Entergy 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

reimbursement for previously-incurred investment recovery costs.

The investment recovery property is reflected as a regulatory

asset on the consolidated Entergy Louisiana balance sheet. The

creditors of Entergy Louisiana do not have recourse to the assets or

revenues of Entergy Louisiana Investment Recovery Funding,

including the investment recovery property, and the creditors

of Entergy Louisiana Investment Recovery Funding do not have

recourse to the assets or revenues of Entergy Louisiana. Entergy

Louisiana has no payment obligations to Entergy Louisiana

Investment Recovery Funding except to remit investment recovery

charge collections.

Entergy Texas Securitization Bonds – Hurricane Rita

In April 2007 the PUCT issued a financing order authorizing the

issuance of securitization bonds to recover $353 million of Entergy

Texas’s Hurricane Rita reconstruction costs and up to $6 million of

transaction costs, offset by $32 million of related deferred income tax

benefits. In June 2007, Entergy Gulf States Reconstruction Funding

I, LLC, a company that is now wholly-owned and consolidated

by Entergy Texas, issued $329.5 million of senior secured

transition bonds (securitization bonds) as follows (in thousands):

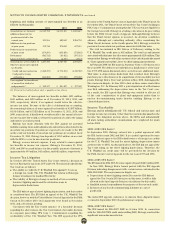

Senior Secured Transition Bonds, Series A:

Tranche A-1 (5.51%) due October 2013 $ 93,500

Tranche A-2 (5.79%) due October 2018 121,600

Tranche A-3 (5.93%) due June 2022 114,400

Total senior secured transition bonds $329,500

Although the principal amount of each tranche is not due until

the Although the principal amount of each tranche is not due

until the dates given above, Entergy Gulf States Reconstruction

Funding expects to make principal payments on the bonds over

the next five years in the amounts of $20.8 million for 2012, $21.9

million for 2013, $23.2 million for 2014, $24.6 million for 2015, and

$26.0 million for 2016. Of the scheduled principal payments for 2012,

$18.5 million are for Tranche A-1 and $2.3 million are for Tranche

A-2, and all of the scheduled principal payments for 2013-2016 are

for Tranche A-2.

With the proceeds, Entergy Gulf States Reconstruction Funding

purchased from Entergy Texas the transition property, which is the

right to recover from customers through a transition charge amounts

sufficient to service the securitization bonds. The transition property

is reflected as a regulatory asset on the consolidated Entergy Texas

balance sheet. The creditors of Entergy Texas do not have recourse

to the assets or revenues of Entergy Gulf States Reconstruction

Funding, including the transition property, and the creditors of

Entergy Gulf States Reconstruction Funding do not have recourse

to the assets or revenues of Entergy Texas. Entergy Texas has no

payment obligations to Entergy Gulf States Reconstruction Funding

except to remit transition charge collections.

Entergy Texas Securitization Bonds –

Hurricane Ike and Hurricane Gustav

In September 2009 the PUCT authorized the issuance of securitization

bonds to recover $566.4 million of Entergy Texas’s Hurricane Ike

and Hurricane Gustav restoration costs, plus carrying costs and

transaction costs, offset by insurance proceeds. In November 2009,

Entergy Texas Restoration funding, LLC (Entergy Texas Restoration

Funding), a company wholly-owned and consolidated by Entergy

Texas, issued $545.9 million of senior secured transition bonds

(securitization bonds), as follows (in thousands):

Senior Secured Transition Bonds, Series A:

Tranche A-1 (2.12%) due February 2016 $ 182,500

Tranche A-2 (3.65%) due August 2019 144,800

Tranche A-3 (4.38%) due November 2023 218,600

Total senior secured transition bonds $545,900

Although the principal amount of each tranche is not due until the

dates given above, Entergy Texas Restoration Funding expects to

make principal payments on the bonds over the next five years in

the amount of $38.6 million for 2012, $39.4 million for 2013, $40.2

million for 2014, $41.2 million for 2015, and $42.6 million for 2016. All

of the scheduled principal payments for 2012-2014 are for Tranche

A-1, $13.8 million of the scheduled principal payments for 2015 are

for Tranche A-1 and $27.4 million are for Tranche A-2, and all of the

scheduled principal payments for 2016 are for Tranche A-2.

With the proceeds, Entergy Texas Restoration Funding purchased

from Entergy Texas the transition property, which is the right

to recover from customers through a transition charge amounts

sufficient to service the securitization bonds. The transition property

is reflected as a regulatory asset on the consolidated Entergy Texas

balance sheet. The creditors of Entergy Texas do not have recourse

to the assets or revenues of Entergy Texas Restoration Funding,

including the transition property, and the creditors of Entergy Texas

Restoration Funding do not have recourse to the assets or revenues

of Entergy Texas. Entergy Texas has no payment obligations to

Entergy Texas Restoration Funding except to remit transition

charge collections.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

85