Food Lion 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

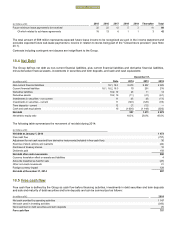

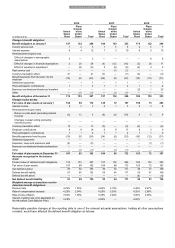

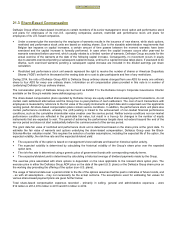

DELHAIZE GROUP FINANCIAL STATEMENTS 2014 // 133

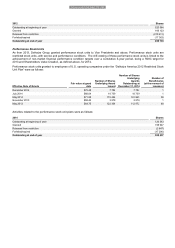

2014

2013

2012

(in millions of €)

United

States

Plans

Plans

Outside

of the

United

States

Total

United

States

Plans

Plans

Outside

of the

United

States

Total

United

States

Plans

Plans

Outside

of the

United

States

Total

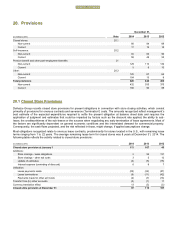

Change in benefit obligation:

Benefit obligation at January 1

157

132

289

180

153

333

174

122

296

Current service cost

1

4

5

1

5

6

2

5

7

Interest expense

8

4

12

7

3

10

8

5

13

Remeasurement (gain) loss

Effect of changes in demographic

assumptions

3

—

3

—

—

—

—

6

6

Effect of changes in financial assumptions

2

26

28

(4)

(12)

(16)

(3)

20

17

Effect of experience adjustment

—

(9)

(9)

3

(8)

(5)

(2)

4

2

Past service cost

—

—

—

—

(1)

(1)

—

—

—

Currency translation effect

21

—

21

(7)

—

(7)

(3)

—

(3)

Benefit payments from the plan / by the

employer

(19)

(5)

(24)

(24)

(9)

(33)

(19)

(12)

(31)

Settlement payments

—

1

1

—

1

1

—

1

1

Plan participants’ contributions

1

1

2

1

1

2

1

1

2

Business combinations/divestures/ transfers

—

—

—

—

—

—

22

1

23

Other

—

(1)

(1)

—

(1)

(1)

—

—

—

Benefit obligation at December 31

174

153

327

157

132

289

180

153

333

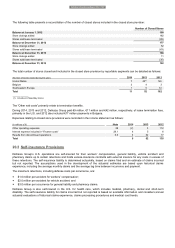

Change in plan assets:

Fair value of plan assets at January 1

104

68

172

125

72

197

130

73

203

Interest income

5

2

7

4

1

5

5

3

8

Remeasurement gain (loss)

Return on plan asset (excluding interest

income)

(3)

12

9

(6)

(4)

(10)

4

5

9

Changes in asset ceiling (excluding

interest income)

—

—

—

—

—

—

—

—

—

Curren

cy translation effect

13

—

13

(5)

—

(5)

(2)

—

(2)

Employer contributions

8

8

16

9

8

17

6

3

9

Plan participants’ contributions

1

1

2

1

1

2

1

1

2

Benefits payments from the plan

(19)

(5)

(24)

(24)

(9)

(33)

(19)

(12)

(31)

Settlement payments

—

—

—

—

—

—

—

—

—

Expenses, taxes and premiums paid

(2)

—

(2)

—

—

—

—

(1)

(1)

Business combinations/divestures/transfers

—

—

—

—

—

—

—

—

—

Other

—

(1)

(1)

—

(1)

(1)

—

—

—

Fair value of plan assets at December 31

107

85

192

104

68

172

125

72

197

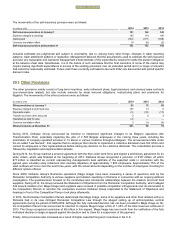

Amounts recognized in the balance

sheet:

Present value of defined benefit obligations

174

153

327

157

132

289

180

153

333

Fair value of plan assets

107

85

192

104

68

172

125

72

197

Net deficit/(surplus)

67

68

135

53

64

117

55

81

136

Defined benefit liability

67

68

135

53

64

117

59

81

140

Defined benefit asset

—

—

—

—

—

—

(4)

—

(4)

Net defined benefit liability

67

68

135

53

64

117

55

81

136

Weighted average assumptions used to

determine benefit obligations:

Discount rate

4.25%

1.55%

4.85%

3.19%

3.49%

2.27%

Rate of compensation increase

4.25%

2.94%

4.25%

3.03%

4.25%

2.66%

Rate of price inflation

3.50%

1.98%

3.48%

2.02%

3.05%

2.00%

Interest crediting rate (only applicable for

the Hannaford Cash Balance Plan)

3.25%

—

4.00%

—

4.00%

—

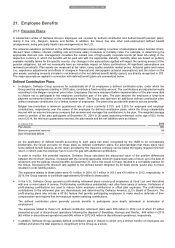

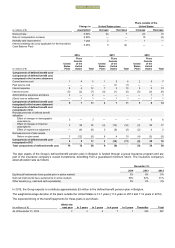

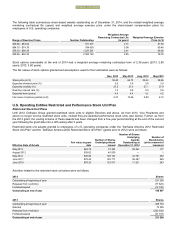

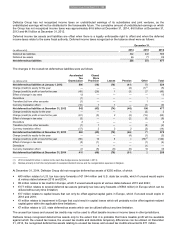

Reasonably possible changes at the reporting date to one of the relevant actuarial assumptions, holding all other assumptions

constant, would have affected the defined benefit obligation as follows:

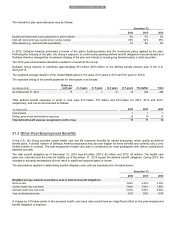

Delhaize Group Annual Report 2014 • 135