Entergy 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We can’t change the perception of the political risk associated

with nuclear power overnight; not when countries like Germany

announce their intent to exit nuclear generation completely, or

when a technology-savvy country like Japan experiences an event

like Fukushima. All we can do is continue to safely operate our

plants at the highest possible performance levels, ensure we do

not shortchange risk management in the design, investment and

maintenance of our plants, assure that the public has the facts

relative to the safety of our plants, and rely on the regulatory and

legal systems to protect our right to operate a safe plant.

More generally, the strategies, plans and initiatives under

way today set the foundation toward our vision of the future for

Entergy and the industry.

Our Utility Business:

Finding Opportunity in Challenge

Our utility business is committed to safely providing affordable,

reliable and clean power to its customers. In years past, our

utility operating companies have faced multiple challenges to

achieving that goal. They have worked diligently to develop

solutions to address each challenge.

One of our top priorities has been to secure flexible regulatory

mechanisms that allow our utility operating companies the

opportunity to earn returns commensurate with investment

alternatives of comparable risk. In recent years, we realized

significant improvement in achieving authorized returns on equity.

In fact, over the last 12 months, we were near the top of our

industry in making the most of the opportunities available to us.

All Entergy jurisdictions use alternative rate recovery mechanisms

including riders and/or Formula Rate Plans to reduce regulatory

lag. While efficient and effective, they do not eliminate the need

for rate cases. Late last year, we filed a base rate case in Texas,

and plan to make rate case filings in Louisiana by January 2013.

In other jurisdictions, including Arkansas, the next base rate

case is likely to align with the timing related to the System

Agreement exits and the proposed move to MISO.

Our utility operating companies also moved to address their

ongoing generation capacity needs. Examples of the build, buy

or contract actions taken in 2011 include: Entergy Arkansas

and Entergy Mississippi each announced plans to purchase a

combined-cycle gas-turbine unit; Entergy Louisiana requested

regulatory approval to build a 550-megawatt CCGT unit at its

existing Ninemile Point plant, including selling a portion of

the output to Entergy Gulf States Louisiana and Entergy

New Orleans; and Entergy Texas entered into a 10-year,

485-megawatt power purchase agreement with Calpine Energy

Services, L.P., with 50 percent of the output to be sold to Entergy

Gulf States Louisiana. Thanks in part to these types of efforts to

develop efficient regulatory constructs and identify opportunities

to meet our customers’ long-term generation needs, the past

five-year increase in average residential rates for Entergy utility

customers was substantially less than the U.S. average. At the

same time, customer service performance improved.

Finally, our utility operating companies continued to work

tirelessly in 2011 to find an acceptable solution to address

the upcoming exits of two utility operating companies from

the System Agreement as well as long-term arrangements for

the transmission business. After comprehensive review and

analysis, we determined that joining MISO is expected to provide

substantial long-term benefits for Entergy utility customers.

We identified potential customer savings of up to $1.4 billion

in power production and related costs in the 2013 to 2022

time frame. These benefits derive from joining an RTO with

substantial scale and a “Day Two” market. “Day Two” refers to an

RTO that includes day-ahead and real-time energy markets. MISO

has a functioning “Day Two” market today that will generate

savings for our customers on day one. The other RTO evaluated –

the Southwest Power Pool – does not, even though comparative

cost-benefit analysis assumed SPP will get there by December

2013. Formal requests to join MISO have been filed, or are being

prepared for filing, with our retail regulators. Decisions are

expected by fall 2012.

Joining MISO effectively provides a reliable and cost-effective

option for Entergy Arkansas and Entergy Mississippi to exit

the System Agreement in December 2013 and November 2015,

respectively. It replaces the expiring Independent Coordinator

of Transmission arrangement for the system. The target

implementation date is by December 2013 for transferring

functional control of transmission facilities to MISO.

Given the numerous challenges faced and overcome in

recent years, it’s fair to say our utility business sets a standard

for successful adaptation in a difficult climate of change. It

has a long record of delivering affordable, reliable power to

its customers and is on track to deliver 6 percent to 8 percent

compound average annual net income growth over the 2010 to

2014 period (2009 base year), set before the announcement of

the spin-merge of the transmission business. Details on how

the long-term financial outlook will be affected by the proposed

transmission business spin-off and merger will be provided at

a future date. It is important to note that, with a 2013 targeted

closing date, the transmission business will be part of the utility

for a majority of the duration of this financial outlook, and

Entergy’s shareholders will continue to have ownership in

both businesses after the transaction closes.

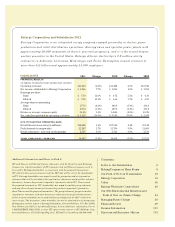

Entergy Corporation and Subsidiaries 2011

5