Entergy 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

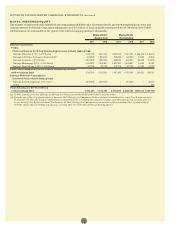

The expected long term rate of return for the non-taxable

postretirement trust assets is determined using the same

methodology described above for pension assets, but the asset

allocation specific to the non-taxable postretirement assets is used.

For the taxable postretirement trust assets, the investment

allocation includes a high percentage of tax-exempt fixed income

securities. This asset allocation in combination with the same

methodology employed to determine the expected return for other

trust assets (as described above), with a modification to reflect

applicable taxes, is used to produce the expected long-term rate of

return for taxable postretirement trust assets.

Entergy currently expects long term rates of return higher

than last year’s expectation for both the non-taxable and taxable

postretirement trusts because of the planned increases to their

equity allocations in 2012.

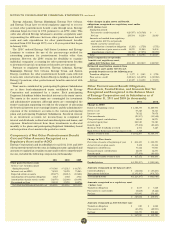

CONCENTRATIONS OF CREDIT RISK

Entergy’s investment guidelines mandate the avoidance of risk

concentrations. Types of concentrations specified to be avoided

include, but are not limited to, investment concentrations in a

single entity, type of industry, foreign country, geographic area

and individual security issuance. As of December 31, 2011 all

investment managers and assets were materially in compliance

with the approved investment guidelines, therefore there were no

significant concentrations (defined as greater than 10 percent of plan

assets) of risk in Entergy’s pension and other postretirement benefit

plan assets.

Fair Value Measurements

Accounting standards provide the framework for measuring

fair value. That framework provides a fair value hierarchy that

prioritizes the inputs to valuation techniques used to measure fair

value. The hierarchy gives the highest priority to unadjusted quoted

prices in active markets for identical assets or liabilities (level 1

measurements) and the lowest priority to unobservable inputs

(level 3 measurements).

The three levels of the fair value hierarchy are described below:

n Level 1 - Level 1 inputs are unadjusted quoted prices for identical

assets or liabilities in active markets that the Plan has the ability to

access at the measurement date. Active markets are those in which

transactions for the asset or liability occur in sufficient frequency

and volume to provide pricing information on an ongoing basis.

n Level 2 - Level 2 inputs are inputs other than quoted prices included

in Level 1 that are, either directly or indirectly, observable for the

asset or liability at the measurement date. Assets are valued based

on prices derived by an independent party that uses inputs such

as benchmark yields, reported trades, broker/dealer quotes, and

issuer spreads. Prices are reviewed and can be challenged with the

independent parties and/or overridden if it is believed such would

be more reflective of fair value. Level 2 inputs include

the following:

n quoted prices for similar assets or liabilities in active markets;

n quoted prices for identical assets or liabilities in inactive

markets;

n inputs other than quoted prices that are observable for the asset

or liability; or

n inputs that are derived principally from or corroborated by

observable market data by correlation or other means.

If an asset or liability has a specified (contractual) term, the Level 2

input must be observable for substantially the full term of the asset

or liability.

n Level 3 - Level 3 refers to securities valued based on significant

unobservable inputs.

Assets and liabilities are classified in their entirety based on the

lowest level of input that is significant to the fair value measurement.

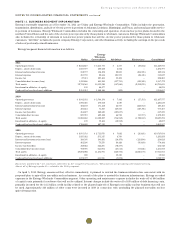

The following tables set forth by level within the fair value hierarchy

a summary of the investments held for the qualified pension and

other postretirement plans measured at fair value on a recurring

basis at December 31, 2011 and December 31, 2010 (in thousands):

Qualified Pension Trust

2011 Level 1 Level 2 Level 3 Total

Equity securities:

Corporate stocks:

Preferred $ 3,738(b) $ 8,014(a) $– $ 11,752

Common 1,010,491(b) – – 1,010,491

Common collective trusts(a) – 1,074,178(c) – 1,074,178

Fixed income securities:

U.S. government securities 142,509(b) 157,737(a) – 300,246

Corporate debt instruments – 380,558 _ 380,558

Registered investment

companies 53,323(d) 444,275 – 497,598

Other – 101,674(b) – 101,674

Other:

Insurance company

general account

(unallocated contracts) – 34,696(g) – 34,696

Total investments $1,210,061 $2,201,132 $– $3,411,193

Cash 75

Other pending transactions (9,238)

Less: Other postretirement

assets included in total

investments (2,114)

Total fair value of

qualified pension assets $3,399,916

96