Food Lion 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

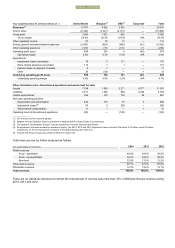

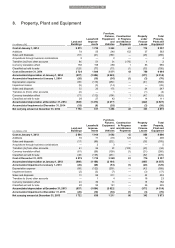

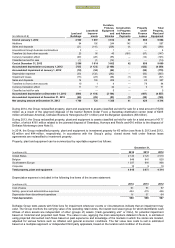

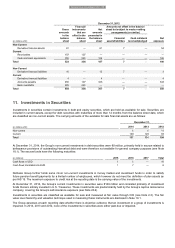

104 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

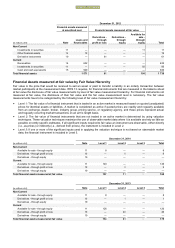

(in millions of €)

Land and

Buildings

Leasehold

Improve

-

ments

Furniture,

Fixtu

res,

Equipment

and

Vehicles

Construction

in Progress

and Advance

Payments

Property

under

Finance

Leases

Total

Property,

Plant and

Equipment

Cost at January 1, 2012

2 530

1 897

3 612

86

969

9 094

Additions

94

100

244

145

14

5

97

Sales and disposals

(21)

(110)

(228)

(4)

(26)

(389)

Acquisitions through business combinations

3

—

1

—

—

4

Transfers (to) from other accounts

29

56

40

(185)

(87)

(147)

Currency translation effect

(48)

(28)

(55)

—

(14)

(145)

Classified as held for sale

(1)

(1)

(12)

—

—

(14)

Cost at December 31, 2012

2 586

1 914

3 602

42

856

9 000

Accumulated depreciation at January 1, 2012

(735)

(1 123)

(2 109)

—

(422)

(4 389)

Accumulated impairment at January 1, 2012

(18)

(34)

(62)

—

(56)

(170)

Depreciation expense

(93)

(132)

(292)

—

(50)

(567)

Impairment losses

(15)

(23)

(36)

(1)

(12)

(87)

Sales and disposals

14

109

209

—

25

357

Transfers to (from) other accounts

10

1

4

—

79

94

Currency translation effect

11

17

34

—

9

71

Classified as held for sale

—

—

5

—

—

5

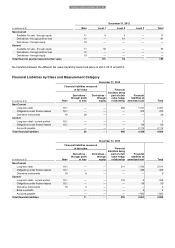

Accumulated depreciation at December 31, 2012

(800)

(1 156)

(2 194)

—

(407)

(4 557)

Accumulated impairment at December 31, 2012

(26)

(29)

(53)

(1)

(20)

(129)

Net carrying amount at December 31, 2012

1 760

729

1 355

41

429

4 314

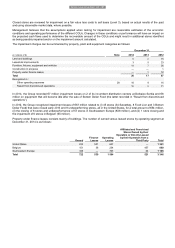

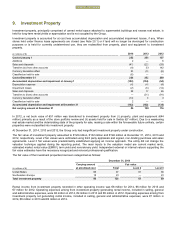

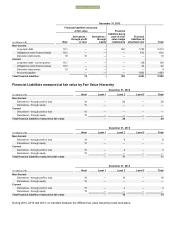

During 2014, the Group reclassified property, plant and equipment to assets classified as held for sale for a total amount of €224

million as a result of the (planned) disposal of the banner Bottom Dollar Food, a Sweetbay distribution center (total of €205

million at Delhaize America), Delhaize Bosnia & Herzegovina (€11 million) and the Bulgarian operations (€8 million).

During 2013, the Group reclassified property, plant and equipment to assets classified as held for sale for a total amount of €177

million, of which €161 million related to the planned disposal of Sweetbay, Harveys and Reid’s and €16 million to the disposal of

Delhaize Montenegro (see Note 5).

In 2014, the Group reclassified property, plant and equipment to investment property for €0 million (see Note 9; 2013 and 2012,

€2 million and €44 million, respectively). In accordance with the Group’s policy, closed stores held under finance lease

agreements are reclassified to investment property.

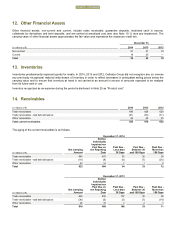

Property, plant and equipment can be summarized by reportable segment as follows:

December 31,

(in millions of €)

2014

2013

2012

United States

2 120

2 129

2 510

Belgium

848

841

828

Southeastern Europe

1 037

994

966

Corporate

10

9

10

Total property, plant and equipment

4 015

3 973

4 314

Depreciation expense is included in the following line items of the income statement:

(in millions of €)

2014

2013

2012

Cost of sales

60

56

57

Selling, general and administrative expenses

424

415

446

Depreciation from discontinued operations

16

37

64

Total depreciation

500

508

567

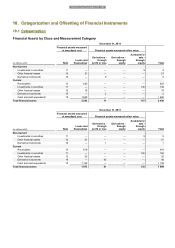

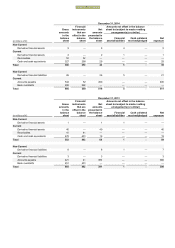

Delhaize Group tests assets with finite lives for impairment whenever events or circumstances indicate that an impairment may

exist. The Group monitors the carrying value of its operating retail stores, the lowest level asset group for which identifiable cash

inflows of store assets are independent of other (groups of) assets (“cash-generating unit” or CGU), for potential impairment

based on historical and projected cash flows. The value in use, applying the main assumptions detailed in Note 6, is estimated

using projected discounted cash flows based on past experience and knowledge of the markets in which the stores are located,

adjusted for various factors such as inflation and general economic conditions. The fair value less costs to sell is estimated

based on a multiples approach or independent third party appraisals, based on the location and condition of the stores.

FINANCIAL STATEMENTS