Entergy 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

Geographic Areas

For the years ended December 31, 2011 and 2010, the amount of

revenue Entergy derived from outside of the United States was

insignificant. As of December 31, 2011 and 2010, Entergy had no

long-lived assets located outside of the United States.

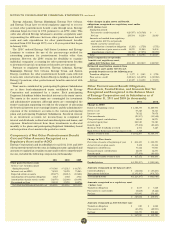

NOTE 14. EQUITY METHOD INVESTMENTS

As of December 31, 2011, Entergy owns investments in the

following companies that it accounts for under the equity method

of accounting:

Investment Ownership Description

Entergy-Koch 50% partnership interest Entergy-Koch was in the

energy commodity marketing

and trading business and gas

transportation and storage

business until the fourth

quarter of 2004 when these

businesses were sold.

RS Cogen LLC 50% member interest Co-generation project that

produces power and steam

on an industrial and merchant

basis in the Lake Charles,

Louisiana area.

Top Deer 50% member interest Wind-powered electric

generation joint venture.

Following is a reconciliation of Entergy’s investments in equity

affiliates (in thousands):

2011 2010 2009

Beginning of year $ 40,697 $ 39,580 $ 66,247

Loss from the investments (88) (2,469) (7,793)

Dispositions and other adjustments 4,267 3,586 (18,874)

End of year $44,876 $40,697 $39,580

Transactions with Equity Method Investees

Entergy Gulf States Louisiana purchased approximately $41.1

million, $50.8 million, and $49.3 million of electricity generated from

Entergy’s share of RS Cogen in 2011, 2010, and 2009, respectively.

Entergy’s operating transactions with its other equity method

investees were not significant in 2011, 2010, or 2009.

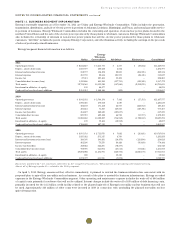

NOTE 15. ACQUISITIONS AND DISPOSITIONS

Acquisitions

ACAD I A

In April 2011, Entergy Louisiana purchased Unit 2 of the Acadia

Energy Center, a 580 MW generating unit located near Eunice,

Louisiana, from an independent power producer. The Acadia Energy

Center, which entered commercial service in 2002, consists of two

combined-cycle gas-fired generating units, each nominally rated at

580 MW. Entergy Louisiana purchased 100 percent of Acadia Unit 2

and a 50 percent ownership interest in the facility’s common assets

for approximately $300 million. In a separate transaction, Cleco

Power acquired Acadia Unit 1 and the other 50 percent interest in

the facility’s common assets. Cleco Power will serve as operator for

the entire facility. The FERC and the LPSC approved the transaction.

RHOD E IS L AN D STATE ENERGY CE NTE R

In December 2011 a subsidiary in the Entergy Wholesale Commodities

business segment purchased the Rhode Island State Energy Center,

a 583 MW natural gas-fired combined-cycle generating plant located

in Johnston, Rhode Island, from a subsidiary of NextEra Energy

Resources, for approximately $346 million. The Rhode Island State

Energy Center began commercial operation in 2002.

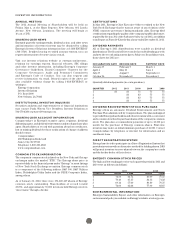

PALI S ADES PURC H A S E D POWER AGR E E M E N T

Entergy’s purchase of the Palisades plant in 2007 included a unit-

contingent, 15-year purchased power agreement (PPA) with

Consumers Energy for 100% of the plant’s output, excluding any

future uprates. Prices under the PPA range from $43.50/MWh in 2007

to $61.50/MWh in 2022, and the average price under the PPA is $51/

MWh. For the PPA, which was at below-market prices at the time of

the acquisition, Entergy will amortize a liability to revenue over the

life of the agreement. The amount that will be amortized each period

is based upon the difference between the present value calculated

at the date of acquisition of each year’s difference between revenue

under the agreement and revenue based on estimated market prices.

Amounts amortized to revenue were $43 million in 2011, $46 million

in 2010, and $53 million in 2009. The amounts to be amortized to

revenue for the next five years will be $17 million in 2012, $18 million

for 2013, $16 million for 2014, $15 million for 2015, and $13 million

for 2016.

NYPA VALUE SH ARING AGR E E M E N TS

Entergy’s purchase of the FitzPatrick and Indian Point 3 plants from

NYPA included value sharing agreements with NYPA. In October

2007, Entergy subsidiaries and NYPA amended and restated the

value sharing agreements to clarify and amend certain provisions

of the original terms. Under the amended value sharing agreements,

Entergy subsidiaries will make annual payments to NYPA based on

the generation output of the Indian Point 3 and FitzPatrick plants

from January 2007 through December 2014. Entergy subsidiaries will

pay NYPA $6.59 per MWh for power sold from Indian Point 3, up to

an annual cap of $48 million, and $3.91 per MWh for power sold from

FitzPatrick, up to an annual cap of $24 million. The annual payment

for each year’s output is due by January 15 of the following year.

Entergy will record the liability for payments to NYPA as power is

generated and sold by Indian Point 3 and FitzPatrick. An amount

equal to the liability will be recorded to the plant asset account as

contingent purchase price consideration for the plants. In 2011, 2010,

and 2009, Entergy Wholesale Commodities recorded $72 million as

plant for generation during each of those years. This amount will be

depreciated over the expected remaining useful life of the plants.

102