Food Lion 2014 Annual Report Download - page 142

Download and view the complete annual report

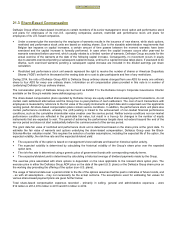

Please find page 142 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

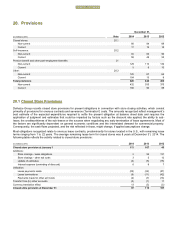

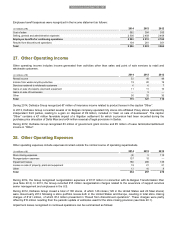

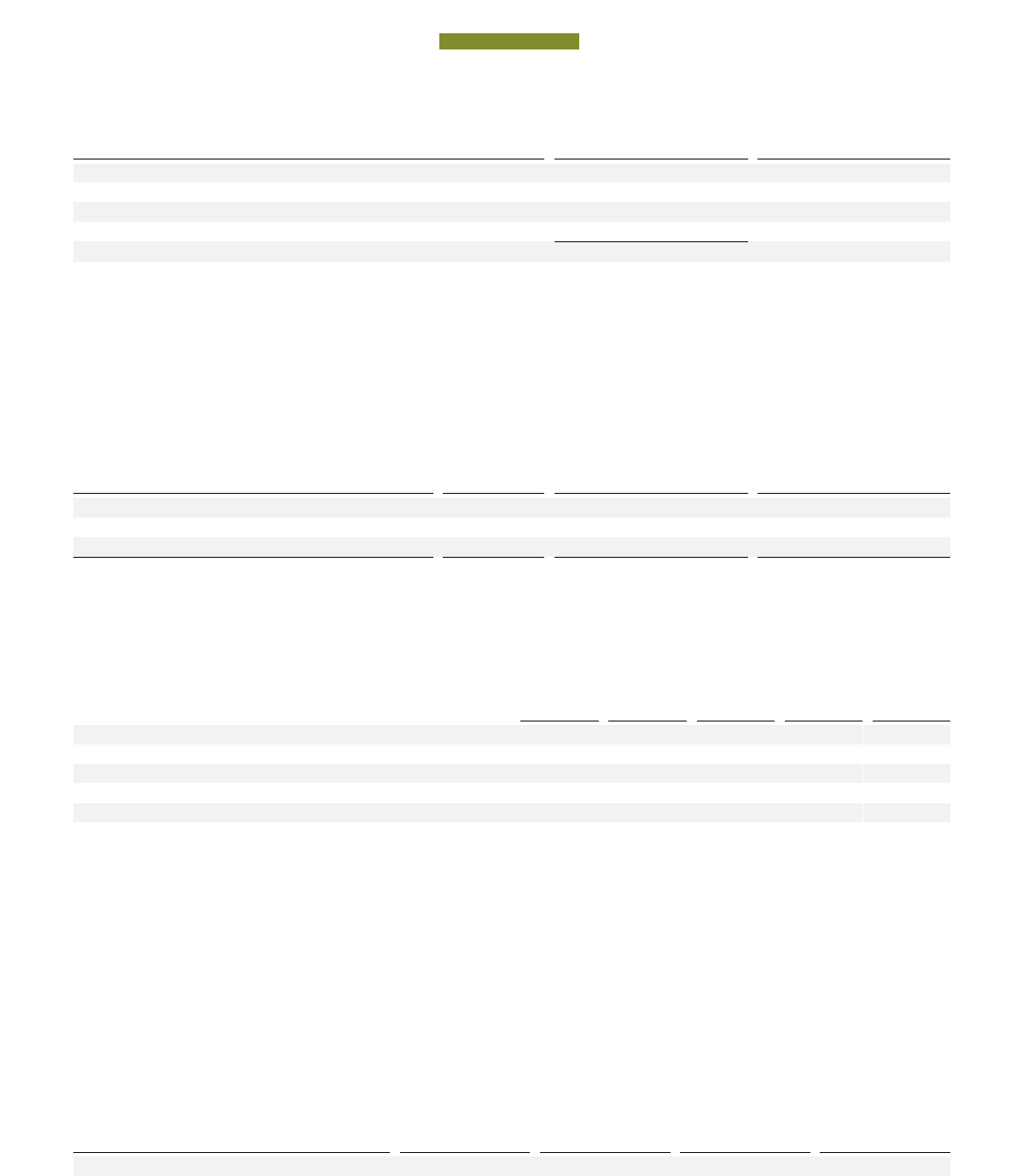

138 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

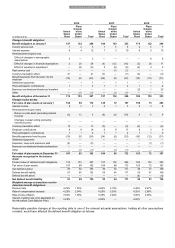

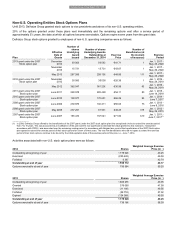

2012

Shares

Weighted Average Exercise

Price (in €)

