Entergy 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

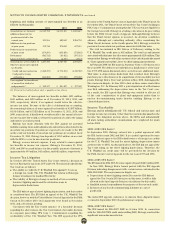

NOTE 3. INCOME TAXES

Income tax expenses from continuing operations for 2011, 2010,

and 2009 for Entergy Corporation and Subsidiaries consist of the

following (in thousands):

2011 2010 2009

Current:

Federal $ 452,713 $ 145,161 $ (433,105)

Foreign 130 131 154

State 152,711 19,313 (108,552)

Total 605,554 164,605 (541,503)

Deferred and non-current - net (311,708) 468,698 1,191,418

Investment tax credit

adjustments - net (7,583) (16,064) (17,175)

Income tax expense from

continuing operations $286,263 $617,239 $ 632,740

Total income taxes for Entergy Corporation and Subsidiaries differ

from the amounts computed by applying the statutory income tax rate

to income before taxes. The reasons for the differences for the years

2011, 2010, and 2009 are (in thousands):

2011 2010 2009

Net income attributable to

Entergy Corporation $1,346,439 $1,250,242 $1,231,092

Preferred dividend

requirements of subsidiaries 20,933 20,063 19,958

Consolidated net income 1,367,372 1,270,305 1,251,050

Income taxes 286,263 617,239 632,740

Income before income taxes $1,653,635 $1,887,544 $1,883,790

Computed at statutory

rate (35%) $ 578,772 $ 660,640 $ 659,327

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 93,940 40,530 65,241|

Regulatory differences -

utility plant items 39,970 31,473 57,383

Equity component of AFUDC (30,184) (16,542) (17,741)

Amortization of investment

tax credits (14,962) (15,980) (16,745)

Net-of-tax regulatory liability(a) 65,357 – –

Deferred tax reversal on

PPA settlement(a) (421,819) – –

Write-off of

reorganization costs – (19,974) –

Tax law change-Medicare

Part D – 13,616 –

Decommissioning

trust fund basis – – (7,917)

Capital gains (losses) – – (28,051)

Flow-through/permanent

differences (17,848) (26,370) (31,745)

Provision for uncertain

tax positions 2,698 (43,115) (17,435)

Valuation allowance – – (40,795)

Other - net (9,661) (7,039) 11,218

Total income

taxes as reported $ 286,263 $ 617,239 $632,740

Effective income tax rate 17.3% 32.7% 33.6%

(a) See “Income Tax Audits - 2006-2007 Audit” below for discussion of these items.

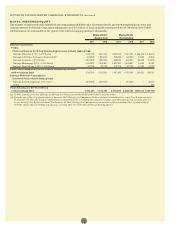

Significant components of accumulated deferred income taxes

and taxes accrued for Entergy Corporation and Subsidiaries as of

December 31, 2011 and 2010 are as follows (in thousands):

2011 2010

Deferred tax liabilities:

Plant basis differences - net $ (7,349,990) $ (6,572,627)

Regulatory assets for income taxes - net (430,807) (449,266)

Power purchase agreements (17,138) (265,429)

Nuclear decommissioning trusts (553,558) (439,481)

Other (686,006) (679,302)

Total (9,037,499) (8,406,105)

Deferred tax assets:

Accumulated deferred investment

tax credit 108,338 111,170

Pension and other post-employment benefits 315,134 161,730

Nuclear decommissioning liabilities 612,945 285,889

Sale and leaseback 217,430 256,157

Provision for regulatory adjustments 97,607 100,504

Provision for contingencies 28,504 28,554

Unbilled/deferred revenues 12,217 18,642

Customer deposits 14,825 15,724

Net operating loss carryforwards 253,518 123,710

Capital losses 12,995 56,602

Other 96,676 19,009

Valuation allowance (85,615) (70,089)

Total 1,684,574 1,107,602

Noncurrent accrued taxes (including

unrecognized tax benefits) $ (814,597) $ (1,261,455)

Accumulated deferred income

taxes accrued $(8,167,522) $(8,559,958)

Entergy’s estimated tax attribute carryovers and their expiration

dates as of December 31, 2011 are as follows:

Carryover Description Carryover Amount Year(s) of expiration

Federal net operating losses $ 9 billion 2023 - 2031

State net operating losses $ 8 billion 2012 - 2031

State capital losses $162 million 2013 - 2015

Federal minimum tax credits $ 79 million never

Other federal and state credits $ 80 million 2012 - 2031

As a result of the accounting for uncertain tax positions,

the amount of the deferred tax assets reflected in the financial

statements is less than the amount of the tax effect of the federal

and state net operating loss carryovers, tax credit carryovers, and

other tax attributes reflected on income tax returns.

Because it is more likely than not that the benefit from certain

state net operating and capital loss carryovers will not be utilized, a

valuation allowance of $66 million and $13 million has been provided

on the deferred tax assets relating to these state net operating and

capital loss carryovers, respectively.

Unrecognized Tax Benefits

Accounting standards establish a “more-likely-than-not” recognition

threshold that must be met before a tax benefit can be recognized in

the financial statements. If a tax deduction is taken on a tax return,

but does not meet the more-likely-than-not recognition threshold,

an increase in income tax liability, above what is payable on the

tax return, is required to be recorded. A reconciliation of Entergy’s

79