Entergy 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

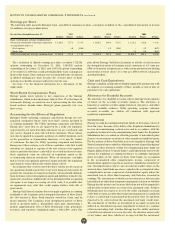

Entergy Corporation and Subsidiaries 2011

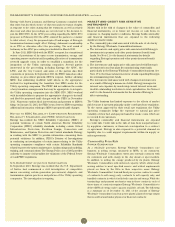

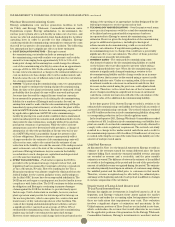

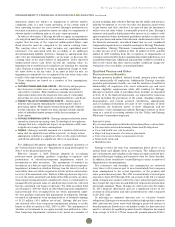

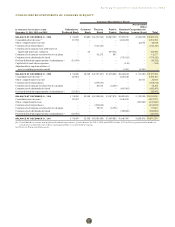

Common Shareholders’ Equity

Accumulated

Other

In thousands, for the years ended Subsidiaries’ Common Treasury Paid–in Retained Comprehensive

December 31, 2011, 2010, and 2009 Preferred Stock Stock Stock Capital Earnings Income (Loss) Total

BALANCE AT DECEMBER 31, 2008 $ 94,000 $2,482 $(4,175,214) $4,869,303 $7,382,719 $(112,698) $8,060,592

Consolidated net income(a) 19,958 – – – 1,231,092 – 1,251,050

Other comprehensive income – – – – – 43,878 43,878

Common stock repurchases – – (613,125) – – – (613,125)

Common stock issuances in settlement of

equity unit purchase contracts – 66 – 499,934 – – 500,000

Common stock issuances related to stock plans – – 61,172 805 – – 61,977

Common stock dividends declared – – – – (576,913) – (576,913)

Preferred dividend requirements of subsidiaries(a) (19,958) – – – – – (19,958)

Capital stock and other expenses – – – – (141) – (141)

Adjustment for implementation of

new accounting pronouncement – – – – 6,365 (6,365) –

BALANCE AT DECEMBER 31, 2009 $ 94,000 $2,548 $(4,727,167) $5,370,042 $8,043,122 $ (75,185) $ 8,707,360

Consolidated net income(a) 20,063 – – – 1,250,242 – 1,270,305

Other comprehensive income – – – – – 36,973 36,973

Common stock repurchases – – (878,576) – – – (878,576)

Common stock issuances related to stock plans – – 80,932 (2,568) – – 78,364

Common stock dividends declared – – – – (603,963) – (603,963)

Preferred dividend requirements of subsidiaries(a) (20,063) – – – – – (20,063)

BALANCE AT DECEMBER 31, 2010 $ 94,000 $2,548 $(5,524,811) $5,367,474 $8,689,401 $ (38,212) $8,590,400

Consolidated net income(a) 20,933 – – – 1,346,439 – 1,367,372

Other comprehensive loss – – – – – (130,240) (130,240)

Common stock repurchases – – (234,632) – – – (234,632)

Common stock issuances related to stock plans – – 78,975 (6,792) – – 72,183

Common stock dividends declared – – – – (588,880) – (588,880)

Preferred dividend requirements of subsidiaries(a) (20,933) – – – – – (20,933)

BALANCE AT DECEMBER 31, 2011 $ 94,000 $2,548 $(5,680,468) $5,360,682 $9,446,960 $(168,452) $9,055,270

(a) Consolidated net income and preferred dividend requirements of subsidiaries for 2011, 2010, and 2009 include $13.3 million of preferred dividends on

subsidiaries’ preferred stock without sinking fund that is not presented as equity.

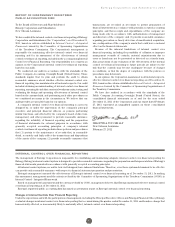

See Notes to Financial Statements.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

57