Entergy 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

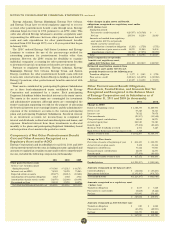

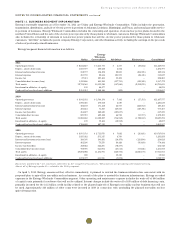

NOTE 13. BUSINESS SEGMENT INFORMATION

Entergy’s reportable segments as of December 31, 2011 are Utility and Entergy Wholesale Commodities. Utility includes the generation,

transmission, distribution, and sale of electric power in portions of Arkansas, Louisiana, Mississippi, and Texas, and natural gas utility service

in portions of Louisiana. Entergy Wholesale Commodities includes the ownership and operation of six nuclear power plants located in the

northern United States and the sale of the electric power produced by those plants to wholesale customers. Entergy Wholesale Commodities

also includes the ownership of interests in non-nuclear power plants that sell the electric power produced by those plants to wholesale

customers. “All Other” includes the parent company, Entergy Corporation, and other business activity, including the earnings on the proceeds

of sales of previously-owned businesses.

Entergy’s segment financial information is as follows:

Entergy

Wholesale

Utility Commodities* All Others Eliminations Consolidated

2011

Operating revenues $ 8,841,827 $ 2,413,773 $ 4,157 $ (30,684) $11,229,073

Deprec., amort. & decomm. 1,027,597 260,638 4,562 – 1,292,797

Interest and investment income 158,737 136,492 28,830 (194,925) 129,134

Interest expense 455,739 20,634 121,599 (84,345) 513,627

Income tax 27,311 225,456 33,496 – 286,263

Consolidated net income (loss) 1,123,866 491,841 (137,755) (110,580) 1,367,372

Total assets 32,734,549 10,533,080 (507,860) (2,058,070) 40,701,699

Investment in affiliates - at equity 199 44,677 – – 44,876

Cash paid for long-lived asset additions 2,351,913 1,048,146 (402) – 3,399,657

2010

Operating revenues $ 8,941,332 $ 2,566,156 $ 7,442 $ (27,353) $11,487,577

Deprec., amort. & decomm. 1,006,385 270,658 4,587 – 1,281,630

Interest and investment income 182,493 171,158 44,757 (212,953) 185,455

Interest expense 493,241 71,817 129,505 (119,396) 575,167

Income tax (benefits) 454,227 268,649 (105,637) – 617,239

Consolidated net income 829,719 489,422 44,721 (93,557) 1,270,305

Total assets 31,080,240 10,102,817 (714,968) (1,782,813) 38,685,276

Investment in affiliates - at equity 199 59,456 (18,958) – 40,697

Cash paid for long-lived asset additions 1,766,609 687,313 75 – 2,453,997

2009

Operating revenues $ 8,055,353 $ 2,711,078 $ 5,682 $ (26,463) $10,745,650

Deprec., amort. & decomm. 1,025,922 251,147 4,769 – 1,281,838

Interest and investment income (loss) 180,505 196,492 (10,470) (129,899) 236,628

Interest expense 462,206 78,278 86,420 (56,460) 570,444

Income tax (benefits) 388,682 322,255 (78,197) – 632,740

Consolidated net income (loss) 708,905 641,094 (25,511) (73,438) 1,251,050

Total assets 29,892,088 11,134,791 (646,756) (2,818,170) 37,561,953

Investment in affiliates - at equity 200 – 39,380 – 39,580

Cash paid for long-lived asset additions 1,872,997 661,596 (5,874) – 2,528,719

Businesses marked with * are sometimes referred to as the “competitive businesses.” Eliminations are primarily intersegment activity.

Almost all of Entergy’s goodwill is related to the Utility segment.

On April 5, 2010, Entergy announced that, effective immediately, it planned to unwind the business infrastructure associated with its

proposed plan to spin-off its non-utility nuclear business. As a result of the plan to unwind the business infrastructure, Entergy recorded

expenses in the Entergy Wholesale Commodities segment. Other operating and maintenance expense includes the write-off of $64 million

of capital costs, primarily for software that will not be utilized. Interest charges include the write-off of $39 million of debt financing costs,

primarily incurred for the $1.2 billion credit facility related to the planned spin-off of Entergy’s non-utility nuclear business that will not

be used. Approximately $16 million of other costs were incurred in 2010 in connection with unwinding the planned non-utility nuclear

spin-off transaction.

101