Entergy 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS continued

Entergy Gulf States Louisiana and Entergy Louisiana complied with

this order, but also filed a notice of objection and reservation of rights

in response to the order, stating that the testimony, as well as related

discovery and other proceedings, are not relevant to the decision to

join the MISO RTO. In the APSC proceeding regarding the MISO RTO

proposal, in February 2012 the APSC ordered the parties to consider

to what extent, if any, the proposed spin-off and merger of Entergy’s

transmission business might affect Entergy Arkansas’s membership

in an RTO or otherwise affect the proceeding. The next round of

testimony in the APSC proceeding is scheduled for March 2012.

In June 2011, MISO filed with the FERC a request for a transitional

waiver of provisions of its open access transmission, energy, and

operating reserve markets tariff regarding allocation of transmission

network upgrade costs, in order to establish a transition for the

integration of the Utility operating companies. Several parties

intervened in the proceeding, including Entergy, the APSC, the

LPSC, and the City Council, and some of the parties also filed

comments or protests. In September 2011 the FERC issued an order

denying on procedural grounds MISO’s request, further advising

MISO that submitting modified tariff sheets is the appropriate

method for implementing the transition that MISO seeks for the

Utility operating companies. The FERC did not address the merits

of any transition arrangements that may be appropriate to integrate

the Utility operating companies into the MISO RTO. MISO worked

with its stakeholders to prepare the appropriate changes to its tariff

and filed the proposed tariff changes with the FERC in November

2011. Numerous entities filed interventions and protests to MISO’s

filing. On January 25, 2012, the FERC sent a letter to MISO requesting

additional information relating to MISO’s proposed tariff changes.

NOTICE TO SERC RELIABILITY CORPORATION REGARDING

RELIABILITY STANDARDS AND FERC INVESTIGATION

Entergy has notified the SERC Reliability Corporation (SERC) of

potential violations of certain North American Electric Reliability

Corporation (NERC) reliability standards, including certain Critical

Infrastructure Protection, Facilities Design, Connection and

Maintenance, and System Protection and Control standards. Entergy

is working with the SERC to provide information concerning these

potential violations. In addition, FERC’s Division of Investigations

is conducting an investigation of certain issues relating to the Utility

operating companies compliance with certain Reliability Standards

related to protective system maintenance, facility ratings and modeling,

training, and communications. The Energy Policy Act of 2005 provides

authority to impose civil penalties for violations of the Federal Power

Act and FERC regulations.

U.S. DEPARTMENT OF JUSTICE INVESTIGATION

In September 2010, Entergy was notified that the U.S. Department

of Justice had commenced a civil investigation of competitive

issues concerning certain generation procurement, dispatch, and

transmission system practices and policies of the Utility operating

companies. The investigation is ongoing.

MARKET AND CREDIT RISK SENSITIVE

INSTRUMENTS

Market risk is the risk of changes in the value of commodity and

financial instruments, or in future net income or cash flows, in

response to changing market conditions. Entergy holds commodity

and financial instruments that are exposed to the following

significant market risks:

n The commodity price risk associated with the sale of electricity

by the Entergy Wholesale Commodities business.

n The interest rate and equity price risk associated with Entergy’s

investments in pension and other postretirement benefit trust

funds. See Note 11 to the financial statements for details

regarding Entergy’s pension and other postretirement benefit

trust funds.

n The interest rate and equity price risk associated with Entergy’s

investments in nuclear plant decommissioning trust funds,

particularly in the Entergy Wholesale Commodities business. See

Note 17 to the financial statements for details regarding Entergy’s

decommissioning trust funds.

n The interest rate risk associated with changes in interest rates

as a result of Entergy’s issuances of debt. Entergy manages its

interest rate exposure by monitoring current interest rates and

its debt outstanding in relation to total capitalization. See Notes 4

and 5 to the financial statements for the details of Entergy’s

debt outstanding.

The Utility business has limited exposure to the effects of market

risk because it operates primarily under cost-based rate regulation.

To the extent approved by their retail rate regulators, the Utility

operating companies hedge the exposure to natural gas price

volatility of their fuel and gas purchased for resale costs, which are

recovered from customers.

Entergy’s commodity and financial instruments are exposed

to credit risk. Credit risk is the risk of loss from nonperformance

by suppliers, customers, or financial counterparties to a contract

or agreement. Entergy is also exposed to a potential demand on

liquidity due to credit support requirements within its supply or

sales agreements.

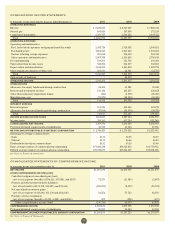

Commodity Price Risk

POWER GENERATION

As a wholesale generator, Entergy Wholesale Commodities core

business is selling energy, measured in MWh, to its customers.

Entergy Wholesale Commodities enters into forward contracts with

its customers and sells energy in the day ahead or spot markets.

In addition to selling the energy produced by its plants, Entergy

Wholesale Commodities sells unforced capacity, which allows load-

serving entities to meet specified reserve and related requirements

placed on them by the ISOs in their respective areas. Entergy

Wholesale Commodities’ forward fixed price power contracts consist

of contracts to sell energy only, contracts to sell capacity only, and

bundled contracts in which it sells both capacity and energy. While the

terminology and payment mechanics vary in these contracts, each of

these types of contracts requires Entergy Wholesale Commodities to

deliver MWh of energy, make capacity available, or both. The following

is a summary as of December 31, 2011 of the amount of Entergy

Wholesale Commodities’ nuclear power plants’ planned energy output

that is sold forward under physical or financial contracts:

48