Entergy 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

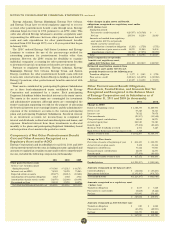

Qualified Pension Trust

2010 Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stocks:

Preferred $ – $ 8,354(a) $– $ 8,354

Common 1,375,531(b) – – 1,375,531

Common collective trusts(a) – 657,075(c) – 657,075

Fixed income securities:

Interest-bearing cash 103,731(d) – – 103,731

U.S. government securities 75,124(b) 187,957(a) – 263,081

Corporate debt instruments – 298,760(a) – 298,760

Registered investment

companies(c) – 385,020(e) – 385,020

Other – 108,305(f) – 108,305

Other:

Insurance company

general account

(unallocated contracts) – 33,439(g) – 33,439

Total investments $1,554,386 $1,678,910 $– $3,233,296

Cash 321

Other pending transactions (14,954)

Less: Other postretirement

assets included in total

investments (2,395)

Total fair value of

qualified pension assets $3,216,268

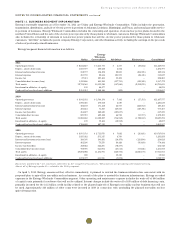

Other Postretirement Trusts

2011 Level 1 Level 2 Level 3 Total

Equity securities:

Common collective trust $ – $208,812(c) $– $208,812

Fixed income securities:

U.S. government

securities 42,577(b) 57,151(a) – 99,728

Corporate debt instruments – 42,807(a) – 42,807

Registered investment

companies(b) 4,659(d) – – 4,659

Other – 69,287(f) – 69,287

Total investments $47,236 $378,057 $– $425,293

Other pending transactions (235)

Plus: Other postretirement

assets included in the

investments of the

qualified pension trust 2,114

Total fair value of other

postretirement assets $427,172

Other Postretirement Trusts

2010 Level 1 Level 2 Level 3 Total

Equity securities:

Common collective trust(a) $ – $211,835(c) $ – $211,835

Fixed income securities:

Interest-bearing cash 4,014(d) – – 4,014

U.S. government

securities 37,823(b) 52,326(a) – 90,149

Corporate debt instruments – 37,128(a) – 37,128

Other – 58,716(f) – 58,716

Total investments $41,837 $360,005 $ – $401,842

Other pending transactions 193

Plus: Other postretirement

assets included in the

investments of the

qualified pension trust 2,395

Total fair value of other

postretirement assets $404,430

(a) Certain preferred stocks and fixed income debt securities (corporate,

government, and securitized) are stated at fair value as determined by

broker quotes.

(b) Common stocks, treasury notes and bonds, and certain preferred stocks and

fixed income debt securities are stated at fair value determined by quoted

market prices.

(c) The common collective trusts hold investments in accordance with stated

objectives. The investment strategy of the trusts is to capture the growth

potential of equity markets by replicating the performance of a specified

index. Net asset value per share of the common collective trusts estimate

fair value.

(d) The registered investment company is a money market mutual fund with a

stable net asset value of one dollar per share.

(e) The registered investment company holds investments in domestic and

international bond markets and estimates fair value using net asset value

per share.

(f) The other remaining assets are U.S. municipal and foreign government

bonds stated at fair value as determined by broker quotes.

(g) The unallocated insurance contract investments are recorded at contract

value, which approximates fair value. The contract value represents

contributions made under the contract, plus interest, less funds used to pay

benefits and contract expenses, and less distributions to the master trust.

Accumulated Pension Benefit Obligation

The accumulated benefit obligation for Entergy’s qualified pension

plans was $4.6 billion and $3.8 billion at December 31, 2011 and

2010, respectively.

Estimated Future Benefit Payments

Based upon the assumptions used to measure Entergy’s qualified

pension and other postretirement benefit obligations at December

31, 2011, and including pension and other postretirement benefits

attributable to estimated future employee service, Entergy expects

that benefits to be paid and the Medicare Part D subsidies to be

received over the next ten years for Entergy Corporation and its

subsidiaries will be as follows (in thousands):

Estimated Future Benefits Payments

Other Postretirement Estimated Future

Qualified Non-Qualified (before Medicare Medicare Subsidy

Pension Pension Subsidy) Receipts

2012 $ 178,030 $11,199 $ 72,685 $ 5,678

2013 $ 189,881 $18,159 $ 76,731 $ 6,374

2014 $ 204,573 $14,942 $ 81,001 $ 7,137

2015 $ 220,295 $15,502 $ 85,780 $ 7,935

2016 $ 238,242 $22,492 $ 90,143 $ 8,828

2017 - 2021 $1,524,241 $72,724 $523,040 $59,306

97