Entergy 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

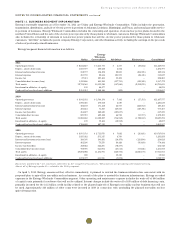

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Entergy Arkansas, Entergy Mississippi, Entergy New Orleans,

and Entergy Texas have received regulatory approval to recover

accrued other postretirement benefit costs through rates. Entergy

Arkansas began recovery in 1998, pursuant to an APSC order. This

order also allowed Entergy Arkansas to amortize a regulatory asset

(representing the difference between other postretirement benefit

costs and cash expenditures for other postretirement benefits

incurred from 1993 through 1997) over a 15-year period that began

in January 1998.

The LPSC ordered Entergy Gulf States Louisiana and Entergy

Louisiana to continue the use of the pay-as-you-go method for

ratemaking purposes for postretirement benefits other than

pensions. However, the LPSC retains the flexibility to examine

individual companies’ accounting for other postretirement benefits

to determine if special exceptions to this order are warranted.

Pursuant to regulatory directives, Entergy Arkansas, Entergy

Mississippi, Entergy New Orleans, Entergy Texas, and System

Energy contribute the other postretirement benefit costs collected

in rates into external trusts. System Energy is funding, on behalf of

Entergy Operations, other postretirement benefits associated with

Grand Gulf.

Trust assets contributed by participating Registrant Subsidiaries

are in three bank-administered trusts, established by Entergy

Corporation and maintained by a trustee. Each participating

Registrant Subsidiary holds a beneficial interest in the trusts’ assets.

The assets in the master trusts are commingled for investment

and administrative purposes. Although assets are commingled, the

trustee maintains supporting records for the purpose of allocating

the beneficial interest in net earnings/(losses) and the administrative

expenses of the investment accounts to the various participating

plans and participating Registrant Subsidiaries. Beneficial interest

in an investment account’s net income/(loss) is comprised of

interest and dividends, realized and unrealized gains and losses, and

expenses. Beneficial interest from these investments is allocated

monthly to the plans and participating Registrant Subsidiary based

on their portion of net assets in the pooled accounts.

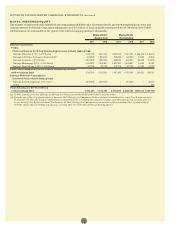

Components of Net Other Postretirement Benefit

Cost and Other Amounts Recognized as a

Regulatory Asset and/or AOCI

Entergy Corporation’s and its subsidiaries’ total 2011, 2010, and 2009

other postretirement benefit costs, including amounts capitalized and

amounts recognized as a regulatory asset and/or other comprehensive

income, included the following components (in thousands):

2011 2010 2009

Other postretirement costs:

Service cost - benefits earned

during the period $ 59,340 $ 52,313 $ 46,765

Interest cost on APBO 74,522 76,078 75,265

Expected return on assets (29,477) (26,213) (23,484)

Amortization of transition obligation 3,183 3,728 3,732

Amortization of prior service credit (14,070) (12,060) (16,096)

Recognized net loss 21,192 17,270 18,970

Net other postretirement benefit cost $114,690 $111,116 $105,152

Other changes in plan assets and benefit

obligations recognized as a regulatory asset and/or

AOCI (before tax)

Arising this period:

Prior service credit for period $(29,507) $(50,548) $ –

Net loss 236,594 82,189 24,983

Amounts reclassified from regulatory

asset and/or AOCI to net periodic

benefit cost in the current year:

Amortization of transition obligation (3,183) (3,728) (3,732)

Amortization of prior service credit 14,070 12,060 16,096

Amortization of net loss (21,192) (17,270) (18,970)

Total $196,782 $ 22,703 $ 18,377

Total recognized as net periodic

benefit cost, regulatory asset,

and/or AOCI (before tax) $311,472 $133,819 $123,529

Estimated amortization amounts from

regulatory asset and/or AOCI to net

periodic benefit cost in the following year

Transition obligation $ 3,177 $ 3,183 $ 3,728

Prior service credit $(18,163) $(14,070) $ (12,060)

Net loss $ 43,127 $ 21,192 $ 17,270

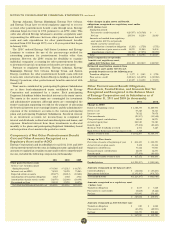

Other Postretirement Benefit Obligations,

Plan Assets, Funded Status, and Amounts Not Yet

Recognized and Recognized in the Balance Sheet

of Entergy Corporation and its Subsidiaries as of

December 31, 2011 and 2010 (in thousands):

2011 2010

Change in APBO

Balance at beginning of year $ 1,386,370 $1,280,076

Service cost 59,340 52,313

Interest cost 74,522 76,078

Plan amendments (29,507) (50,548)

Plan participant contributions 14,650 14,275

Actuarial (gain)/loss 216,549 92,340

Benefits paid (77,454) (83,613)

Medicare Part D subsidy received 4,551 5,449

Early Retiree Reinsurance Program proceeds 3,348 –

Balance at end of year $ 1,652,369 $1,386,370

Change in Plan Assets

Fair value of assets at beginning of year $ 404,430 $ 362,399

Actual return on plan assets 9,432 36,364

Employer contributions 76,114 75,005

Plan participant contributions 14,650 14,275

Benefits paid (77,454) (83,613)

Fair value of assets at end of year $ 427,172 $ 404,430

Funded status $(1,225,197) $ (981,940)

Amounts recognized in the balance sheet

Current liabilities $ (32,832) $ (30,225)

Non-current liabilities (1,192,365) (951,715)

Total funded status $(1,225,197) $ (981,940)

Amounts recognized as a regulatory asset

(before tax)

Transition obligation $ 2,557 $ 5,118

Prior service cost/(credit) (6,628) (8,442)

Net loss 353,905 253,415

$ 349,834 $ 250,091

Amounts recognized as AOCI (before tax)

Transition obligation $ 620 $ 1,242

Prior service credit (66,176) (48,925)

Net loss 313,379 198,466

$ 247,823 $ 150,783

94