Entergy 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

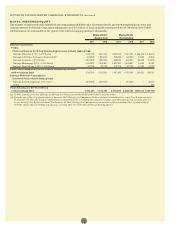

Non-Qualified Pension Plans

Entergy also sponsors non-qualified, non-contributory defined

benefit pension plans that provide benefits to certain key employees.

Entergy recognized net periodic pension cost related to these plans

of $24 million in 2011, $27.2 million in 2010, and $23.6 million in

2009. In 2011, 2010 and 2009 Entergy recognized $4.6 million, $9.3

million and $6.7 million, respectively in settlement charges related

to the payment of lump sum benefits out of the plan that is included

in the non-qualified pension plan cost above. The projected benefit

obligation was $164.4 million and $148.3 million as of December 31,

2011 and 2010, respectively. The accumulated benefit obligation was

$146.5 million and $131.6 million as of December 31, 2011 and 2010,

respectively.

Entergy’s non-qualified, non-current pension liability at December

31, 2011 and 2010 was $153.2 million and $138.7 million, respectively;

and its current liability was $11.2 million and $9.6 million, respectively.

The unamortized transition asset, prior service cost and net loss are

recognized in regulatory assets ($58.9 million at December 31, 2011

and $53.5 million at December 31, 2010) and accumulated other

comprehensive income before taxes ($27.2 million at December 31,

2011 and $24.3 million at December 31, 2010).

Accounting for Pension and Other

Postretirement Benefits

Accounting standards require an employer to recognize in its balance

sheet the funded status of its benefit plans. This is measured as the

difference between plan assets at fair value and the benefit obligation.

Entergy uses a December 31 measurement date for its pension and

other postretirement plans. Employers are to record previously

unrecognized gains and losses, prior service costs, and any remaining

transition asset or obligation (that resulted from adopting prior

pension and other postretirement benefits accounting standards) as

comprehensive income and/or as a regulatory asset reflective of the

recovery mechanism for pension and other postretirement benefit

costs in the Utility’s jurisdictions. For the portion of Entergy Gulf

States Louisiana that is not regulated, the unrecognized prior service

cost, gains and losses, and transition asset/obligation for its pension

and other postretirement benefit obligations are recorded as other

comprehensive income. Entergy Gulf States Louisiana and Entergy

Louisiana recover other postretirement benefit costs on a pay as you

go basis and record the unrecognized prior service cost, gains and

losses, and transition obligation for its other postretirement benefit

obligation as other comprehensive income. Accounting standards

also requires that changes in the funded status be recorded as other

comprehensive income and/or a regulatory asset in the period in

which the changes occur.

With regard to pension and other postretirement costs, Entergy

calculates the expected return on pension and other postretirement

benefit plan assets by multiplying the long term expected rate of

return on assets by the market-related value (MRV) of plan assets.

Entergy determines the MRV of pension plan assets by calculating

a value that uses a 20-quarter phase-in of the difference between

actual and expected returns. For other postretirement benefit plan

assets Entergy uses fair value when determining MRV.

Qualified Pension and Other Postretirement

Plans’ Assets

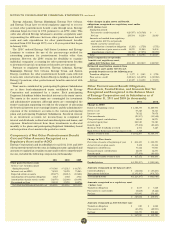

The Plan Administrator’s trust asset investment strategy is to invest

the assets in a manner whereby long term earnings on the assets

(plus cash contributions) provide adequate funding for retiree

benefit payments. The mix of assets is based on an optimization

study that identifies asset allocation targets in order to achieve the

maximum return for an acceptable level of risk, while minimizing the

expected contributions and pension and postretirement expense.

The Plan Administrator approved a new asset allocation and

implementation of an optimization study in 2011 for the pension

assets. The optimization study recommended that the target asset

allocation adjust dynamically based on the funded status of the plan.

The study identifies updated asset allocation targets to maximize

return on the assets within a prudent level of risk, as mentioned

above, and to maintain a level of volatility that is not expected

to have material impact on Entergy’s expected contribution and

expense. Entergy has begun to adjust its asset allocation, and those

adjustments are reflected in the target and actual asset allocations

listed below.

Entergy also completed an optimization study in 2011 for the

postretirement assets that identifies new asset allocation targets.

Entergy plans to adjust to this asset allocation during 2012, and the

target asset allocation will be 39% domestic equity securities, 26%

international equity securities and 35% fixed income securities for all

trusts, taxable and non-taxable.

In the optimization studies, the Plan Administrator formulates

assumptions about characteristics, such as expected asset class

investment returns, volatility (risk), and correlation coefficients

among the various asset classes. The future market assumptions

used in the optimization study are determined by examining

historical market characteristics of the various asset classes, and

making adjustments to reflect future conditions expected to prevail

over the study period. The following targets and ranges were

established to produce an acceptable, economically efficient plan to

manage around the targets. The target asset allocation range below

for pension shows the ranges within which the allocation may adjust

based on funded status, with the expectation that the allocation

to fixed income securities will increase as the pension funded

status increases.

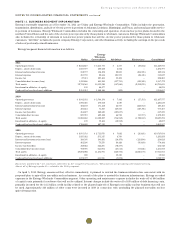

Entergy’s qualified pension and postretirement weighted-average

asset allocations by asset category at December 31, 2011 and 2010

and the target asset allocation and ranges for those time periods are

as follows:

Pension Asset Allocation Target Range 2011 2010

Domestic Equity Securities 45% 34% to 53% 44% 44%

International Equity Securities 20% 16% to 24% 18% 20%

Fixed-Income Securities 35% 31% to 41% 37% 35%

Other –% –% to 10% 1% 1%

Non-Taxable Taxable

Postretirement

Asset Allocation Target Range 2011 2010 Target Range 2011 2010

Domestic

Equity Securities 38% 33% to 43% 39% 39% 35% 30% to 40% 35% 39%

International

Equity Securities 17% 12% to 22% 15% 18% –% –% –% –%

Fixed-Income

Securities 45% 40% to 50% 46% 43% 65% 60% to 70% 64% 60%

Other –% –% to 5% –% –% –% –% to 5% 1% 1%

In determining its expected long term rate of return on plan

assets used in the calculation of benefit plan costs, Entergy reviews

past performance, current and expected future asset allocations,

and capital market assumptions of its investment consultant and

investment managers.

The expected long term rate of return for the qualified pension

plans’ assets is based on the geometric average of the historical

annual performance of a representative portfolio weighted by the

target asset allocation defined in the table above. The time period

reflected is a long dated period spanning several decades.

95