Food Lion 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

3. Segment Information

IFRS 8 applies the so-called “management approach” to segment reporting and requires the Group to report financial and

descriptive information about its reportable segments. Such reportable segments are operating segments or aggregations of

operating segments that meet specified criteria.

Operating segments are components of an entity which engage in business activities from which they may earn revenues and

incur expenses, including revenues and expenses that relate to transactions with any of the Group’s other components, about

which discrete financial information is available that is evaluated regularly by the chief operating decision maker (CODM) in

deciding how to allocate resources and in assessing performance. The Group is required to report separate information about

each operating segment that:

has been identified as described above or results from aggregating two or more of those segments if they exhibit similar

long-term financial performance and have similar economic characteristics; and

exceeds certain quantitative thresholds.

Delhaize Group identified the Executive Committee as its CODM and defined operating segments based on the information

provided to the Executive Committee. Subsequently, the Group reviewed these operating segments in order to establish if any of

these individual operating segments can be considered to have similar economic characteristics and exhibit similar long-term

financial performance as described by IFRS 8, which are then aggregated into one single operating segment. The Group

reviewed its U.S. operating segments for similar economic characteristics and long-term financial performance using, for

example, operating profit margin, gross margin and comparable store sales development as quantitative benchmarks and

concluded aggregating them into the segment “United States” meets the requirements of IFRS 8 and is consistent with the core

principle of the standard. In a final step, reportable segments have been identified, which represent (aggregated) operating

segments that exceed the quantitative thresholds defined by IFRS 8 and require individual disclosure. Operating segments that

do not pass these thresholds are by default combined into the “All Other Segments” category of IFRS 8, which the Group has

labeled as “Southeastern Europe”. P.T. Lion Super Indo, LLC (“Super Indo”), the Group’s equity accounted joint venture, does

not meet the criteria of an operating segment and is therefore not included in the segment information provided below.

Management concluded that the reader of the Group’s financial statements would benefit from distinguishing operating from non-

operating - other business activities - and, therefore, decided to disclose separately the corporate activities of the Group in the

segment “Corporate”.

Overall, this results in a geographical segmentation of the Group’s business, based on the location of customers and stores,

which matches the way Delhaize Group manages its operations.

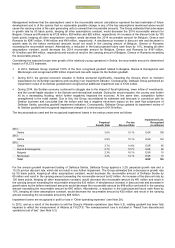

The Executive Committee internally reviews the performance of Delhaize Group’s segments against a number of measures, of

which “underlying operating profit” (UOP), represents the most important measure of profit or loss. UOP adjusts for a number of

elements that the CODM considers as non-representative of the Group’s underlying operating performance. A reconciliation from

operating profit to UOP is included in the segment information. All other amounts of each segment items reported to the CODM

equal consolidated IFRS financial information. Therefore, as the information provided to the CODM and disclosed as segment

information represents consolidated IFRS financial information, no further reconciling items need to be disclosed.

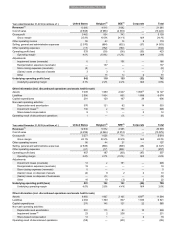

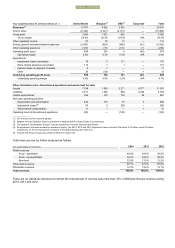

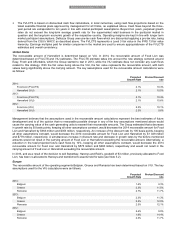

The operating segments information for 2014, 2013 and 2012 is as follows:

FINANCIAL STATEMENTS