Entergy 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Dispositions

HARRI SO N CO U NT Y

In the fourth quarter 2010, an Entergy Wholesale Commodities

subsidiary sold its ownership interest in the Harrison County

Power Project 550 MW combined-cycle plant to two Texas electric

cooperatives that owned a minority share of the Marshall, Texas

unit. Entergy sold its 61 percent share of the plant for $219 million

and realized a gain of $44.2 million ($27.2 million net-of-tax) on

the sale.

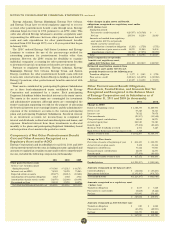

NOTE 16. RISK MANAGEMENT AND FAIR VALUES

Market and Commodity Risks

In the normal course of business, Entergy is exposed to a number

of market and commodity risks. Market risk is the potential loss

that Entergy may incur as a result of changes in the market or fair

value of a particular instrument or commodity. All financial and

commodity-related instruments, including derivatives, are subject

to market risk. Entergy is subject to a number of commodity and

market risks, including:

Type of Risk Affected Businesses

Power price risk Utility, Entergy Wholesale Commodities

Fuel price risk Utility, Entergy Wholesale Commodities

Foreign currency

exchange rate risk Entergy Wholesale Commodities

Equity price and

interest rate

risk-investments Utility, Entergy Wholesale Commodities

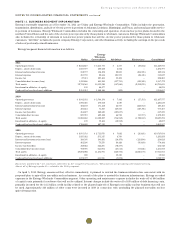

Entergy manages a portion of these risks using derivative

instruments, some of which are classified as cash flow hedges due

to their financial settlement provisions while others are classified

as normal purchase/normal sales transactions due to their

physical settlement provisions. Normal purchase/normal sale risk

management tools include power purchase and sales agreements,

fuel purchase agreements, capacity contracts, and tolling agreements.

Financially-settled cash flow hedges can include natural gas and

electricity futures, forwards, swaps, and options; and interest rate

swaps. Entergy will occasionally enter into financially settled option

contracts to manage market risk under certain hedging transactions

which may or may not be designated as hedging instruments.

Entergy enters into derivatives only to manage natural risks inherent

in its physical or financial assets or liabilities.

Entergy manages fuel price volatility for its Louisiana jurisdictions

(Entergy Gulf States Louisiana, Entergy Louisiana, and Entergy New

Orleans) and Entergy Mississippi primarily through the purchase of

short-term natural gas swaps. These swaps are marked-to-market

with offsetting regulatory assets or liabilities. The notional volumes

of these swaps are based on a portion of projected annual exposure

to gas for electric generation and projected winter purchases for

gas distribution at Entergy Gulf States Louisiana and Entergy

New Orleans.

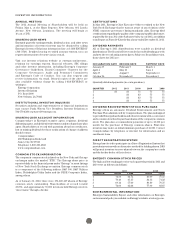

Entergy’s exposure to market risk is determined by a number of

factors, including the size, term, composition, and diversification

of positions held, as well as market volatility and liquidity. For

instruments such as options, the time period during which the option

may be exercised and the relationship between the current market

price of the underlying instrument and the option’s contractual strike

or exercise price also affects the level of market risk. A significant

factor influencing the overall level of market risk to which Entergy

is exposed is its use of hedging techniques to mitigate such risk.

Entergy manages market risk by actively monitoring compliance

with stated risk management policies as well as monitoring the

effectiveness of its hedging policies and strategies. Entergy’s risk

management policies limit the amount of total net exposure and

rolling net exposure during the stated periods. These policies,

including related risk limits, are regularly assessed to ensure their

appropriateness given Entergy’s objectives.

103