Outstanding at beginning of year

1 379 150

55.71

Granted

397 047

30.58

Forfeited

(1

6 463)

55.73

Expired

(153 479)

50.97

Outstanding at end of year

1 606 255

49.95

Options exercisable at end of year

742 612

54.61

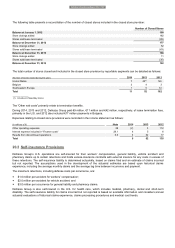

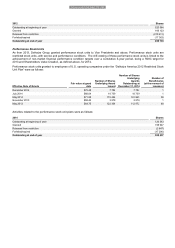

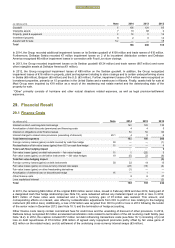

The weighted average remaining contractual term for the stock options outstanding as at December 31, 2014 was 3.65 years

(2013: 4.31 years; 2012: 4.34 years). The weighted average share price for options exercised during 2014, 2013 and 2012

amounted €56.18, €51.48 and €0.00 (as there were no exercises), respectively.

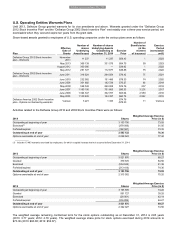

The following table summarizes stock options outstanding and exercisable as of December 31, 2014, and the related weighted

average remaining contractual life (years) and weighted average exercise price under the Delhaize Group stock option plans of

non-U.S. operating companies:

Range of Exercise Prices

Number

Outstanding

Weighted Average

Remaining Contractual Life

(in years)

Weighted Average Exercise

Price (in €)

€26.39 - €43.67

505 030

4.62

33.04

€49.25 - €54.11

726 050

3.52

51.47

€66.29 - €71.84

327 692

2.44

68.95

€26.39 - €71.84

1 558 772

3.65

49.17

Stock options exercisable at the end of 2014 had a weighted average remaining contractual term of €2.46 years (2013: 2.60

years; 2012: 2.80 years).

The weighted average fair values of stock options granted and assumptions used on the date of grant for their estimations were

as follows:

Dec. 2013

Nov. 2013

May 2013

Nov. 2012

May 2012

Share price (in €)

43.20

43.67

50.09

26.39

28.41

Expected dividend yield (%)

3.4

3.4

3.4

3.4

3.3

Expected volatility (%)

24.3

24.5

27.0

26.7

26.0

Risk-free interest rate (%)

1.1

0.9

0.7

0.6

0.7

Expected term (years)

6.0

6.0

6.0

5.8

5.8

Fair value of options granted (in €)

6.98

6.52

8.43

4.27

3.86

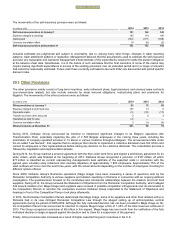

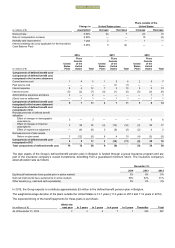

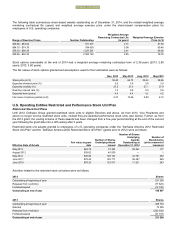

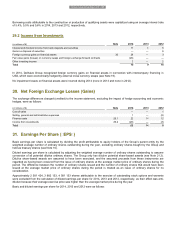

Non-U.S. Operating Entities Performance Stock Units

As from 2014, Delhaize Group granted performance stock units to European members of the Group’s Executive Committee and

certain other senior executives as determined by the Group’s Board of Directors.

Performance stock units are restricted stock units, with service and performance conditions. The cliff-vesting of these

performance stock units is linked to the achievement of a non-market financial performance condition (Shareholders Value

Creation over a cumulative 3-year period). Shareholders Value Creation has been defined by the Group as six times underlying

EBITDA minus the net debt, as also defined by the Group.

Performance stock units granted to European associates under the “Delhaize Group 2014 European Performance Stock Unit

Plan” were as follows:

Effective Date of Grant

Fair value at grant

date

Number of Shares

Underlying Award

Issued

Number of Share

s

Underlying

Awards

Outstanding at

December 31, 2014

Number of

Beneficiaries

(at the moment of

issuance)

May 2014

€53.45

140 981

132 705

80

During 2014, 8 276 performance stock units forfeited.

FINANCIAL STATEMENTS