Food Lion 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

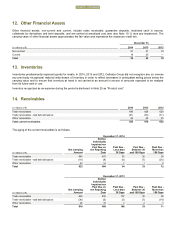

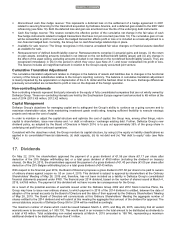

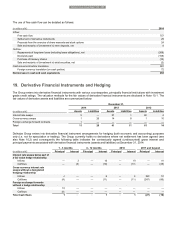

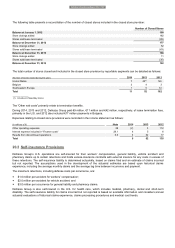

124 // DELHAIZE GROUP FINANCIAL STATEMENTS 2014

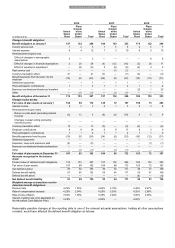

(in millions of €)

2015

2016

2017

2018

2019

Thereafter

Total

Future minimum lease payments to be received

32

23

12

5

3

14

89

Of which related to sub-lease agreements

18

13

6

1

1

3

42

The total amount of €89 million represents expected future lease income to be recognized as such in the income statement and

excludes expected future sub-lease payments to receive in relation to stores being part of the “Closed store provision” (see Note

20.1).

Contracts including contingent rent clauses are insignificant to the Group.

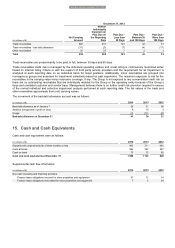

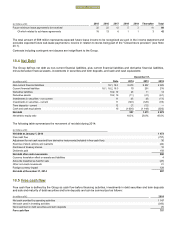

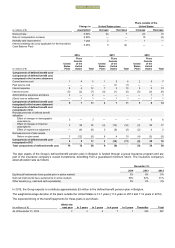

18.4 Net Debt

The Group defines net debt as non-current financial liabilities, plus current financial liabilities and derivative financial liabilities,

minus derivative financial assets, investments in securities and term deposits, and cash and cash equivalents:

December 31,

(in millions of €)

Note

2014

2013

2012

Non-current financial liabilities

18.1, 18.3

2 676

2 507

2 925

Current financial liabilities

18.1, 18.2, 18.3

70

291

218

Derivative liabilities

10.2, 19

26

11

14

Derivative assets

10.2, 19

(11)

(41)

(61)

Investments in securities - non current

11

(8)

(8)

(11)

Investments in securities - current

11

(149)

(126)

(93)

Term deposits

- current

12

(7)

(12)

—

Cash and cash equivalents

15

(1 600)

(1 149)

(920)

Net debt

997

1 473

2 072

Net debt to equity ratio

18.3%

29.0%

40.0%

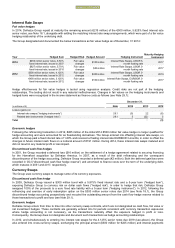

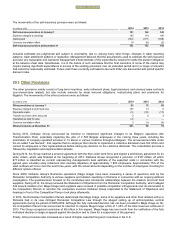

The following table summarizes the movement of net debt during 2014:

(in millions of €)

Net debt at January 1, 2014

1 473

Free cash flow

(757)

Adjustment for net cash received from derivative instruments (included in free cash flow)

30

Exercise of stock options and warrants

(24)

Purchase of treasury shares

10

Dividends paid

158

Net debt after cash movements

890

Currency translation effect on assets and liabilities

4

Amounts classified as held for sale

(47)

Other non-cash movements

21

Foreign currency impact

129

Net debt at December 31, 2014

997

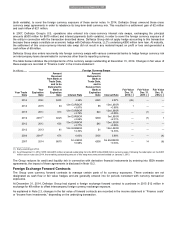

18.5 Free cash flow

Free cash flow is defined by the Group as cash flow before financing activities, investments in debt securities and term deposits

and sale and maturity of debt securities and term deposits and can be summarized as follows:

(in millions of €)

2014

Net cash provided by operating activities

1 147

Net cash used in investing activities

(383)

Net investment in debt securities and term deposits

(7)

Free cash flow

757

FINANCIAL STATEMENTS