2007 and 2006, respectively. The Company had accounts receivable of $10 million and $7 million from LSI

Logic at June 27, 2008 and June 29, 2007, respectively. The Company also made payments to LSI Logic of $208 million and $220 million in

fiscal years 2008 and 2007, respectively, related to purchases of various components. The Company had accounts payable to LSI Logic of $27

million and $26 million at June 27, 2008 and June 29, 2007, respectively.

A former member of our board of directors who became a director of Lenovo Group Limited on May 17, 2005, resigned from the

Company’s board of directors on May 19, 2006. The Company recorded revenue of $136 million from sales to Lenovo Group Limited and its

subcontractors for the period from July 2, 2005 to May 19, 2006.

Another individual who has been a member of our board of directors since October 26, 2006 was also the chief executive officer and a

member of the board of directors of Solectron. The individual resigned from our board of directors on February 22, 2007. The Company

recorded net revenue of $22 million from sales to Solectron for the period from October 26, 2006 through February 22, 2007. Additionally, the

Company made purchases from Solectron of $2 million for the period from October 26, 2006 through February 22, 2007.

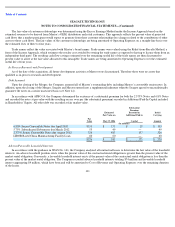

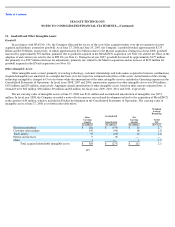

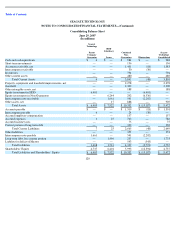

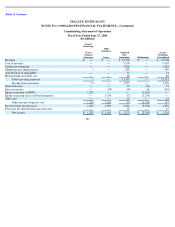

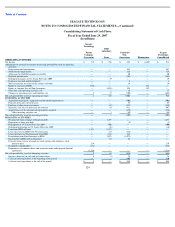

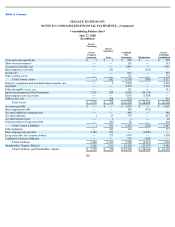

14. Condensed Consolidating Financial Information

The Company has guaranteed HDD

’

s obligations under the 2009 Notes, the 2011 Notes and the 2016 Notes (the

“

Senior Notes

”

),

on a full

and unconditional basis, and prior to October 25, 2006 when the Company’s 8% Notes were redeemed, the Company had guaranteed HDD’s

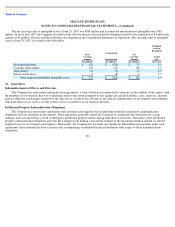

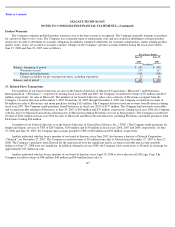

obligations under the 8% Notes. The following tables present parent guarantor, subsidiary issuer and combined non-guarantors Condensed

Consolidating Balance Sheets of the Company and its subsidiaries at June 27, 2008 and June 29, 2007, the Condensed Consolidating Statements

of Operations and Cash Flows for the fiscal years ended June 27, 2008, June 29, 2007 and June 30, 2006. The information classifies the

Company’s subsidiaries into Seagate Technology-parent company guarantor, HDD-subsidiary issuer, and the Combined Non-Guarantors based

upon the classification of those subsidiaries. Under each of these instruments, dividends paid by HDD or its restricted subsidiaries would

constitute restricted payments and loans between the Company and HDD or its restricted subsidiaries would constitute affiliate transactions.

On July 3, 2006, through a corporate organizational change and realignment, Maxtor became a wholly-owned indirect subsidiary of HDD

and of Seagate Technology. As a result, beginning July 3, 2006, the investment in Maxtor is accounted for on an equity method basis in the

financial information of HDD.

118