Food Lion 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash Flow Statement and

Balance Sheet

Net cash provided by operating

activities

In 2014, net cash provided by operating

activities was €1 147 million, a decrease of

€38 million compared to 2013, mainly as a

result of lower EBITDA (€93 million, both from

continuing and discontinued operations),

higher tax payments (€26 million), partially off-

set by a favorable change in operating assets

and liabilities (€76 million).

Free cash flow

As a result of capital expenditures of €606 mil-

lion (€565 million in 2013), €167 million of

proceeds related to divestitures and contin-

ued working capital control, we generated

€757 million free cash flow in 2014 (€669 mil-

lion in 2013).

Net debt

Compared to year-end 2013, net debt

decreased by €476 million to €1.0 billion

mainly as a result of €757 million of free cash

flow generation which was partially offset by

the payment of the dividend in the second

quarter and the strengthening of the U.S.

dollar.

NON-GAAP MEASURES

In its financial communication, Delhaize Group uses certain measures

that have no definition under IFRS or other generally accepted

accounting standards (non-GAAP measures). Delhaize Group does

not represent these measures as alternative measures to net profit

or other financial measures determined in accordance with IFRS.

These measures as reported by Delhaize Group might differ from

similarly titled measures by other companies. We believe that these

measures are important indicators for our business and are widely

used by investors, analysts and other parties. A reconciliation of

these measures to IFRS measures can be found in the chapter

“Supplementary Information” of the Financial Statements

(http://annualreport.delhaizegroup.com). A definition of non-GAAP

measures and ratios composed of non-GAAP measures can be found

in the glossary. The non-GAAP measures provided in this report have

not been audited by the statutory auditor.

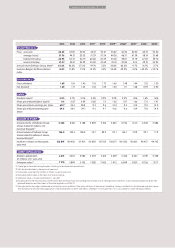

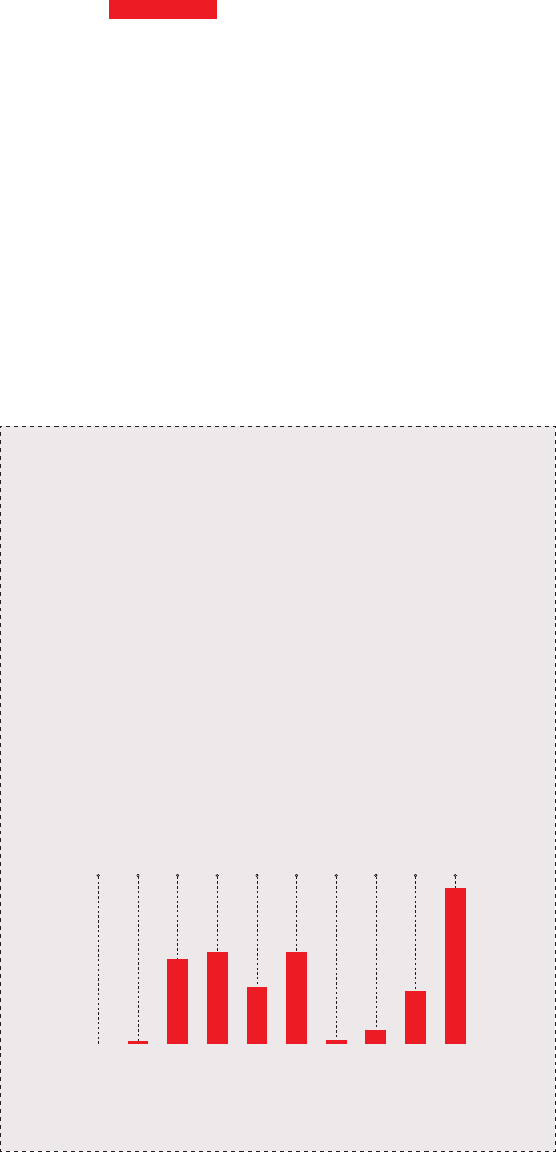

DEBT MATURITY PROFILE

(1)

(AFTER SWAPS)

(IN MILLIONS OF €)

(1) Excluding finance leases; principal payments (related premiums and discounts not

taken into account) after effect of cross-currency interest rate swaps.

PERFORMANCE

0

2015

371

2017

247

2019

10

2024

229

2031

8

2016

400

2018

400

2020

58

2027

681

2040