Entergy 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

total equity in Entergy’s consolidated balance sheets. The preferred

dividends or distributions paid by all subsidiaries are reflected for all

periods presented outside of consolidated net income.

New Accounting Pronouncements

The accounting standard-setting process, including projects between

the FASB and the International Accounting Standards Board (IASB) to

converge U.S. GAAP and International Financial Reporting Standards,

is ongoing and the FASB and the IASB are each currently working on

several projects that have not yet resulted in final pronouncements.

Final pronouncements that result from these projects could have a

material effect on Entergy’s future net income, financial position, or

cash flows.

In May 2011 the FASB issued ASU No. 2011-4, “Fair Value

Measurement (Topic 820): Amendments to Achieve Common Fair

Value Measurement and Disclosure Requirements in U.S. GAAP

and IFRSs,” which states that the ASU explains how to measure fair

value. The ASU states that: 1) the amendments in the ASU result

in common fair value measurement and disclosure requirements

in U.S. GAAP and International Financial Reporting Standards; 2)

consequently, the amendments change the wording used to describe

many of the requirements in U.S. GAAP for measuring fair value and

for disclosing information about fair value measurements; 3) for

many of the requirements, the FASB does not intend for the ASU to

result in a change in the application of the requirements of current

U.S. GAAP; 4) some of the amendments clarify the FASB’s intent about

the application of existing fair value measurement requirements; and

5) other amendments change a particular principle or requirement

for measuring fair value or for disclosing information about fair

value measurements. ASU No. 2011-4 is effective for Entergy for the

first quarter 2012. Entergy does not expect ASU No. 2011-4 to affect

materially its results of operations, financial position, or cash flows.

In September 2011 the FASB issued ASU No. 2011-8, “Intangibles –

Goodwill and Other (Topic 350): Testing Goodwill for Impairment.”

The amendments permit an entity to first assess qualitative factors

to determine whether it is more likely than not that the fair value

of a reporting unit is less than its carrying amount as a basis for

determining whether it is necessary to perform a quantitative

goodwill impairment assessment. ASU No. 2011-8 is effective for

Entergy for the first quarter 2012. The adoption of ASU No. 2011-

8 will have no effect on Entergy’s results of operations, financial

position, or cash flows.

NOTE 2. RATE AND REGULATORY MATTERS

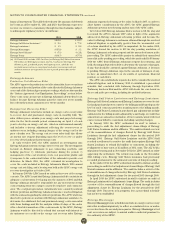

Regulatory Assets

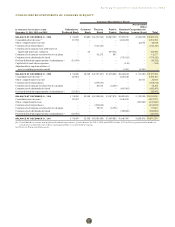

OTH E R RE GU L ATO RY AS S ETS

Regulatory assets represent probable future revenues associated with

costs that are expected to be recovered from customers through the

regulatory ratemaking process affecting the Utility business. In addition

to the regulatory assets that are specifically disclosed on the face of

the balance sheets, the tables below provide detail of “Other regulatory

assets” that are included on Entergy’s and the Registrant Subsidiaries’

balance sheets as of December 31, 2011 and 2010 (in millions):

2011 2010

Asset retirement obligation - recovery dependent

upon timing of decommissioning (Note 9)(b) $ 395.9 $ 406.4

Deferred capacity - (Note 2 - Retail Rate

Proceedings - Filings with the LPSC) – 15.8

Grand Gulf fuel - non-current and power

management rider - recovered through rate

riders when rates are redetermined periodically

(Note 2 - Fuel and purchased power cost recovery) 12.4 17.4

New nuclear generation development costs

(Note 2) 56.8 –

Gas hedging costs - recovered through fuel rates 30.3 1.9

Pension & postretirement costs

(Note 11 - Qualified Pension Plans, Other Postretirement

Benefits, and Non-Qualified Pension Plans)(b) 2,542.0 1,734.7

Postretirement benefits - recovered through 2012

(Note 11 - Other Postretirement Benefits)(b) 2.4 4.8

Provision for storm damages, including hurricane

costs - recovered through securitization,

insurance proceeds, and retail rates (Note 2 -

Storm Cost Recovery Filings with

Retail Regulators) 996.4 1,026.0

Removal costs - recovered through depreciation rates

(Note 9)(b) 81.2 81.5

River Bend AFUDC - recovered through August 2025

(Note 1 - River Bend AFUDC) 24.3 26.2

Sale-leaseback deferral - (Note 10 - Sale and

Leaseback Transactions - Grand Gulf Lease

Obligations) – 22.3

Spindletop gas storage facility - recovered through

December 2032(a) 31.0 32.6

Transition to competition costs - recovered over a

15-year period through February 2021 89.2 95.8

Little Gypsy cost proceedings - recovery

through securitiazation (Note 5 - Entergy Louisiana

Securitization Bonds - Little Gypsy) 198.4 200.9

Incremental ice storm costs - recovered through 2032 10.5 11.1

Michoud plant maintenance - recovered over a

7-year period through September 2018 12.9 –

Unamortized loss on reacquired debt -

recovered over term of debt 108.8 122.5

Other 44.4 38.3

Total $4,636.9 $3,838.2

(a) The jurisdictional split order assigned the regulatory asset to Entergy

Texas. The regulatory asset, however, is being recovered and amortized at

Entergy Gulf States Louisiana. As a result, a billing occurs monthly over

the same term as the recovery and receipts will be submitted to Entergy

Texas. Entergy Texas has recorded a receivable from Entergy Gulf States

Louisiana and Entergy Gulf States Louisiana has recorded

a corresponding payable.

(b) Does not earn a return on investment, but is offset by related liabilities.

FUEL AND PURC H A S E D POWER COST RECOV E RY

Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana,

Entergy Mississippi, Entergy New Orleans, and Entergy Texas are

allowed to recover fuel and purchased power costs through fuel

mechanisms included in electric and gas rates that are recorded

as fuel cost recovery revenues. The difference between revenues

collected and the current fuel and purchased power costs is generally

recorded as “Deferred fuel costs” on the Utility operating companies’

67