Food Lion 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

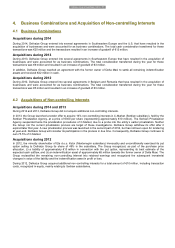

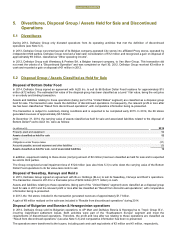

DELHAIZE GROUP FINANCIAL STATEMENTS 2014 // 101

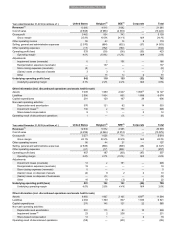

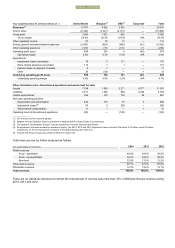

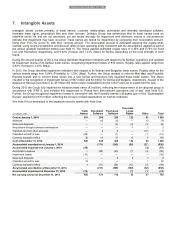

7. Intangible Assets

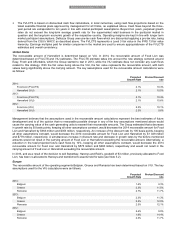

Intangible assets consist primarily of trade names, customer relationships, purchased and internally developed software,

favorable lease rights, prescription files and other licenses. Delhaize Group has determined that its trade names have an

indefinite useful life and are not amortized, but are tested annually for impairment and whenever events or circumstances

indicate that impairment may have occurred. Trade names are tested for impairment by comparing their recoverable amount,

being their FVLCTS (Level 3), with their carrying amount. The recoverable amount is estimated applying the royalty-relief-

method, using revenue projections and discount rates of each operating entity consistent with the assumptions applied as part of

the annual goodwill impairment testing (see Note 6). The Group applied estimated royalty rates of 0.45% and 0.70% for Food

Lion and Hannaford, respectively, and 0.62% (Tempo) and 1.41% (Maxi) for Serbia, depending on the local strength of each

brand.

During the second quarter of 2014, the Group identified impairment indicators with respect to its Serbian operations and updated

its impairment review of its Serbian trade names, recognizing impairment losses of €10 million. Royalty rates applied range from

0.62% (Tempo) to 1.43% (Maxi).

In 2013, the Group identified impairment indicators with respect to its Serbian and Bulgarian trade names. Royalty rates for the

various brands range from 0.54% (Piccadilly) to 1.20% (Maxi). Further, the Group decided to retire its Mini Maxi and Piccadilly

Express brands and to convert these stores into a new format and therefore fully impaired these trade names. The above

resulted in the recognition of impairment losses of €67 million and €4 million for Serbia and Bulgaria, respectively. As part of the

disposal of Harveys (see Note 5.2), $5 million (€4 million) were reclassified from the CGU Food Lion to assets held for sale.

During 2012 the Group fully impaired the Albanian trade name (€3 million), reflecting the measurement of the disposal group in

accordance with IFRS 5, and included this impairment in “Result from discontinued operations (net of tax)” (see Note 5.3).

Further, the Group recognized impairment losses in connection with the Piccadilly brands in Bulgaria (part of the “Southeastern

Europe” segment) for €15 million, reflecting the Group’s revised expectations on market conditions.

See Note 8 for a description of the impairment test for assets with finite lives.

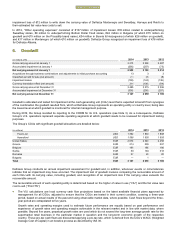

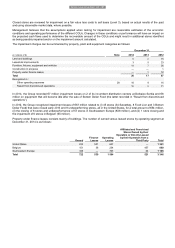

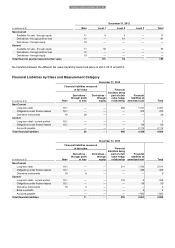

(in millions of €)

Trade

Names

Developed

Software

Purchased

Software

Favorable

Lease

Rights

Other

Total

Cost at January 1, 2014

519

290

359

122

55

1 345

Additions

—

43

23

—

12

78

Sales and disposals

—

—

(2)

(4)

(3)

(9)

Acquisitions through business combinations

—

—

—

1

1

2

Transfers (to) from other accounts

—

2

9

—

(10)

1

Classified as held for sale

(29)

—

(1)

—

(1)

(31)

Currency translation effect

38

13

37

15

6

109

Cost at December 31, 2014

528

348

425

134

60

1 495

Accumulated amortization at January 1, 2014

—

(171)

(242)

(86)

(27)

(526)

Accumulated impairment at January 1, 2014

(85)

—

—

—

(2)

(87)

Amortization expense

—

(35)

(43)

(7)

(4)

(89)

Impairment losses

(10)

—

—

—

—

(10)

Sales and disposals

—

—

2

4

3

9

Classified as held for sale

19

—

—

—

1

20

Currency translation effect

4

(11)

(26)

(12)

(4)

(49)

Accumulated amortization at December 31, 2014

—

(217)

(309)

(100)

(32)

(658)

Accumulated impairment at December 31, 2014

(72)

—

—

(1)

(1)

(74)

Net carrying amount at December 31, 2014

456

131

116

33

27

763

Delhaize Group Annual Report 2014 • 103