Food Lion 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

150 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

over and above the amounts currently recorded as liabilities in its consolidated financial statements will be material to its financial

condition or future results of operations.

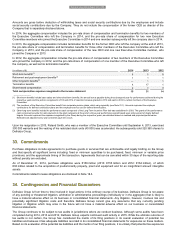

Delhaize Group is from time to time subject to investigations or inquiries by the competition authorities related to potential

violations of competition laws in jurisdictions where we conduct business.

In this context, in 2007, representatives of the Belgian Competition Authority visited Delhaize Belgium’s procurement department

in Zellik, Belgium, and requested the provision of certain documents. This visit was part of a national investigation affecting

several companies active in Belgium in the supply and retail sale of health and beauty products and other household goods. In

2012, the Auditor to the Belgian Competition Authority issued its investigation report. The investigation involves 11 suppliers and

7 retailers, including Delhaize Belgium, alleging coordination of price increases for certain health and beauty products sold in

Belgium from 2002 to 2007. In 2013, Delhaize Belgium and other retailers lodged an appeal against the decision of the Auditor to

utilize certain documents seized during the visits to Zellik and other companies’ facilities. The decision of the Court of Appeal of

Brussels is pending. According to Belgian legislation, fines for competition law infringements are calculated on the revenues of

the products affected by the alleged infringement in the last full year of the alleged coordination activities, capped at 10% of the

Group’s annual Belgian revenues in the year preceding the decision of the Competition Authority. There are many variables and

uncertainties associated with the application of the relevant legislation to the facts and circumstances of this investigation,

regardless of the outcome of the procedural appeal pending before the Court of Appeal. A decision on the merits of the matter by

the Authority would likely not occur before the end of 2015, and, under current Belgian legislation, the parties have the right to

appeal an adverse decision of the Authority in court. Consequently, the Group currently does not have sufficient information

available to make a reliable estimate of any possible financial impact or the timing thereof.

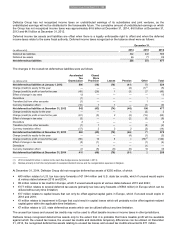

In a shareholders’ matter related to the Group’s wholly-owned subsidiary in Greece, Delhaize Group was notified in 2011 that

some former shareholders of Alfa Beta Vassilopoulos S.A., who together held 7% of Alfa Beta shares, have filed a claim in front

of the Court of First Instance of Athens challenging the price paid by the Group during the squeeze-out process that was

approved by the Hellenic Capital Markets Commission. Delhaize Group believes that the squeeze-out transaction has been

executed and completed in compliance with all legal and regulatory requirements. Delhaize Group continues to assess the merits

and any potential exposure of this claim and to vigorously defend itself. The first hearing took place in 2013 and the Court of First

Instance of Athens appointed a financial expert to assist the Court in assessing the value of the Alfa Beta shares when the

squeeze-out was launched. A decision on the merits of the matter by the Court of First Instance of Athens is not expected to

occur before 2016, and the parties have the right to appeal an adverse decision of such Court.

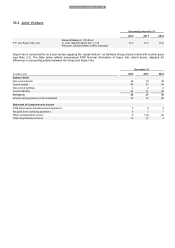

Following the closing of Delhaize Group’s agreed sale of Sweetbay, Harveys and Reid’s and the planned sale of Bottom Dollar

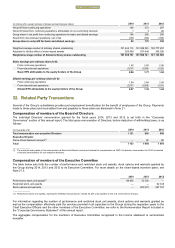

Food, the Group provides guarantees for a number of existing operating or finance lease contracts, which extend through 2037.

In the event of a future default of the buyer, Delhaize Group will be obligated under the terms of the contract to the landlords. The

