Food Lion 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

16. Equity

Issued capital

There were 102 819 053, 102 449 570 and 101 921 498 Delhaize Group ordinary shares issued and fully paid at December 31,

2014, 2013 and 2012, respectively (par value of €0.50), of which 1 115 094, 1 200 943 and 1 044 135 ordinary shares were held

in treasury at December 31, 2014, 2013 and 2012, respectively. Delhaize Group’s ordinary shares may be in either

dematerialized or registered form, within the limits provided for by applicable law. Each shareholder is entitled to one vote for

each ordinary share held on each matter submitted to a vote of shareholders.

In the event of a liquidation, dissolution or winding up of Delhaize Group, holders of Delhaize Group ordinary shares are entitled

to receive, on a pro-rata basis, any proceeds from the sale of Delhaize Group’s remaining assets available for distribution. Under

Belgian law, the approval of holders of Delhaize Group ordinary shares is required for any future capital increases. Existing

shareholders are entitled to preferential subscription rights to subscribe to a pro-rata portion of any such future capital increases

of Delhaize Group, subject to certain limitations.

Authorized Capital

As authorized by the Extraordinary General Meeting held on May 24, 2012, the Board of Directors of Delhaize Group may, for a

period of five years expiring in June 2017, within certain legal limits, increase the capital of Delhaize Group or issue convertible

bonds or subscription rights which might result in an increase of capital by a maximum of €5.1 million, corresponding to

approximately 10.2 million shares. The authorized increase in capital through issuance of new shares, convertible debt or

warrants, may be achieved by contributions in cash or, to the extent permitted by law, by contributions in kind or by incorporation

of available or unavailable reserves or of the share premium account. The Board of Directors of Delhaize Group may, for this

increase in capital, limit or remove the preferential subscription rights of Delhaize Group’s shareholders, within certain legal

limits.

In 2014, Delhaize Group SA issued 369 483 shares of common stock (2013: 528 072; 2012: 29 308) for €14 million (2013:

€16 million; 2012: €1 million), net of €5 million (2013: €8 million; 2012: insignificant) representing the portion of the subscription

price funded by Delhaize America, LLC in the name and for the account of the optionees and net of issue costs.

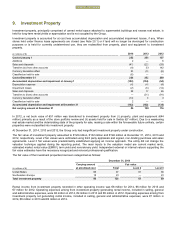

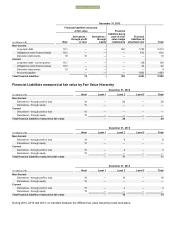

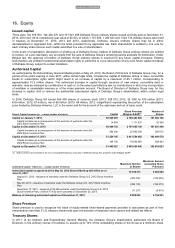

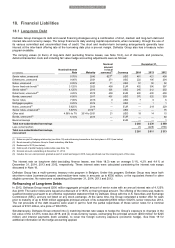

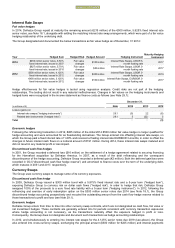

Recent Capital Increases (in €, except number of shares)

Capital

Share Premium

(Belgian GAAP)(1)

Number of

Shares

Capital on January 1, 2012

50 946 095

2 796 483 909

101 892 190

Capital increase as a consequence of the exercise of warrants under the

2002 Stock Incentive Plan

14 654

1 171 837

29 308

Capital on December 31, 2012

50 960 749

2 797 655 746

101 921 498

Capital increase as a consequence of the exercise of warrants under the

2002 Stock Incentive Plan

264 036

23 899 236

528 072

Capital on December 31, 2013

51 224 785

2 821 554 982

102 449 570

Capital increase as a consequence of the exercise of warrants under the

2002 Stock Incentive Plan

184 742

18 899 664

369 483

Capital on December 31, 2014

51 409 527

2 840 454 646

102 819 053

_______________

(1) Share premium as recorded in the non-consolidated statutory accounts of Delhaize Group SA, prepared under Belgian GAAP.

