Entergy 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Deferred taxes on unrealized gains/(losses) are recorded in other

comprehensive income for the decommissioning trusts which do not

meet the criteria for regulatory accounting treatment as described

above. Unrealized gains/(losses) above are reported before deferred

taxes of $149 million and $130 million as of December 31, 2011

and 2010, respectively. The amortized cost of debt securities was

$1,530 million as of December 31, 2011 and $1,475 million as of

December 31, 2010. As of December 31, 2011, the debt securities

have an average coupon rate of approximately 4.15%, an average

duration of approximately 5.40 years, and an average maturity of

approximately 8.53 years. The equity securities are generally held

in funds that are designed to approximate or somewhat exceed

the return of the Standard & Poor’s 500 Index. A relatively small

percentage of the securities are held in funds intended to replicate

the return of the Wilshire 4500 Index or the Russell 3000 Index.

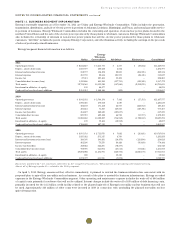

The fair value and gross unrealized losses of available-for-sale

equity and debt securities, summarized by investment type and

length of time that the securities have been in a continuous loss

position, are as follows as of December 31, 2011 (in millions):

Equity Securities Debt Securities

Gross Gross

Fair Unrealized Fair Unrealized

Value Losses Value Losses

Less than 12 months $ 130 $ 9 $ 123 $ 3

More than 12 months 43 5 60 2

Total $173 $14 $183 $5

The fair value and gross unrealized losses of available-for-sale

equity and debt securities, summarized by investment type and

length of time that the securities have been in a continuous loss

position, are as follows as of December 31, 2010 (in millions):

Equity Securities Debt Securities

Gross Gross

Fair Unrealized Fair Unrealized

Value Losses Value Losses

Less than 12 months $ 15 $1 $ 474 $ 11

More than 12 months 105 8 4 1

Total $120 $9 $478 $12

The unrealized losses in excess of twelve months on equity securities

above relate to Entergy’s Utility operating companies and System

Energy.

The fair value of debt securities, summarized by contractual

maturities, as of December 31, 2011 and 2010 are as follows

(in millions):

2011 2010

Less than 1 year $ 69 $ 37

1 year - 5 years 566 557

5 years - 10 years 583 512

10 years - 15 years 187 163

15 years - 20 years 42 47

20 years+ 212 204

Total $1,659 $1,520

During the years ended December 31, 2011, 2010, and 2009,

proceeds from the dispositions of securities amounted to $1,360

million, $2,606 million, and $2,571 million, respectively. During

the years ended December 31, 2011, 2010, and 2009, gross gains

of $29 million, $69 million, and $80 million, respectively, and gross

losses of $11 million, $9 million, and $30 million, respectively, were

reclassified out of other comprehensive income into earnings.

Other Than Temporary Impairments and

Unrealized Gains and Losses

Entergy evaluates unrealized losses at the end of each period

to determine whether an other-than-temporary impairment has

occurred. The assessment of whether an investment in a debt

security has suffered an other-than-temporary impairment is based

on whether Entergy has the intent to sell or more likely than not will

be required to sell the debt security before recovery of its amortized

costs. Further, if Entergy does not expect to recover the entire

amortized cost basis of the debt security, an other-than-temporary

impairment is considered to have occurred and it is measured by

the present value of cash flows expected to be collected less the

amortized cost basis (credit loss). For debt securities held as of

January 1, 2009 for which an other-than-temporary impairment

had previously been recognized but for which assessment under

the new guidance indicates this impairment is temporary, Entergy

recorded an adjustment to its opening balance of retained earnings

of $11.3 million ($6.4 million net-of-tax). Entergy did not have any

material other-than-temporary impairments relating to credit losses

on debt securities for the years ended December 31, 2011 and 2010.

The assessment of whether an investment in an equity security has

suffered an other-than-temporary impairment continues to be based

on a number of factors including, first, whether Entergy has the

ability and intent to hold the investment to recover its value, the

duration and severity of any losses, and, then, whether it is expected

that the investment will recover its value within a reasonable period

of time. Entergy’s trusts are managed by third parties who operate in

accordance with agreements that define investment guidelines and

place restrictions on the purchases and sales of investments. Entergy

recorded charges to other income of $0.1 million in 2011, $1 million

in 2010, and $86 million in 2009, resulting from the recognition of the

other-than-temporary impairment of certain equity securities held in

its decommissioning trust funds.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

108