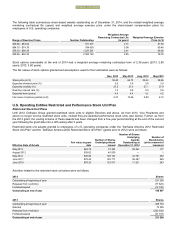

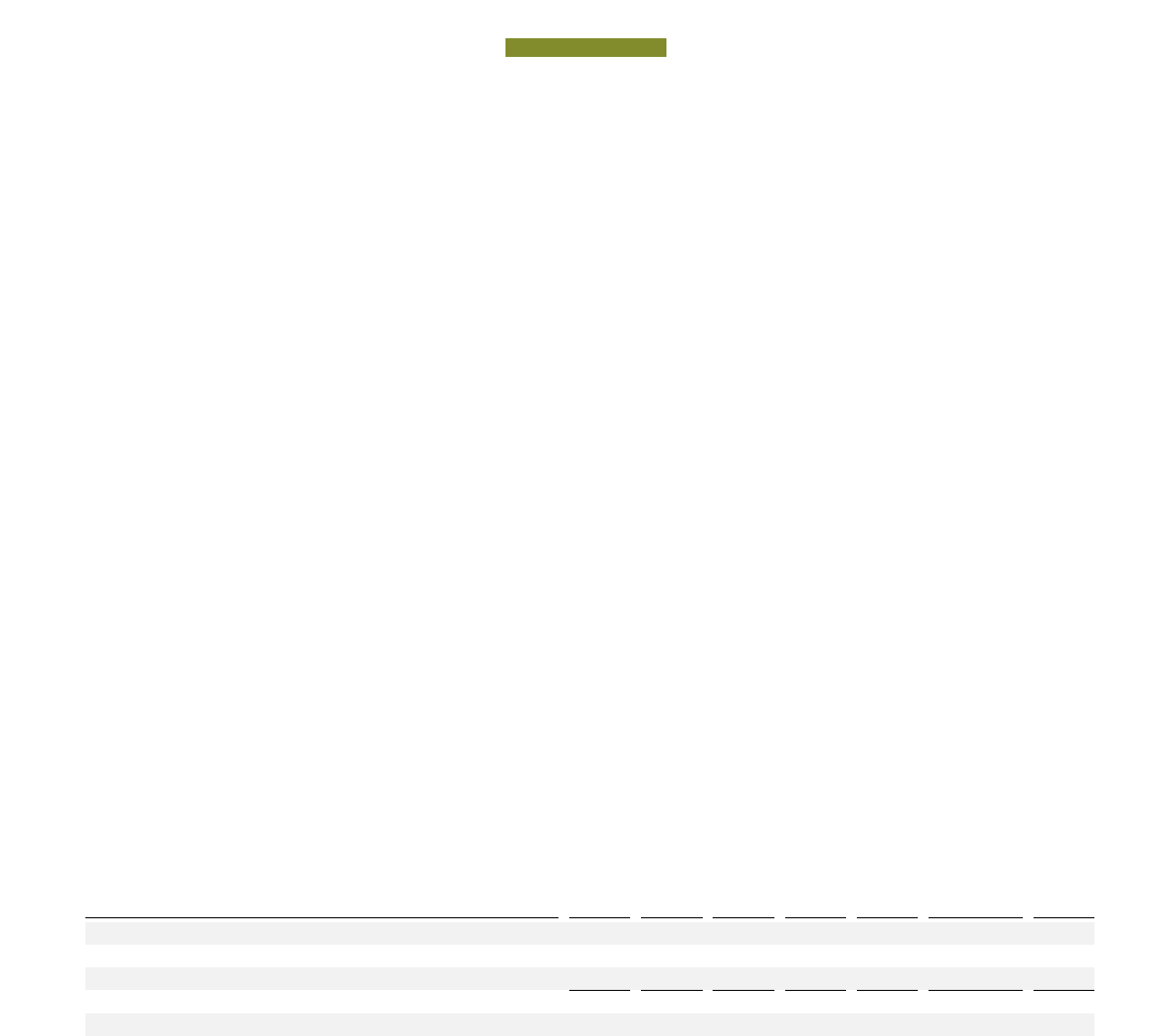

schedule below provides the future minimum lease payments over the non-cancellable lease term of the guaranteed leases,

excluding other direct costs such as common area maintenance expenses and real estate taxes, as of December 31, 2014.

Currently, the Group does not expect to be required to pay any amounts under these guarantees.

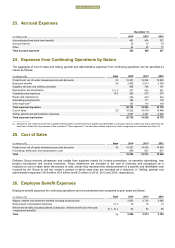

(in millions of €)

2015

2016

2017

2018

2019

Thereafter

Total

Finance leases

Future minimum lease payments

14

14

14

14

14

120

190

Less amount representing interest

(10)

(10)

(10)

(9)

(9)

(47)

(95)

Present value of minimum lease payments

4

4

4

5

5

73

95

Operating leases

Future minimum lease payments (for non

-cancellable leases)

20

20

19

17

15

109

200

In addition, at December 31, 2014, Delhaize Group issued other financial guarantees for a total amount of €2 million.

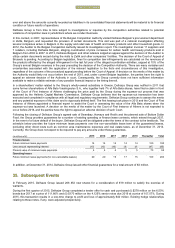

35. Subsequent Events

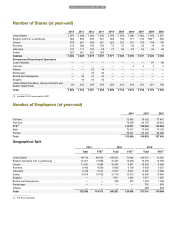

In February 2015, Delhaize Group issued 266 852 new shares for a consideration of €19 million to satisfy the exercise of

warrants.

During the first quarter of 2015, Delhaize Group completed a tender offer for cash and purchased (i) $278 million on the 6.50%

bonds due 2017 at a price of 111.66% and (ii) $170 million on the 4.125% senior notes due 2019 at a price of 107.07%. During

2015, this transaction results in a one-time charge to profit and loss of approximately €40 million. Existing hedge relationships

relating to these notes, if any, were adjusted prospectively.

FINANCIAL STATEMENTS