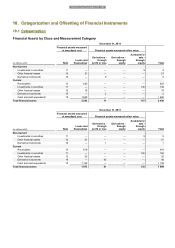

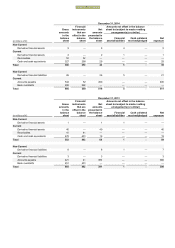

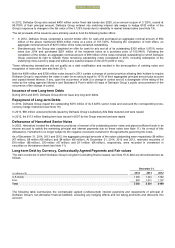

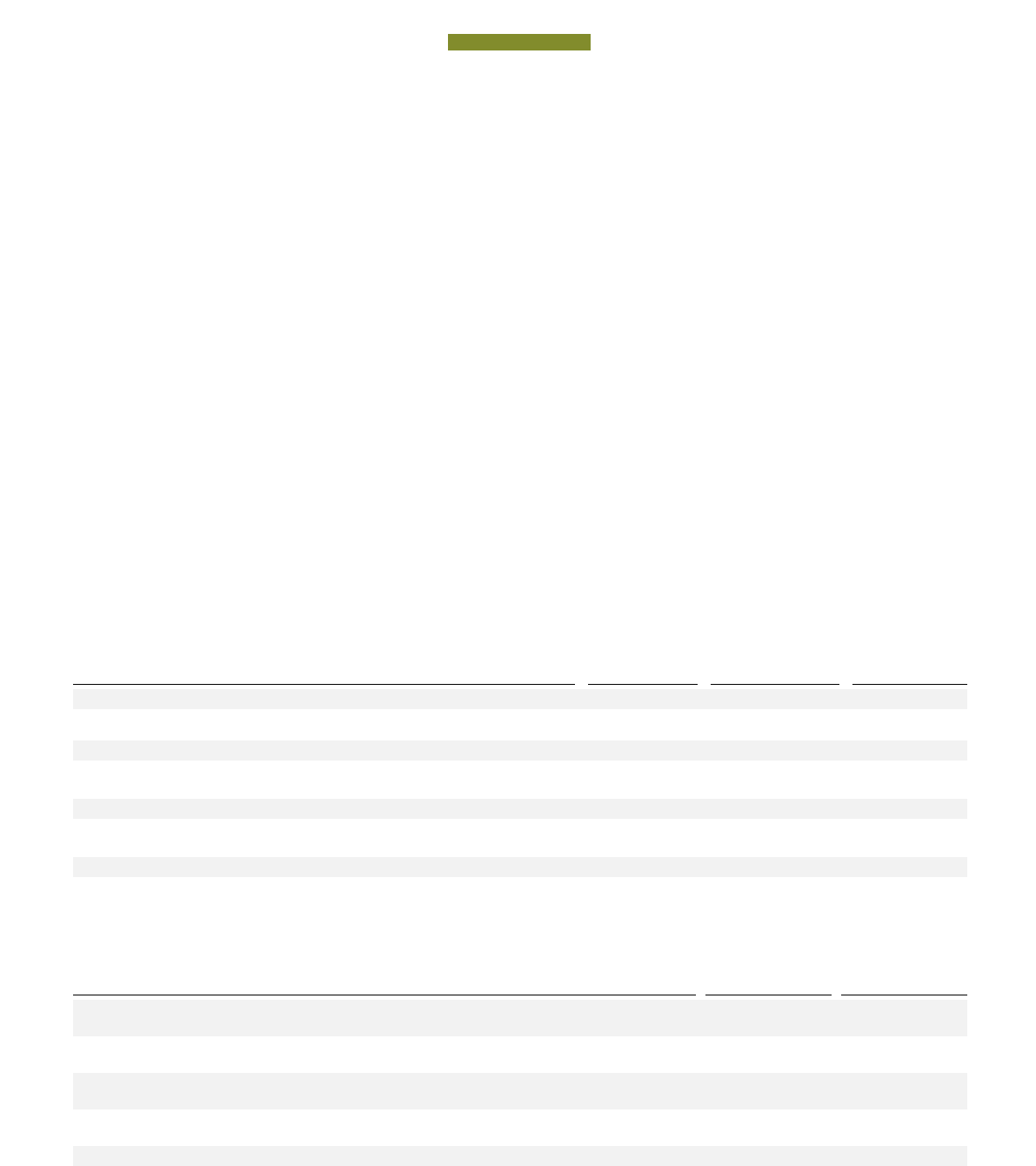

Authorized Capital - Status (in €, except number of shares)

Maximum Number

of Shares

Maximum Amount

(excluding Share

Premium)

Authorized capital as approved at the May 24, 2012 General Meeting with effect as of

June 21, 2012

10 189 218

5 094 609

August 31, 2012 - Issuance of warrants under the Delhaize Group U.S. 2012 Stock Incentive

Plan

(300 000)

(150 000)

May 29, 2013 - Issuance of warrants under the Delhaize Group U.S. 2012 Stock Incentive

Plan

(368 139)

(184 070)

November 12, 2013 - Issuance of 89 069 warrants under the Delhaize Group U.S. 2012

Stock Incentive Plan, of which 77 832 were cancelled on December 23, 2013

(11 237)

(5 618)

Balance of remaining authorized capital as of December 31, 2014

9 509 842

4 754 921

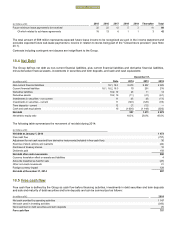

Share Premium

Share premium is used to recognize the value of equity-settled share-based payments provided to associates as part of their

remuneration (see Note 21.3), treasury shares sold upon the exercise of employee stock options and related tax effects.

Treasury Shares

In 2011, at an Ordinary and Extraordinary General Meeting, the Delhaize Group’s shareholders authorized the Board of

Directors, in the ordinary course of business, to acquire up to 10% of the outstanding shares of the Group at a minimum share

FINANCIAL STATEMENTS