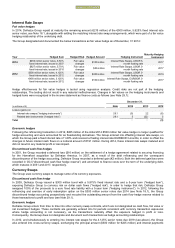

Food Lion 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

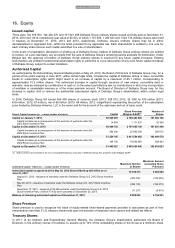

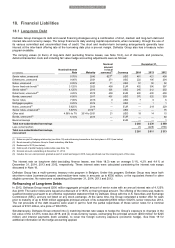

DELHAIZE GROUP FINANCIAL STATEMENTS 2014 // 121

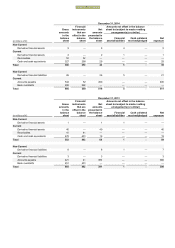

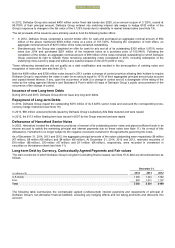

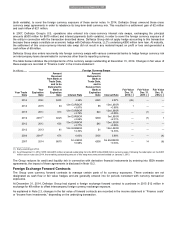

(in millions of $)

2015

2016

2017

2018

2019

Thereafter

Fair Value

Fixed rates

Senior Notes due 2016

—

9

—

—

—

—

10

Interest due

1

—

—

—

—

—

—

Bonds due 2017

—

—

450

—

—

—

497

Interest due

29

29

15

—

—

—

—

Senior Notes due 2019

—

—

—

—

300

—

314

Interest due

12

12

12

12

6

—

—

Notes due 2027

—

—

—

—

—

71

89

Interest due

6

6

6

6

6

43

—

Debentures due 2031

—

—

—

—

—

271

367

Interest due

24

24

24

24

24

281

—

Senior Notes due 2040

—

—

—

—

—

827

878

Interest due

47

47

47

47

47

990

—

Mortgage payable

—

1

—

—

—

—

1

Interest due

—

—

—

—

—

—

—

Other debt

1

—

1

—

—

19

22

Interest due

1

1

1

1

1

8

—

Total $ cash flows

121

129

556

90

384

2 510

2 178

Total cash flows translated

in millions of €

100

106

457

74

316

2 067

1 793

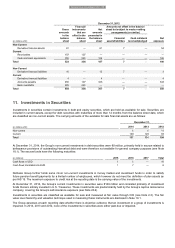

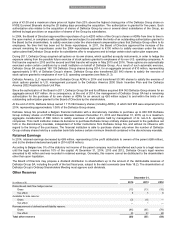

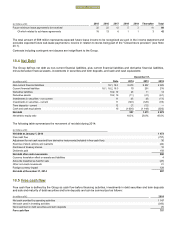

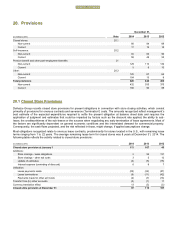

(in millions of €)

2015

2016

2017

2018

2019

Thereafter

Fair Value

Fixed rates

Retail Bond due 2018

—

—

—

400

—

—

445

Interest due

17

17

17

17

—

—

—

Senior Notes due 2020

—

—

—

—

—

400

442

Interest due

13

13

13

13

13

13

Total € cash flows

30

30

30

430

13

413

887

Total cash flows in €

130

136

487

504

329

2 480

2 680

In the event where a counterparty has a choice of when an amount is paid (e.g., on demand deposits), the liability is allocated to

the earliest period in which Delhaize Group can be required to pay. Delhaize Group is managing its liquidity risk based on

contractual maturities.

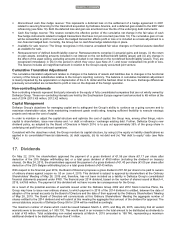

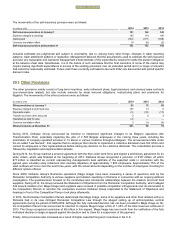

The fair values of the long-term debt (excluding finance leases, see Note 18.3) for which an active market exists have been

determined using their quoted prices (Level 1). The fair values of long-term debts that are classified as Level 2 (non-public debt

or debt for which there is no active market) have been estimated using rates publicly available for debt of similar terms and

remaining maturities offered to the Group and its subsidiaries.

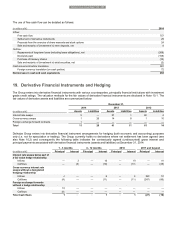

(in millions of €)

Level 1

Level 2

Total

Fair value hierarchy of long-term debt

2 580

100

2 680

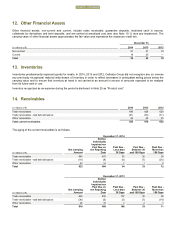

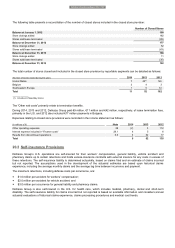

Collateralization

The portion of Delhaize Group’s long-term debt that was collateralized by mortgages and security charges granted or irrevocably

promised on Delhaize Group’s assets was €25 million at December 31, 2014, €22 million at December 31, 2013 and €23 million

at December 31, 2012.

At December 31, 2014, 2013 and 2012, €35 million, €35 million and €39 million, respectively, of assets were pledged as

collateral for mortgages.

(in millions of €)

2014

Property, P

lant and Equipment

9

Investment Property

17

Other

9

Total

35

Delhaize Group Annual Report 2014 • 123