Food Lion 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP FINANCIAL STATEMENTS 2014 // 143

Delhaize Group has not recognized income taxes on undistributed earnings of its subsidiaries and joint ventures, as the

undistributed earnings will not be distributed in the foreseeable future. The cumulative amount of undistributed earnings on which

the Group has not recognized income taxes was approximately €4.6 billion at December 31, 2014, €4.0 billion at December 31,

2013 and €4.0 billion at December 31, 2012.

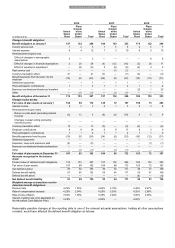

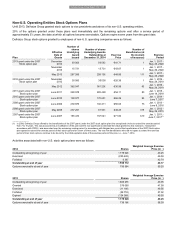

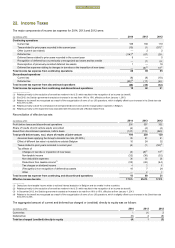

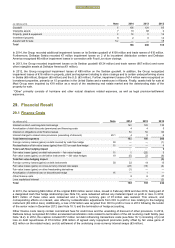

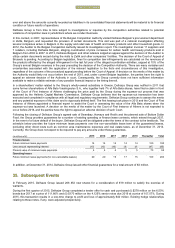

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset and when the deferred

income taxes relate to the same fiscal authority. Deferred income taxes recognized on the balance sheet were as follows:

December 31,

(in millions of €)

2014

2013

2012

Deferred tax liabilit

ies

302

443

566

Deferred tax assets

46

71

89

Net deferred tax liabilities

256

372

477

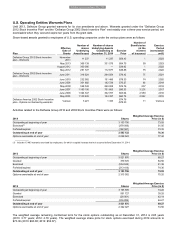

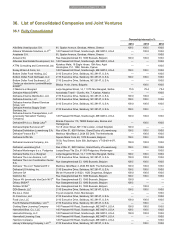

The changes in the overall net deferred tax liabilities were as follows:

(in millions of €)

Accelerated

Tax

Depreciation

Closed

Store

Provision

Leases

Pension

Other

Total

Net deferred tax liabilities at January 1, 2012

586

(18)

(76)

(41)

73

524

Charge (credit) to equity for the year

—

—

—

(4)

(1)

(1)

(5)

Charge (credit) to profit or loss for the year

(45)

(26)

1

(3)

27

(46)

Effect of change in tax rates

13

—

—

—

—

13

Divestiture

(1)

—

—

—

1

—

Transfers (to) from other accounts

(1)

—

—

—

1

—

Currency translation effect

(10)

1

1

—

(1)

(9)

Net deferred tax liabilities at December 31, 2012

542

(43)

(74)

(48)

100

477

Charge (credit) to equity for the year

—

—

—

4

(2)

2

Charge (credit) to profit or loss for the year

(61)

(5)

2

(2)

(19)

(85)

Effect of change in tax rates

(3)

—

—

(2)

(3)

(8)

Divestiture

2

—

—

—

—

2

Transfers (to) from other accounts

(1)

1

—

—

(2)

(2)

Currency translation effect

(17)

2

2

2

(3)

(14)

Net deferred tax liabilities at December 31, 2013

462

(45)

(70)

(46)

71

372

Charge (credit) to equity for the year

—

—

—

(4)

(1)

(5)

Charge (credit) to profit or loss for the year

(86)

10

8

4

(76)

(2)

(140)

Effect of change in tax rates

(2)

(1)

—

—

(1)

(4)

Divestiture

—

1

—

—

(1)

—

Currency translation effect

41

(5)

(8)

(5)

10

33

Net deferred tax liabilities at December 31, 2014

415

(40)

(70)

(51)

2

256

__________

(1) 2012 included €2 million in relation to the cash flow hedge reserve (terminated in 2013).

(2) Relates primarily to both the carryforward of exempted dividend income and the reorganization expenses in Belgium.

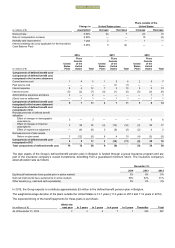

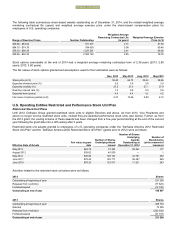

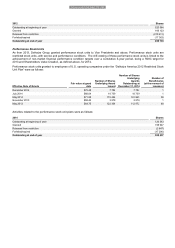

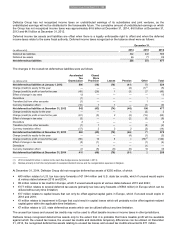

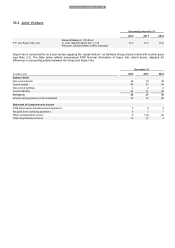

At December 31, 2014, Delhaize Group did not recognize deferred tax assets of €250 million, of which:

€40 million relates to U.S. tax loss carry-forwards of €1 044 million and U.S. state tax credits, which if unused would expire

at various dates between 2015 and 2034;

€8 million relates to tax credits in Europe, which if unused would expire at various dates between 2015 and 2023;

€177 million relates to several deferred tax assets (primarily tax loss carry-forwards of €563 million) in Europe which can be

utilized without any time limitation;

€17 million relates to capital losses that can only be offset against capital gains in Europe, which if unused would expire in

2018 and 2019;

€1 million relates to impairment in Europe that could result in capital losses which will probably not be offset against realized

capital gains within the applicable time limitations;

€7 million relates to U.S. state deferred tax assets which can be utilized without any time limitation.

The unused tax losses and unused tax credits may not be used to offset taxable income or income taxes in other jurisdictions.

Delhaize Group recognized deferred tax assets only to the extent that it is probable that future taxable profit will be available

against which the unused tax losses, the unused tax credits and deductible temporary differences can be utilized. At December

31, 2014, the recognized deferred tax assets relating to unused tax losses and unused tax credits amounted to €71 million.

Delhaize Group Annual Report 2014 • 145