Entergy 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

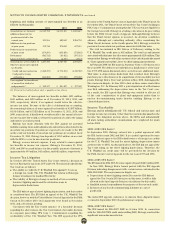

beginning and ending amount of unrecognized tax benefits is as

follows (in thousands):

2011 2010 2009

Gross balance at January 1 $ 4,949,788 $ 4,050,491 $ 1,825,447

Additions based on tax

positions related to the

current year 211,966 480,843 2,286,759

Additions for tax positions

of prior years 332,744 871,682 697,615

Reductions for tax positions

of prior years (259,895) (438,460) (372,862)

Settlements (841,528) (10,462) (385,321)

Lapse of statute of limitations (5,295) (4,306) (1,147)

Gross balance at December 31 4,387,780 4,949,788 4,050,491

Offsets to gross unrecognized

tax benefits:

Credit and loss carryovers (3,212,397) (3,771,301) (3,349,589)

Cash paid to taxing

authorities (363,266) (373,000) (373,000)

Unrecognized tax benefits net

of unused tax attributes

and payments(1) $ 812,117 $ 805,487 $ 327,902

(1) Potential tax liability above what is payable on tax returns

The balances of unrecognized tax benefits include $521 million,

$605 million, and $522 million as of December 31, 2011, 2010, and

2009, respectively, which, if recognized, would lower the effective

income tax rates. Because of the effect of deferred tax accounting,

the remaining balances of unrecognized tax benefits of $3.867 billion,

$4.345 billion, and $3.528 billion as of December 31, 2011, 2010, and

2009, respectively, if disallowed, would not affect the annual effective

income tax rate but would accelerate the payment of cash to the taxing

authority to an earlier period.

Entergy has made deposits with the IRS against its potential

liabilities arising from audit adjustments and settlements related to its

uncertain tax positions. Deposits are expected to be made to the IRS

as the cash tax benefits of uncertain tax positions are realized. As of

December 31, 2011, Entergy has deposits of $363 million on account

with the IRS to cover its uncertain tax positions.

Entergy accrues interest expense, if any, related to unrecognized

tax benefits in income tax expense. Entergy’s December 31, 2011,

2010, and 2009 accrued balance for the possible payment of interest is

approximately $99 million, $45 million, and $48 million, respectively.

Income Tax Litigation

In October 2010 the United States Tax Court entered a decision in

favor of Entergy for tax years 1997 and 1998. The issues decided by the

Tax Court are as follows:

n The ability to credit the U.K. Windfall Tax against U.S. tax as

a foreign tax credit. The U.K. Windfall Tax relates to Entergy’s

former investment in London Electricity.

n The validity of Entergy’s change in method of tax accounting

for street lighting assets and the related increase in

depreciation deductions.

The IRS did not appeal street lighting depreciation, and that matter

is considered final. The IRS filed an appeal of the U.K. Windfall Tax

decision, however, with the United States Court of Appeals for the Fifth

Circuit in December 2010. Oral arguments were heard in November

2011, and a decision is pending.

Concurrent with the Tax Court’s issuance of a favorable decision

regarding the above issues, the Tax Court issued a favorable decision

in a separate proceeding, PPL Corp. v. Commissioner, regarding the

creditability of the U.K. Windfall Tax. The IRS appealed the PPL

decision to the United States Court of Appeals for the Third Circuit. In

December 2011, the Third Circuit reversed the Tax Court’s holding in

PPL Corp. v. Commissioner, stating that the U.K. tax was not eligible for

the foreign tax credit. Entergy is awaiting a decision in its proceeding

before the Fifth Circuit Court of Appeals. Although Entergy believes

that the Third Circuit opinion is incorrect, its decision constitutes

adverse, although not controlling authority. After considering the

Third Circuit decision, in the fourth quarter 2011, Entergy revised its

provision for uncertain tax positions associated with this issue.

The total tax included in IRS Notices of Deficiency relating to the

U.K. Windfall Tax credit issue is $82 million. The total tax and interest

associated with this issue for all years is approximately $239 million. This

assumes that Entergy would utilize a portion of its cash deposits discussed

in “Unrecognized tax benefits” above to offset underpayment interest.

In February 2008 the IRS issued a Statutory Notice of Deficiency for

the year 2000. The deficiency resulted from a disallowance of the same

two 1997-1998 issues discussed above as well as one additional issue.

That issue is depreciation deductions that resulted from Entergy’s

purchase price allocations on its acquisitions of its non-utility nuclear

plants. Entergy filed a Tax Court petition in May 2008 challenging the

three issues in dispute. In June 2010 a trial on these issues was held in

Washington, D.C. In February 2011 a joint stipulation of settled issues

was filed addressing the depreciation issue in the Tax Court case.

As a result, the IRS agreed that Entergy was entitled to allocate all

of the cash consideration to plant and equipment rather than to

nuclear decommissioning trusts thereby entitling Entergy to its

claimed depreciation.

Income Tax Audits

Entergy and its subsidiaries file U.S. federal and various state and

foreign income tax returns. Other than the matters discussed in the

Income Tax Litigation section above, the IRS’s and substantially

all state taxing authorities’ examinations are completed for years

before 2004.

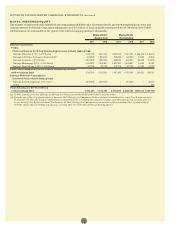

2002-2003 IRS AUDIT

In September 2009, Entergy entered into a partial agreement with

the IRS for the years 2002 and 2003. It is a partial agreement because

Entergy did not agree to the IRS’s disallowance of foreign tax credits

for the U.K. Windfall Tax and the street lighting depreciation issues

as they relate to 2002. As discussed above, the IRS did not appeal the

Tax Court ruling on the street lighting depreciation. Therefore, the

U.K. Windfall tax credit issue will be governed by the decision by

the Fifth Circuit Court of Appeals for the tax years 1997 and 1998.

2004-2005 IRS AUDIT

The IRS issued its 2004-2005 Revenue Agent’s Report (RAR) in May 2009.

In June 2009, Entergy filed a formal protest with the IRS Appeals

Division indicating disagreement with certain issues contained in the

2004-2005 RAR. The major issues in dispute are:

n Depreciation of street lighting assets (Because the IRS did not

appeal the Tax Court’s 2010 decision on this issue, it will be fully

allowed in the final Appeals Division calculations for this audit).

n Qualified research expenditures for purposes of the research credit.

n Inclusion of nuclear decommissioning liabilities in cost of

goods sold.

The initial IRS appeals conference to discuss these disputed issues

occurred in September 2010. Negotiations are ongoing.

2006-2007 IRS AUDIT

The IRS issued its 2006-2007 RAR in October 2011. In connection

with the 2006-2007 IRS audit and resulting RAR, Entergy resolved the

significant issues discussed below.

80