Food Lion 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

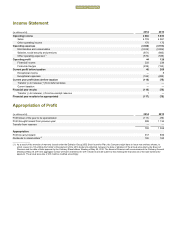

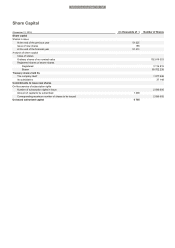

DELHAIZE GROUP FINANCIAL STATEMENTS 2014 // 161

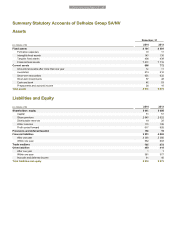

Summary Statutory Accounts of Delhaize Group SA/NV

The summarized annual statutory accounts of Delhaize Group SA/NV are presented below. In accordance with the Belgian

Company Code, the full annual accounts, the statutory Directors’ report and the Statutory Auditor’s report will be filed with the

National Bank of Belgium. These documents will also be available on the Company’s website, www.delhaizegroup.com, and can

be obtained upon request from Delhaize Group SA/NV, rue Osseghemstraat 53, 1080 Brussels, Belgium. The Statutory Auditor

has expressed an unqualified opinion on these annual accounts.

Summary of Accounting Principles

The annual statutory accounts of Delhaize Group SA are prepared in accordance with Belgian Generally Accepted Accounting

Principles (Belgian GAAP).

Formation expenses

Formation expenses are capitalized and amortized over a period of five years or, if they are related to debt issuance costs, over

the maturity of the loans.

Intangible Fixed Assets

Intangible assets are recognized as assets in the balance sheet and amortized over their expected useful life. The intangible

assets are amortized as follows:

Goodwill

Software

5 years

5 to 8 years

Internally developed software

Internally developed software is recognized as an intangible asset and is measured at cost to the extent that such cost does not

exceed its value in use for the Company. The Company recognizes internally developed software as an intangible asset when it

is expected that such asset will generate future economic benefits and when the Company has demonstrated its ability to

complete and use the intangible asset. The cost of internally developed software comprises the directly or indirectly attributable

costs of preparing the asset for its intended use to the extent that such costs have been incurred until the asset is ready for use.

Internally developed software is amortized over a period of 5 years to 8 years.

Tangible Fixed Assets

Tangible fixed assets are recorded at purchase price or at agreed contribution value.

Assets held as finance leases are stated at an amount equal to the fraction of deferred payments provided for in the contract

representing the capital value.

Depreciation rates are applied on a straight-line basis at the rates admissible for tax purposes:

Land

Buildings

Distribution centers

Equipment for intensive use

Furniture

Motor vehicles

0.00%/year

5.00%/year

3.00%/year

33.33%/year

20.00%/year

25.00%/year

Plant, machinery and equipment are depreciated over periods of 5, 12 and 25 years based on the expected useful life of each

type of component.

Financial Fixed Assets

Financial fixed assets are valued at cost, less accumulated impairment losses. Impairment loss is recorded to reflect long-term

impairment of value. Impairment loss is reversed when it is no longer justified due to a recovery in the asset value. A fair

valuation method is applied, taking into account the nature and the features of the financial asset. One single traditional valuation

method or an appropriate weighted average of various traditional valuation methods can be used. Generally, the net equity

method is applied and is adjusted by the potential unrecognized capital gain if any. The measurement of foreign investments is

calculated by using the year-end exchange rate. Once selected, the valuation method is consistently applied on a year-to-year

basis, except when the circumstances prevent doing so. When the valuation method shows a fair value lower than the book

value of a financial asset, an impairment loss is recognized but only to reflect the long-term impairment of value.

Delhaize Group Annual Report 2014 • 163