Food Lion 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

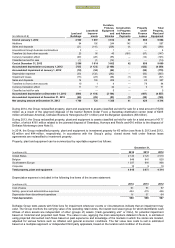

114 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

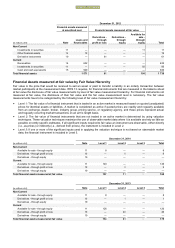

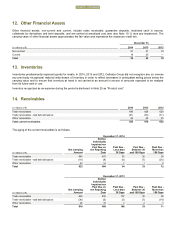

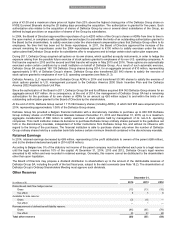

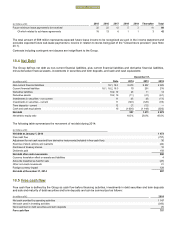

12. Other Financial Assets

Other financial assets, non-current and current, include notes receivable, guarantee deposits, restricted cash in escrow,

collaterals for derivatives and term deposits, and are carried at amortized cost (see also Note 10.1), less any impairment. The

carrying value of other financial assets approximates the fair value and represents the maximum credit risk.

December 31,

(in millions of €)

2014

2013

2012

Non

-current

21

21

19

Current

18

25

—

Total

39

46

19

13. Inventories

Inventories predominantly represent goods for resale. In 2014, 2013 and 2012, Delhaize Group did not recognize any (or reverse

any previously recognized) material write-downs of inventory in order to reflect decreases in anticipated selling prices below the

carrying value and to ensure that inventory at hand is not carried at an amount in excess of amounts expected to be realized

from its future sale or use.

Inventory recognized as an expense during the period is disclosed in Note 25 as “Product cost.”

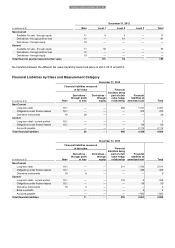

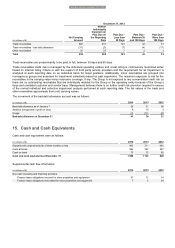

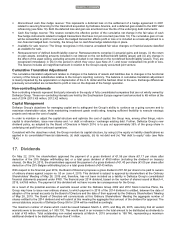

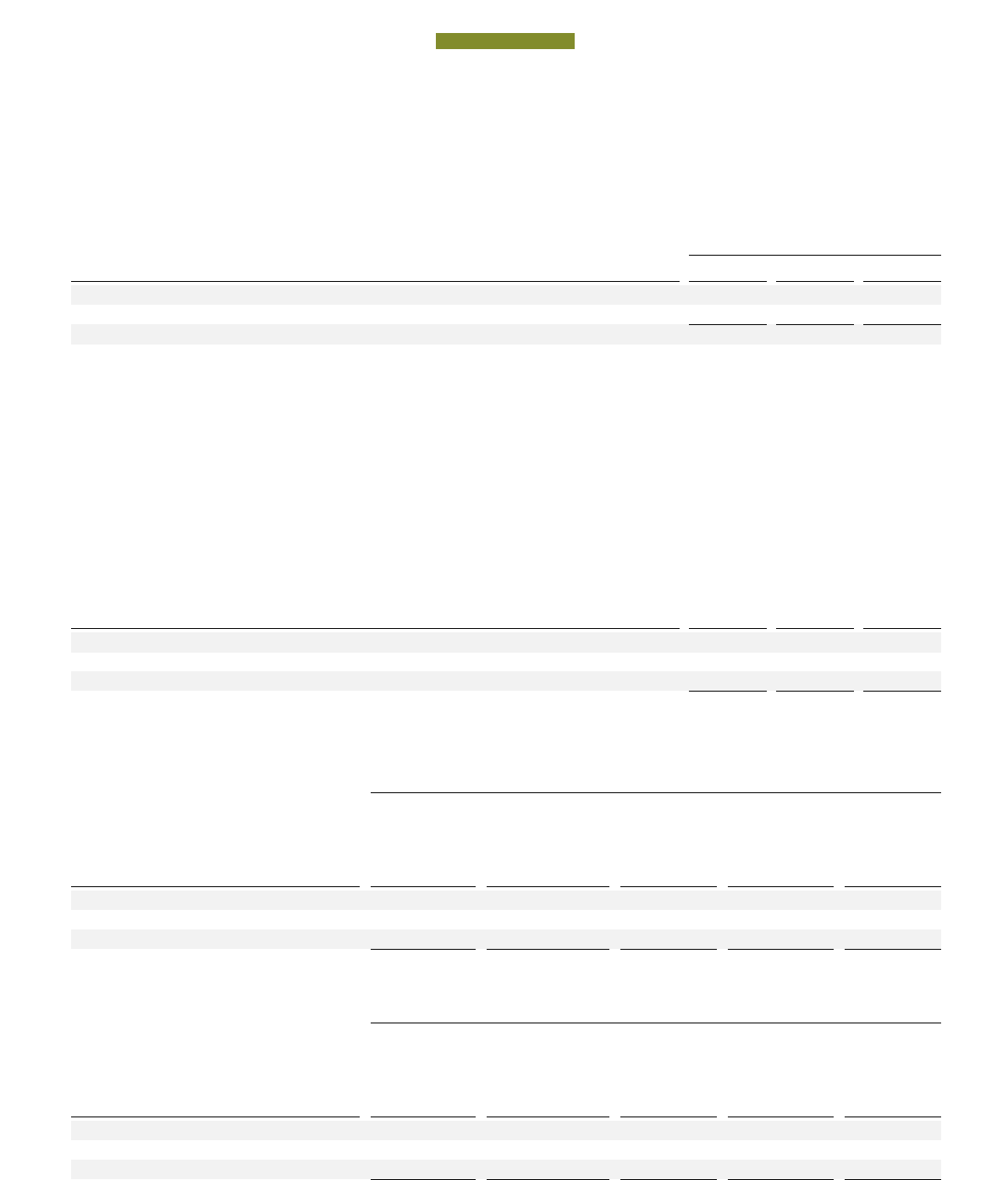

14. Receivables

(in millions of €)

2014

2013

2012

Trade receivables

640

628

628

Trade receivables - bad debt allowance

(41)

(36)

(31)

Other receivables

24

26

35

Total current receivables

623

618

632

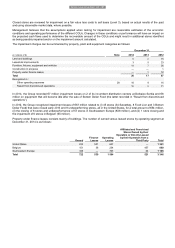

The aging of the current receivables is as follows:

December 31, 2014

(in millions of €)

Net Carrying

Amount

Neither

Individually

Impaired nor

Past Due on

the Reporting

Date

Past Due

-

Less than

30 Days

Past Due

-

Between 30

and 180 Days

Past Due

-

More than

180 Days

Trade receivables

640

478

93

39

30

Trade receivables - bad debt allowance

(41)

(8)

(6)

(7)

(20)

Other receivables

24

14

7

1

2

Total

623

484

94

33

12

December 31, 2013

(in millions of €)

Net Carrying

Amount

Neither

Ind

ividually

Impaired nor

Past Due on

the Reporting

Date

Past Due

-

Less than

30 Days

Past Due

-

Between 30

and 180 Days

Past Due

-

More than

180 Days

Trade receivables

628

455

107

38

28

Trade receivables - bad debt allowance

(36)

(6)

(5)

(7)

(18)

Other receivables

26

19

4

2

1

Total

618

468

106

33

11

FINANCIAL STATEMENTS