Entergy 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

based on certain year-to-date information. The preliminary estimate

was recorded based on the following estimate of the payments/receipts

among the Utility operating companies for 2012 (in millions):

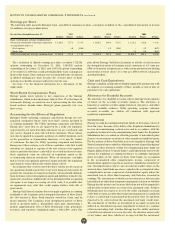

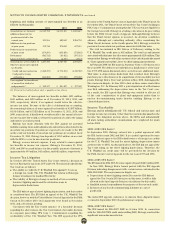

Payments or (Receipts)

Entergy Arkansas $ 37

Entergy Gulf States Louisiana $ –

Entergy Louisiana $(37)

Entergy Mississippi $ –

Entergy New Orleans $ –

Entergy Texas $ –

The actual payments/receipts for 2012, based on calendar year 2011

production costs, will not be calculated until the Utility operating

companies’ FERC Form 1s have been filed. Once the calculation is

completed, it will be filed at the FERC. The level of any payments and

receipts is significantly affected by a number of factors, including, among

others, weather, the price of alternative fuels, the operating characteristics

of the Entergy System generating fleet, and multiple factors affecting the

calculation of the non-fuel related revenue requirement components of the

total production costs, such as plant investment.

2011 Rate Filing Based on Calendar Year 2010

Production Costs

In May 2011, Entergy filed with the FERC the 2011 rates in accordance

with the FERC’s orders in the System Agreement proceeding. The filing

shows the following payments/receipts among the Utility operating

companies for 2011, based on calendar year 2010 production costs,

commencing for service in June 2011, are necessary to achieve rough

production cost equalization under the FERC’s orders (in millions):

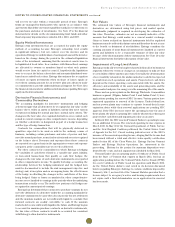

Payments or (Receipts)

Entergy Arkansas $ 77

Entergy Gulf States Louisiana $(12)

Entergy Louisiana $ –

Entergy Mississippi $(40)

Entergy New Orleans $(25)

Entergy Texas $ –

Several parties intervened in the proceeding at the FERC, including the

LPSC, which filed a protest as well. In July 2011, the FERC accepted

Entergy’s proposed rates for filing, effective June 1, 2011, subject

to refund, set the proceeding for hearing procedures, and then held

those procedures in abeyance pending FERC decisions in the prior

production cost proceedings currently before the FERC on review.

PRIOR YEARS’ ROUGH PRODUCTION

COST EQUALIZATION RATES

Each May since 2007 Entergy has filed with the FERC the rates to

implement the FERC’s orders in the System Agreement proceeding.

These filings show the following payments/receipts among the Utility

operating companies are necessary to achieve rough production cost

equalization as defined by the FERC’s orders (in millions):

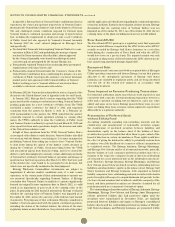

2007 Payments 2008 Payments 2009 Payments 2010 Payments

or or or or

(Receipts) Based (Receipts) Based (Receipts) Based (Receipts) Based

on 2006 Costs on 2007 Costs on 2008 Costs on 2009 Costs

Entergy

Arkansas $ 252 $ 252 $ 390 $ 41

Entergy Gulf

States

Louisiana $ (120) $(124) $(107) $ –

Entergy

Louisiana $ (91) $ (36) $(140) $(22)

Entergy

Mississippi $ (41) $ (20) $ (24) $ (19)

Entergy

New Orleans $ – $ (7) $ – $ –

Entergy Texas $ (30) $ (65) $(119) $ –

The APSC has approved a production cost allocation rider for

recovery from customers of the retail portion of the costs allocated

to Entergy Arkansas. Management believes that any changes in the

allocation of production costs resulting from the FERC’s decision and

related retail proceedings should result in similar rate changes for retail

customers, subject to specific circumstances that have caused trapped

costs. See “Fuel and purchased power cost recovery, Entergy Texas,”

above for discussion of a PUCT decision that resulted in $18.6 million

of trapped costs between Entergy’s Texas and Louisiana jurisdictions.

See “2007 Rate Filing Based on Calendar Year 2006 Production Costs”

below for a discussion of a FERC decision that could result in $14.5

million of trapped costs at Entergy Arkansas.

Based on the FERC’s April 27, 2007 order on rehearing that is

discussed above, in the second quarter 2007 Entergy Arkansas

recorded accounts payable and Entergy Gulf States Louisiana,

Entergy Louisiana, Entergy Mississippi, and Entergy Texas recorded

accounts receivable to reflect the rough production cost equalization

payments and receipts required to implement the FERC’s remedy

based on calendar year 2006 production costs. Entergy Arkansas

recorded a corresponding regulatory asset for its right to collect the

payments from its customers, and Entergy Gulf States Louisiana,

Entergy Louisiana, Entergy Mississippi, and Entergy Texas recorded

corresponding regulatory liabilities for their obligations to pass the

receipts on to their customers. The companies have followed this

same accounting practice each year since then. The regulatory asset

and liabilities are shown as “System Agreement cost equalization” on

the respective balance sheets.

2007 Rate Filing Based on Calendar Year 2006

Production Costs

Several parties intervened in the 2007 rate proceeding at the FERC,

including the APSC, the MPSC, the Council, and the LPSC, which have

also filed protests. The PUCT also intervened. Intervenor testimony

was filed in which the intervenors and also the FERC Staff advocated a

number of positions on issues that affect the level of production costs

the individual Utility operating companies are permitted to reflect in

the bandwidth calculation, including the level of depreciation and

decommissioning expense for nuclear facilities. The effect of the various

positions would be to reallocate costs among the Utility operating

companies. The Utility operating companies filed rebuttal testimony

explaining why the bandwidth payments are properly recoverable under

the AmerenUE contract, and explaining why the positions of FERC Staff

and intervenors on the other issues should be rejected. A hearing in this

proceeding concluded in July 2008, and the ALJ issued an initial decision

in September 2008. The ALJ’s initial decision concluded, among other

things, that: (1) the decisions to not exercise Entergy Arkansas’s option

to purchase the Independence plant in 1996 and 1997 were prudent; (2)

Entergy Arkansas properly flowed a portion of the bandwidth payments

through to AmerenUE in accordance with the wholesale power contract;

and (3) the level of nuclear depreciation and decommissioning expense

reflected in the bandwidth calculation should be calculated based on

NRC-authorized license life, rather than the nuclear depreciation and

decommissioning expense authorized by the retail regulators for

purposes of retail ratemaking. Following briefing by the parties, the

matter was submitted to the FERC for decision. On January 11, 2010,

the FERC issued its decision both affirming and overturning certain

of the ALJ’s rulings, including overturning the decision on nuclear

depreciation and decommissioning expense. The FERC’s conclusion

related to the AmerenUE contract does not permit Entergy Arkansas to

recover a portion of its bandwidth payment from AmerenUE. The Utility

operating companies requested rehearing of that portion of the decision

and requested clarification on certain other portions of the decision.

74