Entergy 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

FILI N G S W ITH T H E APSC ( ENTE RGY AR K AN SA S)

Retail Rates

2009 Base Rate Filing

In September 2009, Entergy Arkansas filed with the APSC for a

general change in rates, charges, and tariffs. In June 2010 the APSC

approved a settlement and subsequent compliance tariffs that

provide for a $63.7 million rate increase, effective for bills rendered

for the first billing cycle of July 2010. The settlement provides for a

10.2% return on common equity.

FILI N G S W ITH T H E LPSC

Formula Rate Plans (Entergy Gulf States Louisiana

and Entergy Louisiana)

In March 2005 the LPSC approved a settlement proposal to resolve

various dockets covering a range of issues for Entergy Gulf States

Louisiana and Entergy Louisiana. The settlement included the

establishment of a three-year formula rate plan for Entergy Gulf

States Louisiana that, among other provisions, established a return on

common equity mid-point of 10.65% for the initial three-year term of the

plan and permits Entergy Gulf States Louisiana to recover incremental

capacity costs outside of a traditional base rate proceeding. Under the

formula rate plan, over- and under-earnings outside an allowed range

of 9.9% to 11.4% are allocated 60% to customers and 40% to Entergy

Gulf States Louisiana. Entergy Gulf States Louisiana made its initial

formula rate plan filing in June 2005. The formula rate plan was

subsequently extended one year.

Entergy Louisiana made a rate filing with the LPSC requesting a

base rate increase in January 2004. In May 2005 the LPSC approved

a settlement that included the adoption of a three-year formula rate

plan, the terms of which included an ROE mid-point of 10.25% for the

initial three-year term of the plan and permit Entergy Louisiana to

recover incremental capacity costs outside of a traditional base rate

proceeding. Under the formula rate plan, over- and under-earnings

outside an allowed regulatory range of 9.45% to 11.05% will be allocated

60% to customers and 40% to Entergy Louisiana. The initial formula

rate plan filing was made in May 2006.

The formula rate plans for Entergy Gulf States Louisiana and Entergy

Louisiana have subsequently been extended, with return on common

equity provisions consistent with the previously approved provisions,

to cover the 2008, 2009, 2010, and 2011 test years.

Retail Rates – Electric

(Entergy Gulf States Louisiana)

In October 2009 the LPSC approved a settlement that resolved Entergy

Gulf States Louisiana’s 2007 test year filing and provided for a formula

rate plan for the 2008, 2009, and 2010 test years. 10.65% is the target

midpoint return on equity for the formula rate plan, with an earnings

bandwidth of +/- 75 basis points (9.90% - 11.40%). Entergy Gulf States

Louisiana, effective with the November 2009 billing cycle, reset its

rates to achieve a 10.65% return on equity for the 2008 test year. The

rate reset, a $44.3 million increase that includes a $36.9 million cost of

service adjustment, plus $7.4 million net for increased capacity costs

and a base rate reclassification, was implemented for the November

2009 billing cycle, and the rate reset was subject to refund pending

review of the 2008 test year filing that was made in October 2009. In

January 2010, Entergy Gulf States Louisiana implemented an additional

$23.9 million rate increase pursuant to a special rate implementation

filing made in December 2009, primarily for incremental capacity costs

approved by the LPSC. In May 2010, Entergy Gulf States Louisiana and

the LPSC staff submitted a joint report on the 2008 test year filing and

requested that the LPSC accept the report, which resulted in a $0.8

million reduction in rates effective in the June 2010 billing cycle and

a $0.5 million refund. At its May 19, 2010 meeting, the LPSC accepted

the joint report.

In May 2010, Entergy Gulf States Louisiana made its formula rate

plan filing with the LPSC for the 2009 test year. The filing reflected a

10.25% return on common equity, which is within the allowed earnings

bandwidth, indicating no cost of service rate change is necessary

under the formula rate plan. The filing does reflect, however, a

revenue requirement increase to provide supplemental funding for

the decommissioning trust maintained for the LPSC-regulated 70%

share of River Bend, in response to a NRC notification of a projected

shortfall of decommissioning funding assurance. The filing also

reflected a rate increase for incremental capacity costs. In July 2010

the LPSC approved a $7.8 million increase in the revenue requirement

for decommissioning, effective September 2010. In August 2010,

Entergy Gulf States Louisiana made a revised 2009 test year filing.

The revised filing reflected a 10.12% earned return on common equity,

which is within the allowed earnings bandwidth resulting in no cost

of service adjustment. The revised filing also reflected two increases

outside of the formula rate plan sharing mechanism: (1) the previously

approved decommissioning revenue requirement, and (2) $25.2

million for capacity costs. The rates reflected in the revised filing

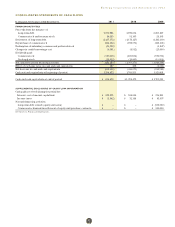

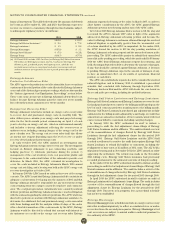

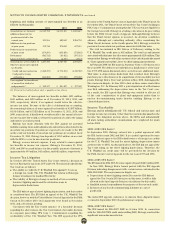

Retail Rate Proceedings

The following chart summarizes the Utility operating companies’ current retail base rates:

Company Authorized Return on Common Equity

Entergy Arkansas 10.2% n Current retail base rates implemented in the July 2010 billing cycle

pursuant to a settlement approved by the APSC.

Entergy Gulf States Louisiana 9.9% - 11.4% Electric; 10.0% - 11.0% Gas n Current retail electric base rates implemented based on Entergy Gulf

States Louisiana’s 2010 test year formula rate plan filing approved by the

LPSC.

n Current retail gas base rates reflect the rate stabilization plan filing for

the 2010 test year ended September 2010.

Entergy Louisiana 9.45% - 11.05% n Current retail base rates on Entergy Louisiana’s 2010 test year formula

rate plan filing approved by the LPSC.

Entergy Mississippi 10.54% - 12.72% n Current retail base rates reflect Entergy Mississippi’s latest formula rate

plan filing, based on the 2010 test year, and a stipulation approved by the

MPSC.

Entergy New Orleans 10.7% - 11.5% Electric; 10.25% - 11.25% Gas n Current retail base rates reflect Entergy New Orleans’s 2010 test year

formula rate plan filing and a settlement approved by the

City Council

Entergy Texas 10.125% n Current retail base rates reflect Entergy Texas’s 2009 base rate case filing

and a settlement approved by the PUCT.

70