Food Lion 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Trading Policy. The Company has also estab-

lished regular periods during each calendar

year prior to and immediately following the

release of the Company’s financial information,

during which directors and certain members

of management are restricted from trading in

Company securities.

Disclosure Policy

As recommended by the Belgian Governance

Code, the Company has adopted a Disclosure

Policy that sets out the framework and the

guiding principles that the Company applies

when disclosing information. This policy is

available at www.delhaizegroup.com.

Compliance with the Belgian

Governance Code

In 2014, the Company was fully compliant

with the provisions of the Belgian Governance

Code.

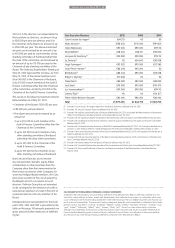

Undertakings upon Change

of Control of the Company,

as of December 31, 2014

Management associates of non-U.S. operating

companies received stock options issued by

the Board of Directors under the Delhaize

Group 2007 stock option plan for associates of

non-U.S. companies, granting to the benefi-

ciaries the right to acquire ordinary shares of

the Company. Management associates of U.S.

operating companies received options, which

qualify as warrants under Belgian law, issued

by the Board of Directors under the Delhaize

Group 2002 Stock Incentive Plan, as amended,

and under the Delhaize Group U.S. 2012 Stock

Incentive Plan, granting to the beneficiaries the

right to subscribe to new American Depositary

Receipts of the Company. The Shareholders’

Meetings of May 23, 2002, May 24, 2007

and May 24, 2012, respectively, approved a

provision of these plans that provide that in the

event of a change of control over the Company

the beneficiaries will have the right to exercise

their options and warrants, regardless of their

vesting period. The number of options and

warrants outstanding under those plans as of

December 31, 2014 can be found under Note

21.3 to the Financial Statements.

Management associates of U.S. operating

companies received restricted stock units and

performance stock units under the Delhaize

America, LLC 2002 and 2012 Restricted Stock

Unit Plans, as amended, granting to bene-

ficiaries the right to receive existing shares

of the Company upon vesting and achieve-

ment of performance conditions, as the case

may be. The Shareholders’ Meetings of May

23, 2002 and May 24, 2012, respectively,

approved a provision of these plans that

provide that in the event of a change in control

over the Company the beneficiary will receive

existing shares regardless of the vesting

period.

In 2003, the Company adopted a global long-

term incentive program which incorporates

a Performance Cash Plan. The grants under

the Performance Cash Plan provide for cash

payments to the beneficiaries at the end of a

three-year period that are dependent on Com-

pany performance against Board-approved

financial targets that are closely correlated

to building long-term shareholder value.

The Shareholders’ Meeting of May 26, 2005

approved a provision of the Performance Cash

Plan that provides that the beneficiaries are

entitled to receive the full cash payment with

respect to any outstanding grant in the event

of a change of control over the Company.

The Ordinary Shareholders’ Meeting held on

May 24, 2007, May 22, 2008, May 28, 2009,

May 27, 2010, May 26, 2011, May 24, 2012,

May 23, 2013 and May 22, 2014, respectively,

approved the inclusion of a provision granting

to the holders of the bonds, convertible bonds

or medium-term notes that the Company

may issue within the 12 months following the

respective ordinary shareholders’ meeting, in

one or several offerings and tranches, denom-

inated either in U.S. Dollars or in Euros, with a

maturity or maturities not exceeding 30 years,

for a maximum aggregate amount of €1.5 bil-

lion, the right to obtain the redemption, or the

right to require the repurchase, of such bonds

or notes for an amount not in excess of 101% of

the outstanding principal amount plus accrued

and unpaid interest of such bonds or notes,

in the event of a change of control over the

Company, as would be provided in the terms

and conditions relating to such bonds and/

or notes.

On June 27, 2007 the Company issued $450

million 6.50% notes due 2017 in a private

placement to qualified investors. Pursuant to

an exchange offer registered under the U.S

Securities Act, the notes were subsequently

exchanged for notes that are freely transfer-

able in the U.S. The notes contain a change

of control provision granting its holders the

right to early repayment for an amount not in

excess of 101% of the outstanding principal

amount thereof in the event of a change of

control over the Company and downgrading

by Moody’s and Standard & Poor’s.

On October 6, 2010, the Company announced

the issuance of new $827 million 5.70% Notes

due 2040 (the “New Notes”) pursuant to a

private offer to exchange 9.00% Debentures

due 2031 and 8.05% Notes due 2027 issued by

its wholly-owned subsidiary Delhaize America,

LLC held by eligible holders. The New Notes

contain a change of control provision granting

their holders the right to early repayment for an

amount not in excess of 101% of the outstand-

ing principal amount thereof in the event of a

change of control over the Company and down-

grading by Moody’s and Standard & Poor’s.

On October 5, 2011 the Company announced

the successful completion on October 4, 2011

of its public offering of €400 million 7 year

4.25% retail bonds in Belgium and in the

Grand Duchy of Luxembourg listed on NYSE

Euronext Brussels pursuant to a prospec-

tus filed by the Company with the Financial

Services and Markets Authority of Belgium

(FSMA). The bonds contain a change of control

provision granting their holders the right to

early repayment for an amount not in excess

of 101% of the outstanding principal amount

thereof in the event of a change of control over

the Company and downgrading by Moody’s

and Standard & Poor’s.

On April 10, 2012 the Company issued

$300 million 4.125% senior notes due 2019

to qualified investors pursuant to a registra-

tion statement filed by the Company with the

SEC. The notes contain a change of control

provision granting their holders the right to

early repayment for an amount not in excess

of 101% of the outstanding principal amount

thereof in the event of a change of control over

the Company and downgrading by Moody’s

and Standard & Poor’s.

On November 27, 2012 the Company issued

€400 million 3.125% senior notes due 2020

listed on NYSE Euronext Brussels to qualified

investors pursuant to a prospectus filed by the

Company with the FSMA. The notes contain a

change of control provision granting their hold-

ers the right to early repayment for an amount

not in excess of 101% of the outstanding princi-

pal amount thereof in the event of a change of

control over the Company and downgrading

by Moody’s and Standard & Poor’s.

The Ordinary Shareholders Meeting held on

May 22, 2014 approved a change in control

clause set out in the € 400 million five-year

(with potentially two additional one-year

extensions) revolving credit facility dated April

14, 2014 entered into among inter alios the

Company, Delhaize America, LLC, Delhaize

Griffin SA, Delhaize The Lion Coordination

GOVERNANCE