Food Lion 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A defined benefit plan is a post-employ-

ment benefit plan which normally defines

an amount of benefit that an employee will

receive upon retirement, usually dependent

on one or more factors such as age, years of

service, compensation and/or guaranteed

returns on contributions.

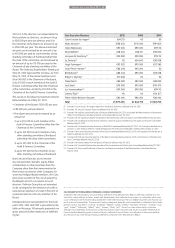

Delhaize Group operates defined benefit plans

at several of its companies and approximately

24% of Delhaize Group’s associates were

covered by defined benefit plans at the end of

2014.

If, at the balance sheet date, the fair value of

the plan assets of a defined benefit plan, are

lower than the defined benefit obligations

(determined based on actuarial assumptions),

the Group would bear a theoretical “under-

funding risk” at that moment in time. At the

end of 2014, Delhaize Group recognized a net

liability of €135 million (2013: €117 million; 2012:

€136 million) to cover such underfunding.

Details on pension plans at Delhaize Group

and its subsidiaries can be found in Note 21.1

”Pension Plans” in the Financial Statements.

Insurance Risk

The Group manages its insurable risk through

a combination of external insurance coverage

and self-insurance. Delhaize Group uses

captive self-insurance program to provide

flexibility and optimize costs. In deciding

whether to purchase external insurance or

self-insure, the Group considers the frequency

and severity of losses, its experience in miti-

gating risk through safety and other internal

risk prevention programs, the cost and terms

of external insurance, and whether external

insurance coverage is mandatory.

The main risks covered by Delhaize Group’s

insurance programs are property, liability and

healthcare. Delhaize America uses a captive

structure for its self-insured retention programs

for its workers’ compensation, general liability,

automotive accident, and pharmacy claims.

In the event of a substantial loss there is a risk

that external insurance coverage or self-insur-

ance reserves may not be sufficient to cover

the loss. Although the Group assesses an

external insurer’s financial strength at the time

we purchase insurance coverage, it is possible

that the financial condition of the insurer may

deteriorate over time in which case it may be

unable to meet its obligation to pay a loss. It is

possible that Delhaize Group, due to changes

in financial or insurance markets, will be una-

ble to continue to purchase certain insurance

coverages on commercially reasonable terms.

Reserves for self-insured retentions are based

upon actuarial estimates of claims reported

and claims incurred but not reported. Delhaize

Group believes these estimates are reason-

able, however these estimates are subject to

a high degree of variability and uncertainty

caused by such factors as future interest and

inflation rates, future economic conditions,

litigation and claims settlement trends, leg-

islative and regulatory changes, changes in

benefit levels and the frequency and severity of

incurred but not reported claims. It is possible

that the final resolution of some claims may

require Delhaize Group to make significant

expenditures in excess of existing reserves.

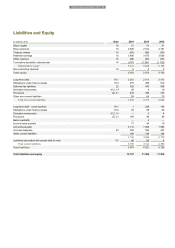

Self-insurance provisions of €152 million are

included as a liability on the balance sheet as

of December 31, 2014. More information on

self-insurance can be found in Note 20.2 “Self

Insurance Provisions” and related investments

held to cover the self-insurance exposure are

included in Note 11 “Investments in Securities”

to the Financial Statements.

If external insurance is not sufficient to cover

losses or is not collectable, or if self-insurance

expenditures exceed existing reserves, the

Group’s financial condition and results of

operation may be adversely affected.

Compliance and Regulatory

Risks

Litigation Risk

From time to time, Delhaize Group is involved

in legal actions, including matters involving

personnel and employment issues, personal

injury, antitrust claims, product liability claims,

environment liability claims, contract claims

and other proceedings arising in the ordi-

nary course of business. The Group regularly

reviews its exposure to the claims and litiga-

tion arising in the normal course of operations.

It recognizes a provision when it has a present

obligation as a result of a past event, it is prob-

able that an outflow of economic resources

will be required to settle the obligation, and

the amount of such obligation can be reliably

estimated. As of December 31, 2014 the Group

believes that it has made adequate provisions

for such exposures. Any litigation, however,

involves risk and unexpected outcomes could

result in an adverse effect on the Group’s

financial statements. More information on

pending litigation can be found in Note 34

“Contingencies” in the Financial Statements.

Regulatory Risk

Delhaize Group is subject to federal, regional,

state, and local laws and regulations in each

country in which it operates relating to, among

others, zoning, land use, antitrust restrictions,

work place safety, public health and safety,

environmental protection, community right-to-

know, information security and data protection,

alcoholic beverage and tobacco sales, and

pharmaceutical sales. A number of jurisdic-

tions regulate the licensing of supermarkets,

including retail alcoholic beverage licenses.

In certain jurisdictions, Delhaize Group is

prohibited from selling alcoholic beverages in

its stores. Employers are also subject to laws

governing their relationship with associates,

including minimum wage requirements,

overtime, working conditions, disabled access

and work permit requirements. Compliance

with, or changes in, these laws could reduce

the revenues and profitability of the Group’s

stores and could affect its business, financial

condition, or results of operations.

The Group is subject to a variety of antitrust

and similar legislation in the countries in which

it operates. In a number of geographies, the

Group has a large number of stores which

may make future significant acquisitions more

difficult. In addition, Delhaize Group is subject

to legislation in many of the jurisdictions in

which it operates relating to unfair competitive

practices and similar behavior. Delhaize Group

has been subject to and may in the future be

subject to allegations of, or further regula-

tory investigations or proceedings into, such

practices. Such allegations, investigations or

proceedings (irrespective of merit), may require

the Group to devote significant management

resources to defending itself against such

allegations. In the event that such allegations

are proven, Delhaize Group may be subject to

significant fines, damages, awards and other

expenses, and its reputation may be harmed.

RISK FACTORS