Food Lion 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

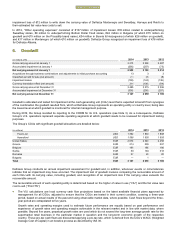

Management believes that the assumptions used in the recoverable amount calculations represent the best estimates of future

development and is of the opinion that no reasonable possible change in any of the key assumptions mentioned above would

cause the carrying value of the cash generating units to exceed their recoverable amounts. The Group estimated that a decrease

in growth rate by 50 basis points, keeping all other assumptions constant, would decrease the 2014 recoverable amount for

Belgium, Greece and Romania by €129 million, €59 million and €20 million, respectively. An increase of the discount rate by 100

basis points, keeping all other assumptions constant, would decrease the 2014 recoverable amount for Belgium, Greece and

Romania by €287 million, €146 million and €49 million, respectively. A simultaneous increase in discount rate and decrease in

growth rates by the before mentioned amounts would not result in the carrying amount of Belgium, Greece or Romania

exceeding the recoverable amount. Alternatively, a reduction in the total projected future cash flows by 10%, keeping all other

assumptions constant, would decrease the 2014 recoverable amount for Belgium, Greece and Romania by €167 million,

€116 million and €44 million, respectively and would not result in the carrying amount of Belgium, Greece or Romania exceeding

the recoverable amount.

Considering the expected longer term growth of the relatively young operations in Serbia, the recoverable amount is determined

based on FVLCTS estimates.

In 2012, Delhaize Group impaired 100% of the then recognized goodwill related to Bulgaria, Bosnia & Herzegovina and

Montenegro and recognized a €85 million impairment loss with respect to the Serbian goodwill.

During 2013, the general economic situation in Serbia worsened significantly, impacting the Group’s short- to mid-term

expectations for its Serbian operations and resulting in an impairment indicator. Consequently, Delhaize Group performed an

impairment review of its Serbian goodwill and recognized an additional impairment loss of €124 million.

During 2014, the Serbian economy continued to struggle due to the impact of fiscal tightening, lower inflow of investments,

and the overall fragile situation in the Serbian and international markets. During the second quarter, the country was further

hit by a devastating flooding, which further negatively impacted the economy. At the same time, competition further

strengthened in the retail market. Due to this, the Group reconsidered its estimates and forecasts in connection with its

Serbian business and concluded that the before said had a negative short-term impact on the cash flow projections of

Delhaize Serbia, providing goodwill impairment indicators. Consequently, Delhaize Group updated its impairment review of

its Serbian goodwill and recognized impairment charges of a total amount of €138 million.

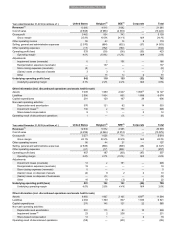

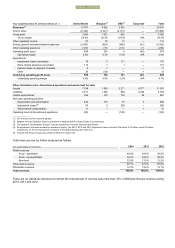

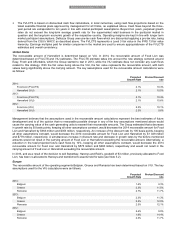

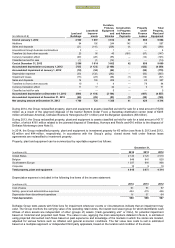

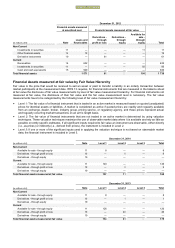

The key assumptions used and the recognized impairment losses in the various years were as follows:

Perpetual

Growth Rate

Pre-

tax

Discount Rate

Impairment Loss

Recognized

(in millions)

2014:

Serbia

3.0%

15.1%

EUR

138

2013:

Serbia

2.8%

15.1%

EUR

124

2012:

Serbia

3.7%

14.6%

EUR

85

Bosnia & Herzegovina

2.7%

10.7%

EUR

26

Bulgaria

2.3%

16.1%

EUR

15

Montenegro

3.4%

14.1%

EUR

10

Total

EUR

136

For the annual goodwill impairment testing of Delhaize Serbia, Delhaize Group applied a 3.2% perpetual growth rate and a

15.2% pre-tax discount rate, which did not result in any further impairment. The Group estimated that a decrease in growth rate

by 50 basis points, keeping all other assumptions constant, would decrease the recoverable amount of Delhaize Serbia by

€9 million and result in the carrying amount exceeding the recoverable amount by €2 million. An increase of the discount rate by

100 basis points, keeping all other assumptions constant, would decrease the recoverable amount by €41 million and result in

the carrying amount exceeding the recoverable amount by €33 million. A simultaneous increase in discount rate and decrease in

growth rates by the before mentioned amounts would decrease the recoverable amount by €48 million and result in the carrying

amount exceeding the recoverable amount by €40 million. Alternatively, a reduction in the total projected future cash flows by

10%, keeping all other assumptions constant, would decrease the recoverable amount by €35 million and result in the carrying

amount exceeding the recoverable amount by €28 million.

Impairment losses are recognized in profit or loss in “Other operating expenses” (see Note 28).

In 2012, and as a result of the decision to sell the Group’s Albanian operations (see Note 5.2), relating goodwill has been fully

impaired to reflect the measurement of Albania at FVLCTS. The remeasurement loss is included in “Result from discontinued

operations (net of tax)” (see Note 5.3).

FINANCIAL STATEMENTS