Food Lion 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delhaize Group Annual Report 2014 • 169

Other operating expenses

Primarily store closing expenses, impairment

losses, reorganization expenses, and losses

on the sale of fixed assets.

Other operating income

Primarily rental income on investment prop-

erty, gains on sale of fixed assets, recycling

income and services rendered to wholesale

customers.

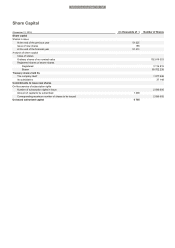

Outstanding shares

The number of shares issued by the Company,

excluding treasury shares.

Pay-out ratio (net earnings)

Proposed dividends on current year earnings

divided by current year Group share in net

profit.

Return on equity

Group share in net result divided by average

shareholders’ equity.

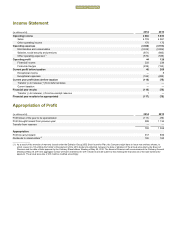

Revenues

Revenues include the sale of goods and

point of sale services to customers, including

wholesale and affiliated customers, relating to

the normal activity of the Company (the sale of

groceries and pet products), net of discounts,

allowances and rebates granted to those

customers.

Selling, general and

administrative expenses

Selling, general and administrative expenses

include store operating expenses, costs

incurred for activities which serve secur-

ing sales, administrative and advertising

expenses.

SKU

Stock Keeping Unit.

Total debt

Long-term financial liabilities, including current

portion and obligations under finance leases,

plus short-term financial liabilities net of deriv-

ative instruments related to financial liabilities.

Treasury shares

Shares repurchased by one of the Group’s

legal entities and that are not cancelled as of

year-end date. Treasury shares are excluded

from the number of shares outstanding and

excluded from the calculation of the weighted

average number of shares for the purpose of

calculating earnings per share.

Underlying EBITDA

Underlying operating profit plus depreciation

and amortization less any depreciation or

amortization that has been excluded from

underlying operating profit.

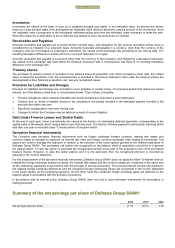

Underlying Group share in net

profit from continued operations

Net profit from continuing operations minus

non-controlling interests (from continuing

operations) and excluding (i) the elements

excluded from operating profit to determine

underlying operating profit (see separate

definition), (ii) material non-recurring finance

costs (e.g. debt refinancing costs) and income

tax expense (e.g. tax settlements), and (iii) the

potential effect of all these items on income tax

and non-controlling interests.

Underlying operating profit

Operating profit (as reported) excluding fixed

assets impairment charges, restructuring

charges, store closing expenses, gains/losses

on disposal of fixed assets and other items

that management considers as not being

representative of the Group’s operating perfor-

mance of the period.

Weighted average number

of shares outstanding

Number of shares outstanding at the

beginning of the period less treasury shares,

adjusted by the number of shares cancelled,

repurchased or issued during the period multi-

plied by a time-weighting factor.

Withholding tax

Withholding by a corporation or financial

institution of a certain percentage of dividend

payments due to tax legislation.

m2

sq.ft.

Number of stores

Location

Surface

Number of products